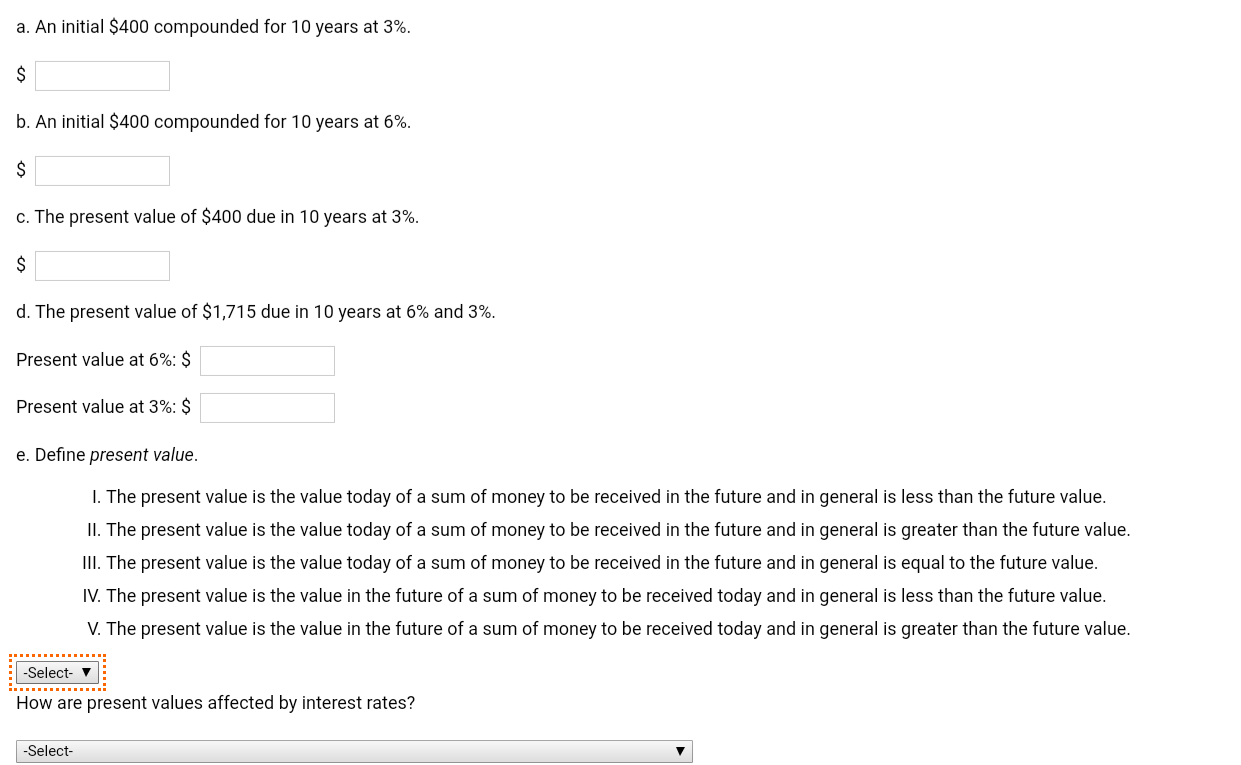

Question: a. An initial $400 compounded for 10 years at 3%. $ b. An initial $400 compounded for 10 years at 6%. $ c. The present

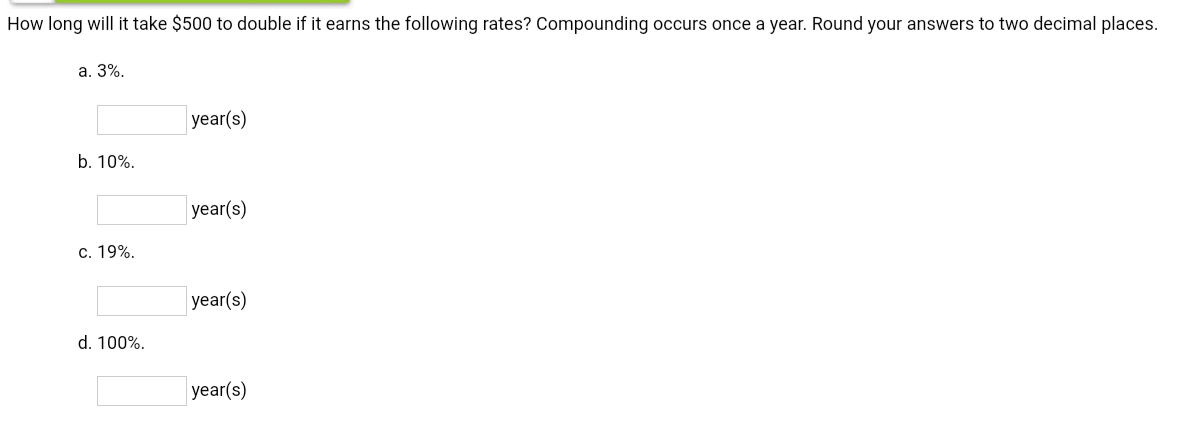

a. An initial $400 compounded for 10 years at 3%. $ b. An initial $400 compounded for 10 years at 6%. $ c. The present value of $400 due in 10 years at 3%. $ d. The present value of $1,715 due in 10 years at 6% and 3%. Present value at 6%: $ Present value at 3%:$ e. Define present value. I. The present value is the value today of a sum of money to be received in the future and in general is less than the future value. II. The present value is the value today of a sum of money to be received in the future and in general is greater than the future value. III. The present value is the value today of a sum of money to be received in the future and in general is equal to the future value. IV. The present value is the value in the future of a sum of money to be received today and in general is less than the future value. V. The present value is the value in the future of a sum of money to be received today and in general is greater than the future value. -Select- v How are present values affected by interest rates? -Select- How long will it take $500 to double if it earns the following rates? Compounding occurs once a year. Round your answers to two decimal places. a. 3%. year(s) b. 10%. year(s) c. 19%. year(s) d. 100% year(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts