Question: a **ANSWER ALL QUESTION (50 point TOTAL)*** DO NOT ATTEMPT IF YOU CANNOT ANSWER ALL Mowbot Company is evaluating the production of a new part.

a

a

**ANSWER ALL QUESTION (50 point TOTAL)*** DO NOT ATTEMPT IF YOU CANNOT ANSWER ALL

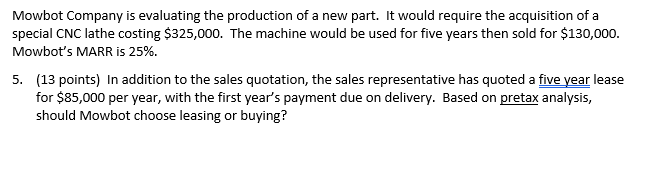

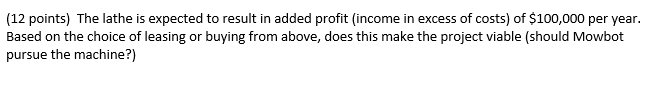

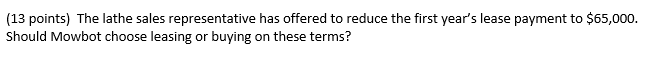

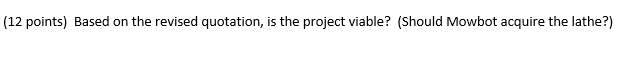

Mowbot Company is evaluating the production of a new part. It would require the acquisition of a special CNC lathe costing $325,000. The machine would be used for five years then sold for $130,000. Mowbot's MARR is 25%. 5. (13 points) In addition to the sales quotation, the sales representative has quoted a five year lease for $85,000 per year, with the first year's payment due on delivery. Based on pretax analysis, should Mowbot choose leasing or buying? (12 points) The lathe is expected to result in added profit (income in excess of costs) of $100,000 per year. Based on the choice of leasing or buying from above, does this make the project viable (should Mowbot pursue the machine?) (12 points) Based on the revised quotation, is the project viable? (Should Mowbot acquire the lathe?) Mowbot Company is evaluating the production of a new part. It would require the acquisition of a special CNC lathe costing $325,000. The machine would be used for five years then sold for $130,000. Mowbot's MARR is 25%. 5. (13 points) In addition to the sales quotation, the sales representative has quoted a five year lease for $85,000 per year, with the first year's payment due on delivery. Based on pretax analysis, should Mowbot choose leasing or buying? (12 points) The lathe is expected to result in added profit (income in excess of costs) of $100,000 per year. Based on the choice of leasing or buying from above, does this make the project viable (should Mowbot pursue the machine?) (12 points) Based on the revised quotation, is the project viable? (Should Mowbot acquire the lathe?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts