Question: a. An economic unit with identifiable boundaries for which we accumulate and report financial information. b. Assets are initially recorded at the amounts paid to

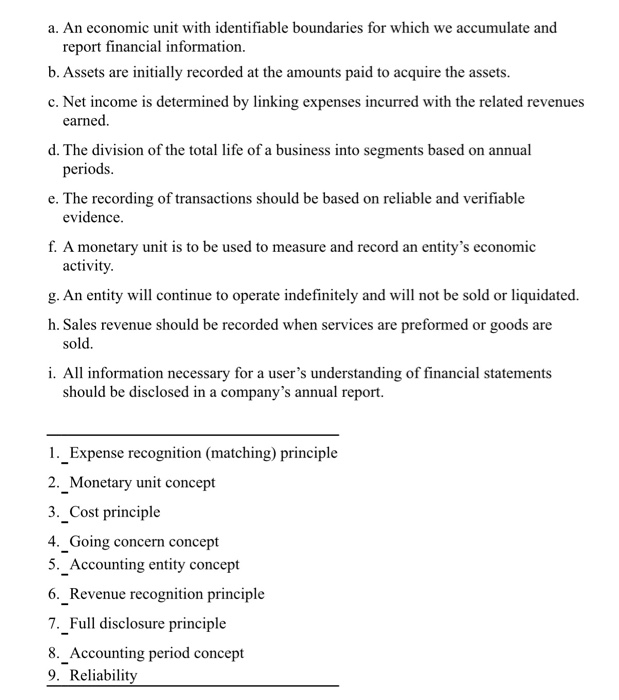

a. An economic unit with identifiable boundaries for which we accumulate and report financial information. b. Assets are initially recorded at the amounts paid to acquire the assets. c. Net income is determined by linking expenses incurred with the related revenues earned d. The division of the total life of a business into segments based on annual periods. e. The recording of transactions should be based on reliable and verifiable evidence. f. A monetary unit is to be used to measure and record an entity's economic activity. g. An entity will continue to operate indefinitely and will not be sold or liquidated. h. Sales revenue should be recorded when services are preformed or goods are sold. i. All information necessary for a user's understanding of financial statements should be disclosed in a company's annual report. 1. _Expense recognition (matching) principle 2. Monetary unit concept 3. Cost principle 4. Going concern concept 5. Accounting entity concept 6. Revenue recognition principle 7. Full disclosure principle 8. Accounting period concept 9. Reliability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts