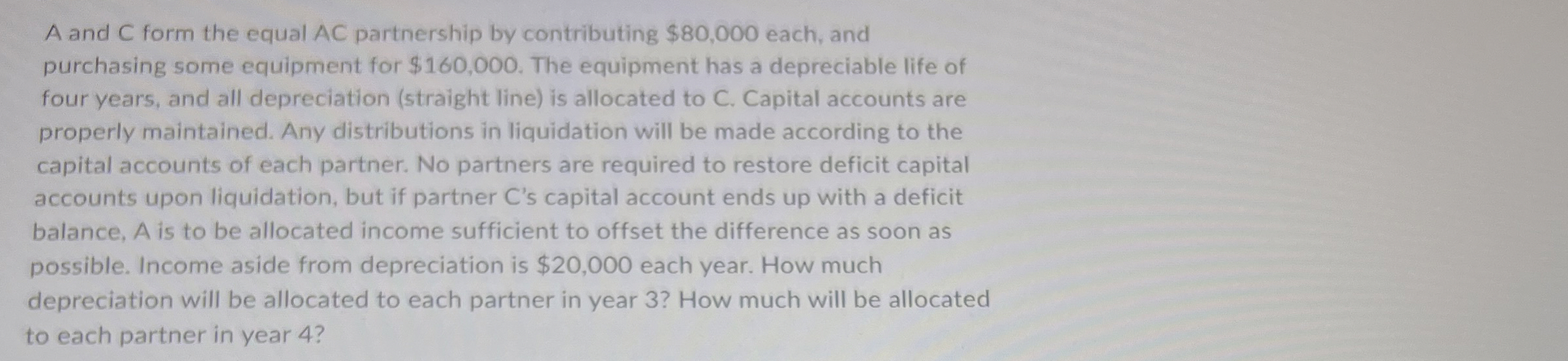

Question: A and C form the equal A C partnership by contributing $ 8 0 , 0 0 0 each, and purchasing some equipment for $

A and form the equal partnership by contributing $ each, and purchasing some equipment for $ The equipment has a depreciable life of four years, and all depreciation straight line is allocated to C Capital accounts are properly maintained. Any distributions in liquidation will be made according to the capital accounts of each partner. No partners are required to restore deficit capital accounts upon liquidation, but if partner Cs capital account ends up with a deficit balance, is to be allocated income sufficient to offset the difference as soon as possible. Income aside from depreciation is $ each year. How much depreciation will be allocated to each partner in year How much will be allocated to each partner in year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock