Question: A and B already solved. Please don't attempt them. Only C and D needed. Assume rates are continuously compounded in the following questions. (a) Suppose

A and B already solved. Please don't attempt them. Only C and D needed.

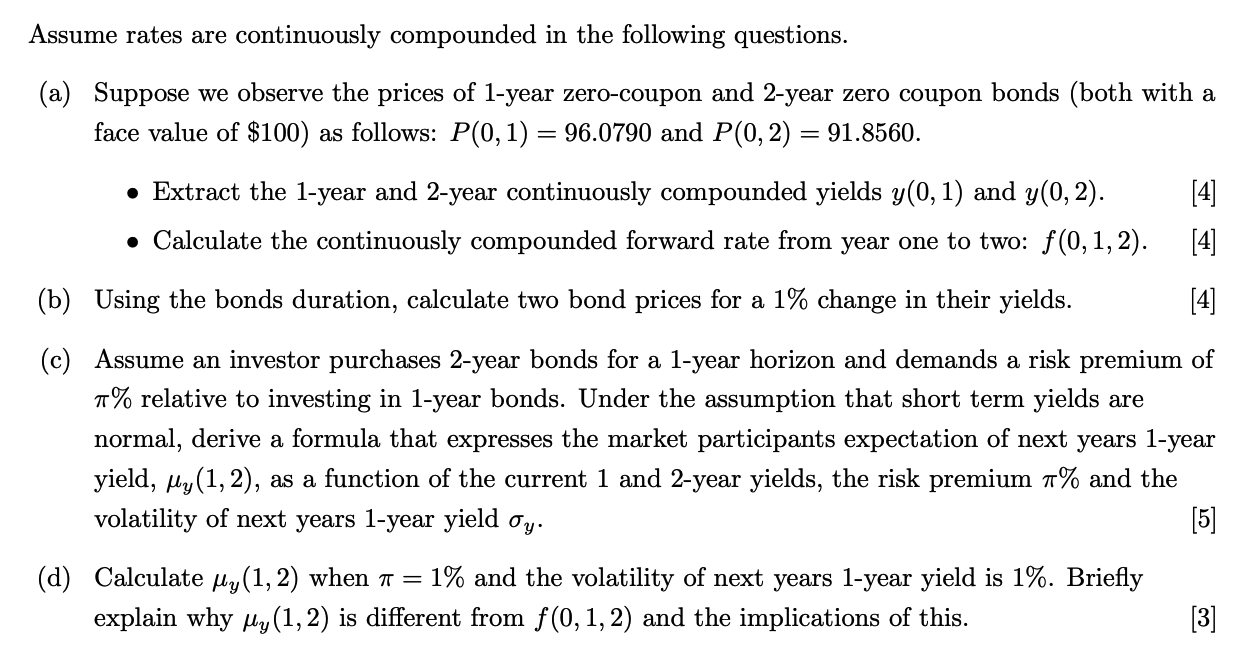

Assume rates are continuously compounded in the following questions. (a) Suppose we observe the prices of 1-year zero-coupon and 2-year zero coupon bonds (both with a face value of $100) as follows: P(0, 1) = 96.0790 and P(0, 2) = 91.8560. Extract the 1-year and 2-year continuously compounded yields y(0, 1) and y(0,2). Calculate the continuously compounded forward rate from year one to two: f(0,1,2). [4] (b) Using the bonds duration, calculate two bond prices for a 1% change in their yields. (c) Assume an investor purchases 2-year bonds for a 1-year horizon and demands a risk premium of 7% relative to investing in 1-year bonds. Under the assumption that short term yields are normal, derive a formula that expresses the market participants expectation of next years 1-year yield, My(1,2), as a function of the current 1 and 2-year yields, the risk premium 7% and the volatility of next years 1-year yield oy. [5] (d) Calculate My(1, 2) when a = 1% and the volatility of next years 1-year yield is 1%. Briefly explain why My(1, 2) is different from f(0, 1, 2) and the implications of this. [3] Assume rates are continuously compounded in the following questions. (a) Suppose we observe the prices of 1-year zero-coupon and 2-year zero coupon bonds (both with a face value of $100) as follows: P(0, 1) = 96.0790 and P(0, 2) = 91.8560. Extract the 1-year and 2-year continuously compounded yields y(0, 1) and y(0,2). Calculate the continuously compounded forward rate from year one to two: f(0,1,2). [4] (b) Using the bonds duration, calculate two bond prices for a 1% change in their yields. (c) Assume an investor purchases 2-year bonds for a 1-year horizon and demands a risk premium of 7% relative to investing in 1-year bonds. Under the assumption that short term yields are normal, derive a formula that expresses the market participants expectation of next years 1-year yield, My(1,2), as a function of the current 1 and 2-year yields, the risk premium 7% and the volatility of next years 1-year yield oy. [5] (d) Calculate My(1, 2) when a = 1% and the volatility of next years 1-year yield is 1%. Briefly explain why My(1, 2) is different from f(0, 1, 2) and the implications of this. [3]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts