Question: a . answer choices: 1 . negative, value 2 . Allowable increase, allowable decrease, reduced cost, objective coefficient b . answer choices: negative, value 1

a answer choices:

negative, value

Allowable increase, allowable decrease, reduced cost, objective coefficient

b answer choices: negative, value

negative, value

Allowable increase, allowable decrease, reduced cost, objective coefficient

c answer choices:

increase, decrease

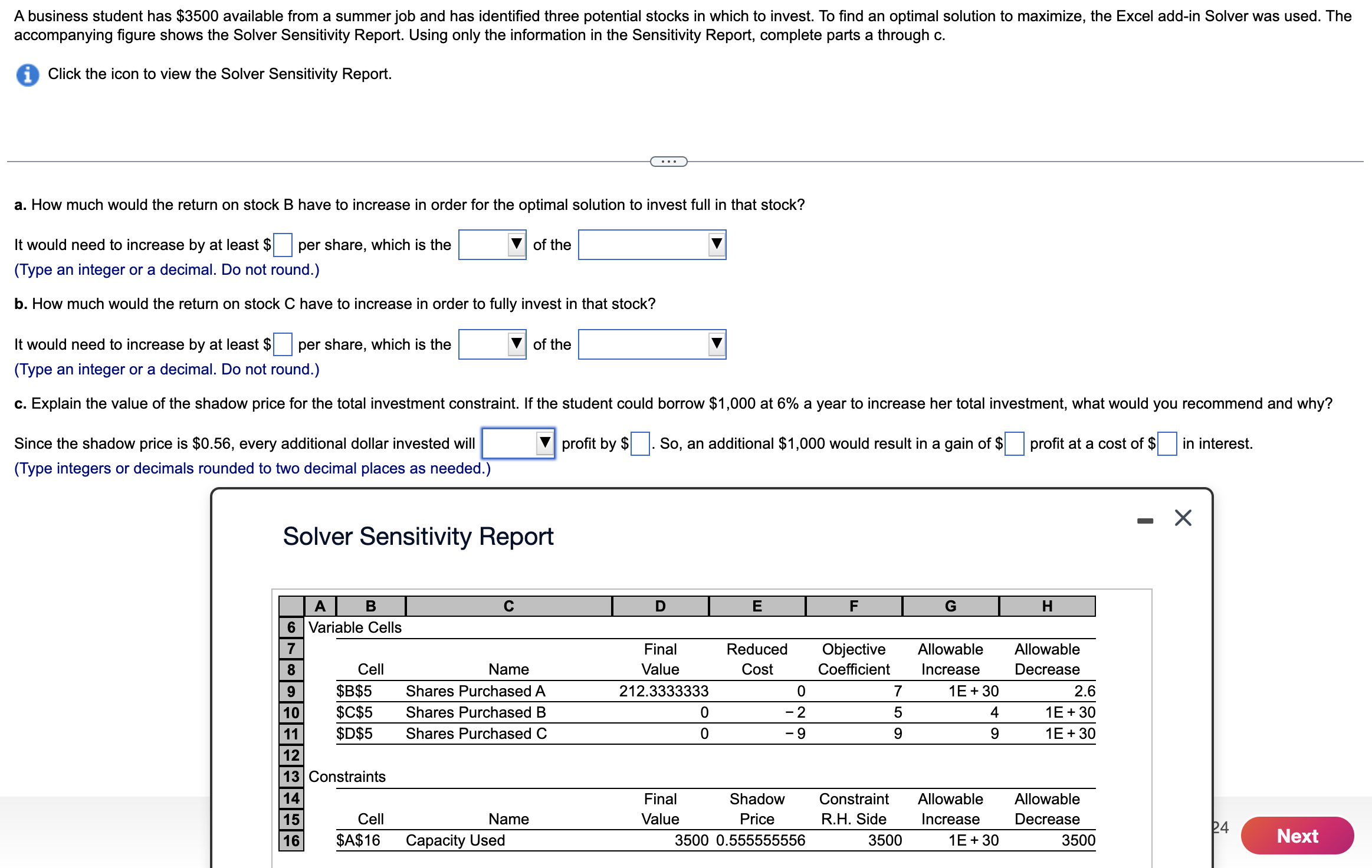

A business student has $ available from a summer job and has identified three potential stocks in which to invest. To find an optimal solution to maximize, the Excel addin Solver was used. The

accompanying figure shows the Solver Sensitivity Report. Using only the information in the Sensitivity Report, complete parts a through c

Click the icon to view the Solver Sensitivity Report.

a How much would the return on stock B have to increase in order for the optimal solution to invest full in that stock?

It would need to increase by at least $

per share, which is the

of the

Type an integer or a decimal. Do not round.

b How much would the return on stock have to increase in order to fully invest in that stock?

It would need to increase by at least $ per share, which is the

of the

Type an integer or a decimal. Do not round.

c Explain the value of the shadow price for the total investment constraint. If the student could borrow $ at a year to increase her total investment, what would you recommend and why?

Since the shadow price is $ every additional dollar invested will

profit by $

So an additional $ would result in a gain of $

profit at a cost of $

in interest.

Type integers or decimals rounded to two decimal places as needed.

Solver Sensitivity Report

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock