Question: (a) An interest rate swap involves paying 2% per annum fixed and receiving LIBOR every six months on $100 million. Suppose the swap has 9

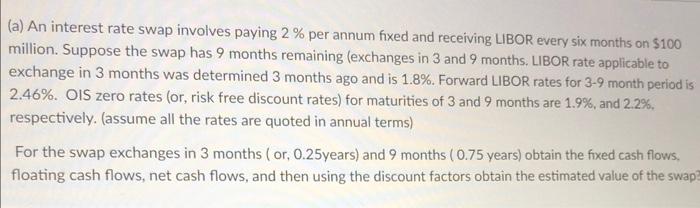

(a) An interest rate swap involves paying 2% per annum fixed and receiving LIBOR every six months on $100 million. Suppose the swap has 9 months remaining (exchanges in 3 and 9 months. LIBOR rate applicable to exchange in 3 months was determined 3 months ago and is 1.8%. Forward LIBOR rates for 3-9 month period is 2.46%. OIS zero rates (or, risk free discount rates) for maturities of 3 and 9 months are 1.9%, and 2.2%, respectively. (assume all the rates are quoted in annual terms) For the swap exchanges in 3 months (or, 0.25years) and 9 months (0.75 years) obtain the fixed cash flows, floating cash flows, net cash flows, and then using the discount factors obtain the estimated value of the swap? (a) An interest rate swap involves paying 2% per annum fixed and receiving LIBOR every six months on $100 million. Suppose the swap has 9 months remaining (exchanges in 3 and 9 months. LIBOR rate applicable to exchange in 3 months was determined 3 months ago and is 1.8%. Forward LIBOR rates for 3-9 month period is 2.46%. OIS zero rates (or, risk free discount rates) for maturities of 3 and 9 months are 1.9%, and 2.2%, respectively. (assume all the rates are quoted in annual terms) For the swap exchanges in 3 months (or, 0.25years) and 9 months (0.75 years) obtain the fixed cash flows, floating cash flows, net cash flows, and then using the discount factors obtain the estimated value of the swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts