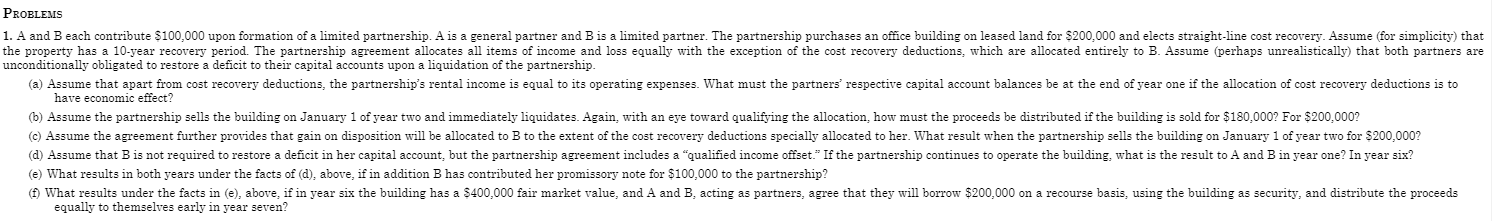

Question: A and B each contribute $ 1 0 0 , 0 0 0 upon formation of a limited partnership. A is a general partner and

A and B each contribute $ upon formation of a limited partnership. A is a general partner and B is a limited partner. The partnership purchases an office building on leased land for $ and elects straightline cost recovery. Assume for simplicity that the property has a year recovery period. The partnership agreement allocates all items of income and loss equally with the exception of the cost recovery deductions, which are allocated entirely to B Assume perhaps unrealistically that both partners are unconditionally obligated to restore a deficit to their capital accounts upon a liquidation of the partnership.

aAssume that apart from cost recovery deductions, the partnerships rental income is equal to its operating expenses. What must the partners respective capital account balances be at the end of year one if the allocation of cost recovery deductions is to have economic effect?

bAssume the partnership sells the building on January of year two and immediately liquidates. Again, with an eye toward qualifying the allocation, how must the proceeds be distributed if the building is sold for $ For $

cAssume the agreement further provides that gain on disposition will be allocated to B to the extent of the cost recovery deductions specially allocated to her. What result when the partnership sells the building on January of year two for $

dAssume that B is not required to restore a deficit in her capital account, but the partnership agreement includes a qualified income offset. If the partnership continues to operate the building, what is the result to A and B in year one? In year six?

eWhat results in both years under the facts of d above, if in addition B has contributed her promissory note for $ to the partnership?

fWhat results under the facts in e above, if in year six the building has a $ fair market value, and A and B acting as partners, agree that they will borrow $ on a recourse basis, using the building as security, and distribute the proceeds equally to themselves early in year seven?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock