Question: a) Arrow Bikes is planning to develop a new electric bike. In order for the project to be successful, the company must develop a lightweight

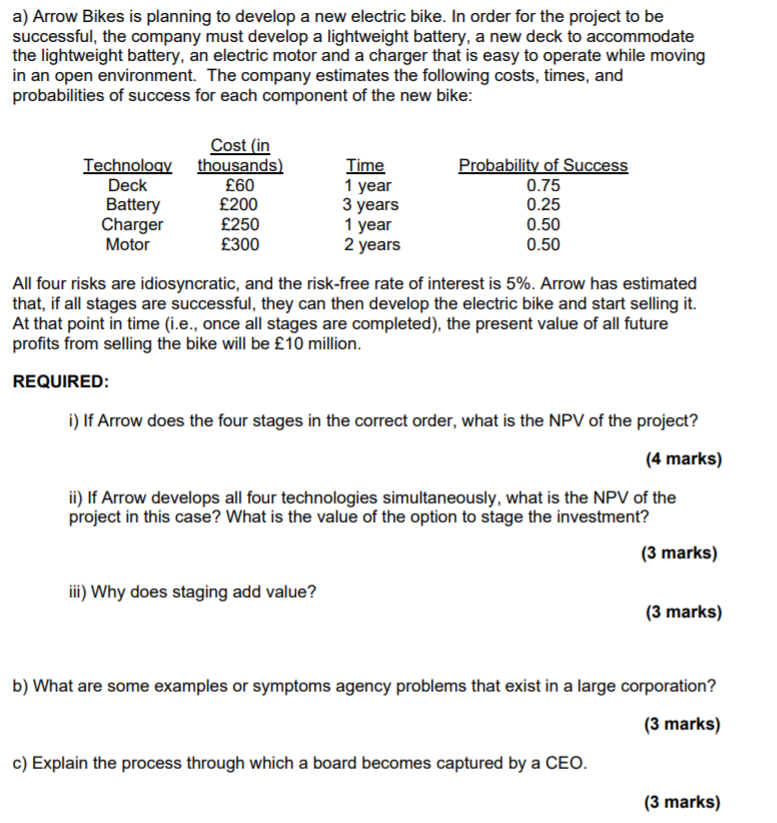

a) Arrow Bikes is planning to develop a new electric bike. In order for the project to be successful, the company must develop a lightweight battery, a new deck to accommodate the lightweight battery, an electric motor and a charger that is easy to operate while moving in an open environment. The company estimates the following costs, times, and probabilities of success for each component of the new bike: Cost (in thousands) Time Technology Deck 60 1 year Probability of Success 0.75 0.25 Battery 200 3 years Charger 250 0.50 1 year 2 years Motor 300 0.50 All four risks are idiosyncratic, and the risk-free rate of interest is 5%. Arrow has estimated that, if all stages are successful, they can then develop the electric bike and start selling it. At that point in time (i.e., once all stages are completed), the present value of all future profits from selling the bike will be 10 million. REQUIRED: i) If Arrow does the four stages in the correct order, what is the NPV of the project? (4 marks) ii) If Arrow develops all four technologies simultaneously, what is the NPV of the project in this case? What is the value of the option to stage the investment? (3 marks) iii) Why does staging add value? (3 marks) b) What are some examples or symptoms agency problems that exist in a large corporation? (3 marks) c) Explain the process through which a board becomes captured by a CEO. (3 marks) a) Arrow Bikes is planning to develop a new electric bike. In order for the project to be successful, the company must develop a lightweight battery, a new deck to accommodate the lightweight battery, an electric motor and a charger that is easy to operate while moving in an open environment. The company estimates the following costs, times, and probabilities of success for each component of the new bike: Cost (in thousands) Time Technology Deck 60 1 year Probability of Success 0.75 0.25 Battery 200 3 years Charger 250 0.50 1 year 2 years Motor 300 0.50 All four risks are idiosyncratic, and the risk-free rate of interest is 5%. Arrow has estimated that, if all stages are successful, they can then develop the electric bike and start selling it. At that point in time (i.e., once all stages are completed), the present value of all future profits from selling the bike will be 10 million. REQUIRED: i) If Arrow does the four stages in the correct order, what is the NPV of the project? (4 marks) ii) If Arrow develops all four technologies simultaneously, what is the NPV of the project in this case? What is the value of the option to stage the investment? (3 marks) iii) Why does staging add value? (3 marks) b) What are some examples or symptoms agency problems that exist in a large corporation? (3 marks) c) Explain the process through which a board becomes captured by a CEO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts