Question: (a) An investment can be defined as the current commitment of money or other resources in the expectation of reaping future benefits. From the viewpoints

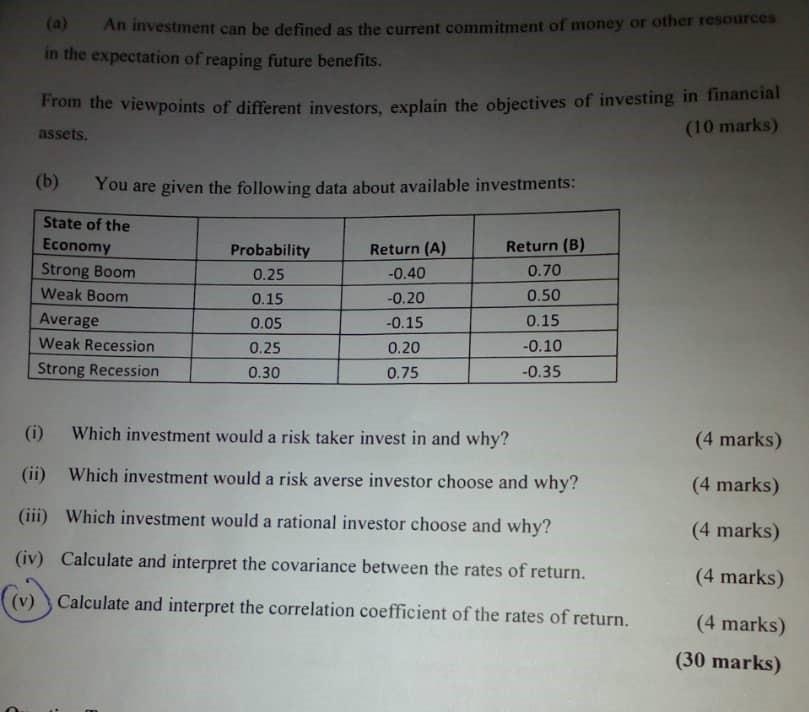

(a) An investment can be defined as the current commitment of money or other resources in the expectation of reaping future benefits. From the viewpoints of different investors, explain the objectives of investing in financial (10 marks) assets. (b) You are given the following data about available investments: State of the Economy Strong Boom Weak Boom Average Weak Recession Strong Recession Probability 0.25 0.15 0.05 0.25 0.30 Return (A) -0.40 -0.20 -0.15 0.20 0.75 Return (B) 0.70 0.50 0.15 -0.10 -0.35 (i) Which investment would a risk taker invest in and why? (4 marks) (ii) Which investment would a risk averse investor choose and why? (4 marks) (iii) Which investment would a rational investor choose and why? (4 marks) (iv) Calculate and interpret the covariance between the rates of return. (4 marks) (V) Calculate and interpret the correlation coefficient of the rates of return. (4 marks) (30 marks) (a) An investment can be defined as the current commitment of money or other resources in the expectation of reaping future benefits. From the viewpoints of different investors, explain the objectives of investing in financial (10 marks) assets. (b) You are given the following data about available investments: State of the Economy Strong Boom Weak Boom Average Weak Recession Strong Recession Probability 0.25 0.15 0.05 0.25 0.30 Return (A) -0.40 -0.20 -0.15 0.20 0.75 Return (B) 0.70 0.50 0.15 -0.10 -0.35 (i) Which investment would a risk taker invest in and why? (4 marks) (ii) Which investment would a risk averse investor choose and why? (4 marks) (iii) Which investment would a rational investor choose and why? (4 marks) (iv) Calculate and interpret the covariance between the rates of return. (4 marks) (V) Calculate and interpret the correlation coefficient of the rates of return. (4 marks) (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts