Question: A . ) Ann would be equally happy with a riskless asset that paid 5 % per year, and a risky asset with a yearly

A Ann would be equally happy with a riskless asset that paid per year, and a risky asset with a yearly expected return of and a return standard deviation of

What is Ann's coefficient of risk aversion?

B Would Ann prefer an investment with an expected return of and a standard deviation of or an investment with an expected return of and a standard deviation of

CBarry's certainty equivalent for an asset with an expected return of and a standard deviation of is Is he more or less risk averse than Ann?

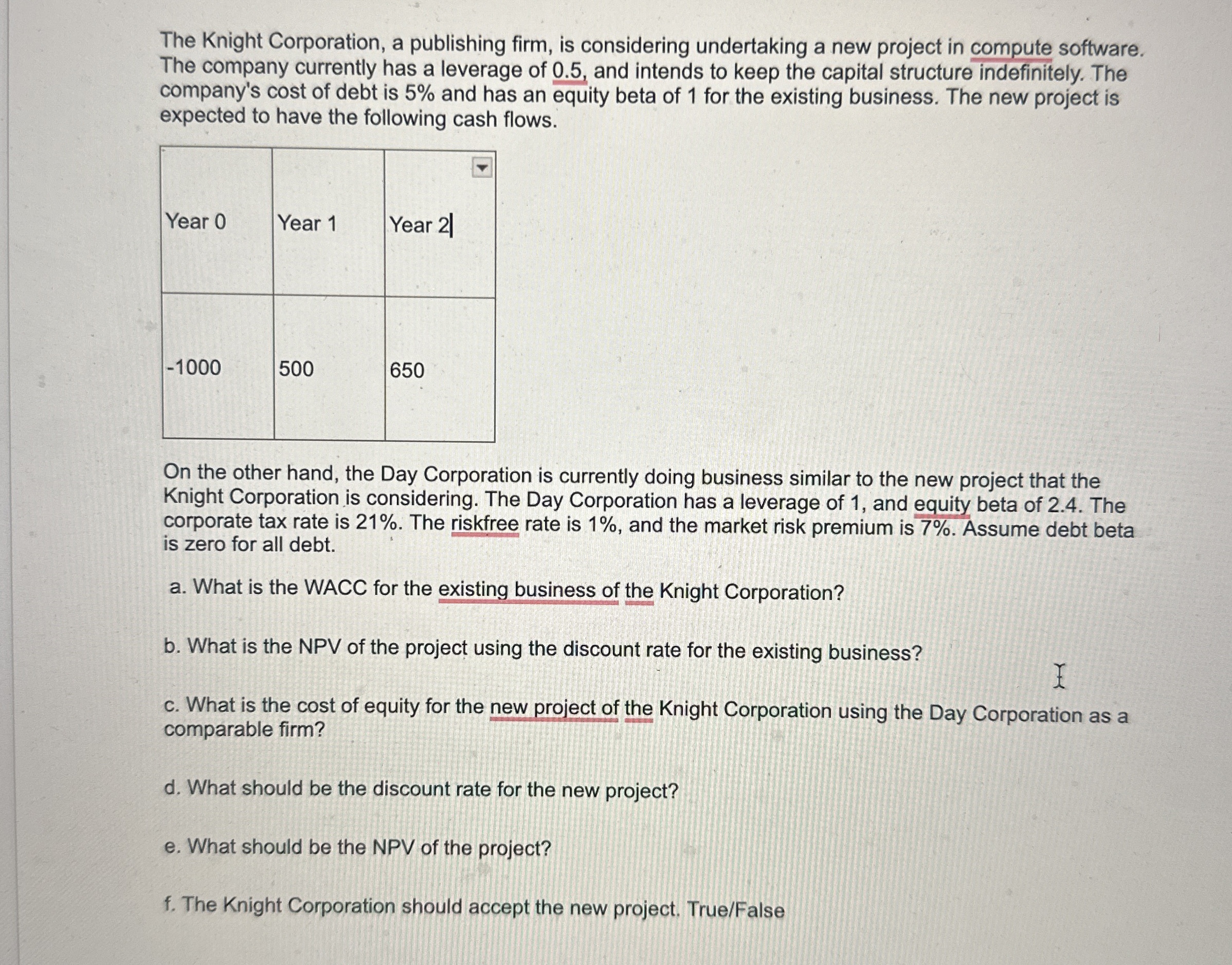

The Knight Corporation, a publishing firm, is considering undertaking a new project in compute software.

The company currently has a leverage of and intends to keep the capital structure indefinitely. The

company's cost of debt is and has an equity beta of for the existing business. The new project is

expected to have the following cash flows.

On the other hand, the Day Corporation is currently doing business similar to the new project that the

Knight Corporation is considering. The Day Corporation has a leverage of and equity beta of The

corporate tax rate is The riskfree rate is and the market risk premium is Assume debt beta

is zero for all debt.

a What is the WACC for the existing business of the Knight Corporation?

b What is the NPV of the project using the discount rate for the existing business?

c What is the cost of equity for the new project of the Knight Corporation using the Day Corporation a

comparable firm?

d What should be the discount rate for the new project?

e What should be the NPV of the project?

f The Knight Corporation should accept the new project. TrueFalse

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock