Question: A and B is correct. I need help solving c. The common stock of Perforated Pool Liners, Incorporated now sells for $50.00 per share. The

A and B is correct. I need help solving c.

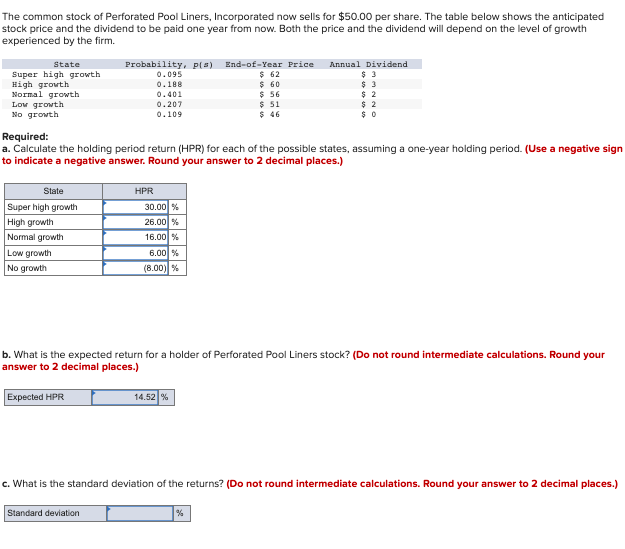

The common stock of Perforated Pool Liners, Incorporated now sells for $50.00 per share. The table below shows the anticipated stock price and the dividend to be paid one year from now. Both the price and the dividend will depend on the level of growth experienced by the firm. State Super high growth High growth Normal growth Low growth No growth Probability, Ps) End-of-Year Price 0.095 $ 62 0.188 0.401 $ 56 0.207 $ 51 0.109 $ 46 $ 60 Annual Dividend $3 $ 2 $ 2 Required: a. Calculate the holding period return (HPR) for each of the possible states, assuming a one-year holding period. (Use a negative sign to indicate a negative answer. Round your answer to 2 decimal places.) HPR State Super high growth High growth Normal growth Low growth No growth 30.00% 26.00% 16.00 % 6.001% (8.00) % b. What is the expected return for a holder of Perforated Pool Liners stock? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Expected HPR 14.52 % c. What is the standard deviation of the returns? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Standard deviation %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts