Question: (A) A U.S.-based MNC is considering establishing a two- year project in New Zealand with a US$32 million initial investment. The firm's cost of capital

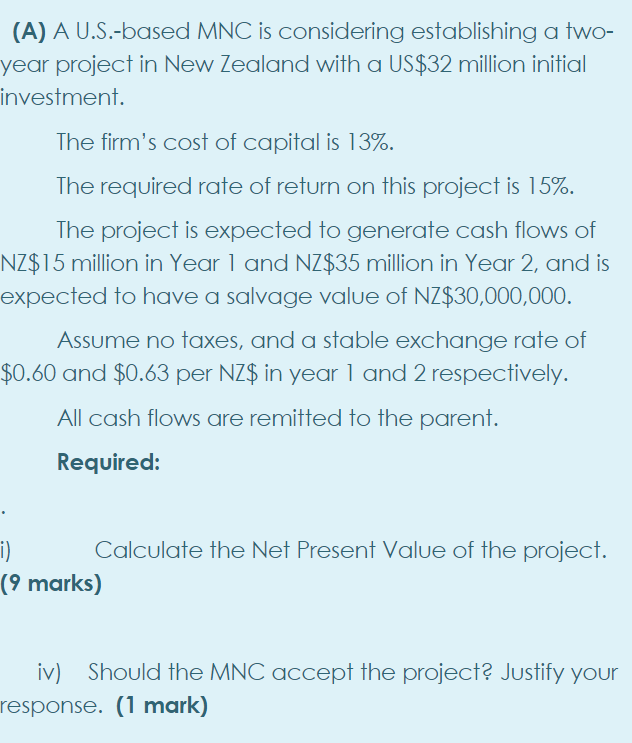

(A) A U.S.-based MNC is considering establishing a two- year project in New Zealand with a US$32 million initial investment. The firm's cost of capital is 13%. The required rate of return on this project is 15%. The project is expected to generate cash flows of NZ$15 million in Year 1 and NZ$35 million in Year 2, and is expected to have a salvage value of NZ$30,000,000. Assume no taxes, and a stable exchange rate of $0.60 and $0.63 per NZ$ in year 1 and 2 respectively. All cash flows are remitted to the parent. Required: i) Calculate the Net Present Value of the project. (9 marks) iv) Should the MNC accept the project? Justify your response. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts