Question: a. A trader creates a bear spread by using two put options. One option has a $27 strike price with a premium of $2.35 and

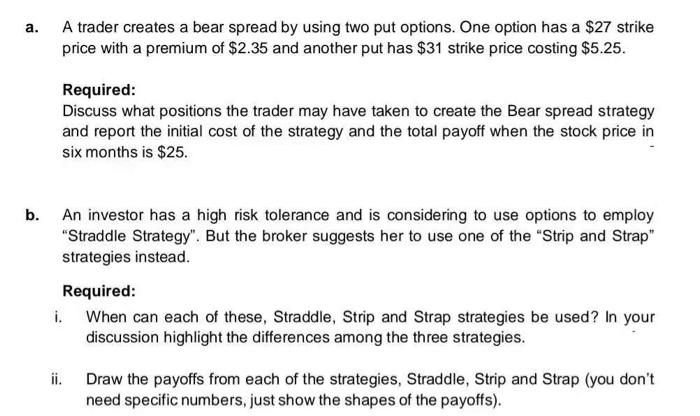

a. A trader creates a bear spread by using two put options. One option has a $27 strike price with a premium of $2.35 and another put has $31 strike price costing $5.25. Required: Discuss what positions the trader may have taken to create the Bear spread strategy and report the initial cost of the strategy and the total payoff when the stock price in six months is $25. b. An investor has a high risk tolerance and is considering to use options to employ "Straddle Strategy". But the broker suggests her to use one of the Strip and Strap" strategies instead. Required: i. When can each of these, Straddle, Strip and Strap strategies be used? In your discussion highlight the differences among the three strategies. Draw the payoffs from each of the strategies, Straddle, Strip and Strap (you don't need specific numbers, just show the shapes of the payoffs)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts