Question: a answer it with a computer and show steps of how you bring the answers, answer it as following 1 2 3 4 5 SportCo

a

answer it with a computer and show steps of how you bring the answers, answer it as following

1

2

3

4

5

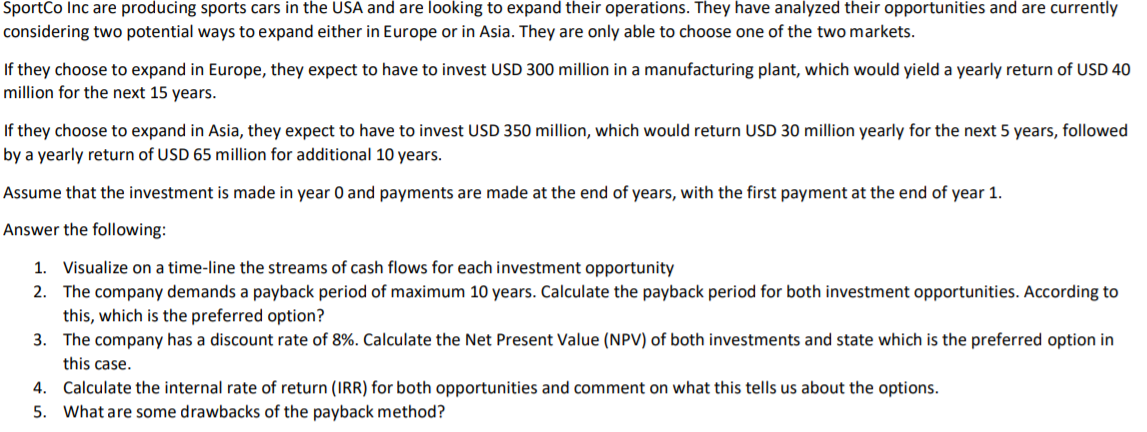

SportCo Inc are producing sports cars in the USA and are looking to expand their operations. They have analyzed their opportunities and are currently considering two potential ways to expand either in Europe or in Asia. They are only able to choose one of the two markets. If they choose to expand in Europe, they expect to have to invest USD 300 million in a manufacturing plant, which would yield a yearly return of USD 40 million for the next 15 years. If they choose to expand in Asia, they expect to have to invest USD 350 million, which would return USD 30 million yearly for the next 5 years, followed by a yearly return of USD 65 million for additional 10 years. Assume that the investment is made in year 0 and payments are made at the end of years, with the first payment at the end of year 1. Answer the following: 1. Visualize on a time-line the streams of cash flows for each investment opportunity 2. The company demands a payback period of maximum 10 years. Calculate the payback period for both investment opportunities. According to this, which is the preferred option? 3. The company has a discount rate of 8%. Calculate the Net Present Value (NPV) of both investments and state which is the preferred option in this case. 4. Calculate the internal rate of return (IRR) for both opportunities and comment on what this tells us about the options. 5. What are some drawbacks of the payback method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts