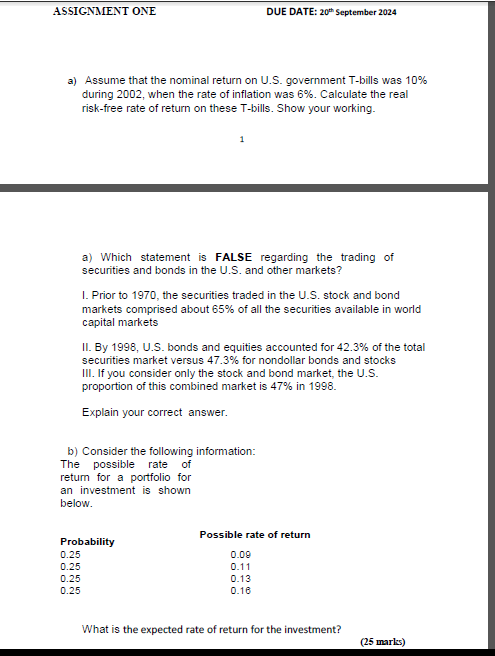

Question: a ) Assume that the nominal return on U . S . government T - bills was 1 0 % during 2 0 0 2

a Assume that the nominal return on US government Tbills was

during when the rate of inflation was Calculate the real

riskfree rate of return on these Tbills. Show your working.

a Which statement is FALSE regarding the trading of

securities and bonds in the US and other markets?

I. Prior to the securities traded in the US stock and bond

markets comprised about of all the securities available in world

capital markets

II By US bonds and equities accounted for of the total

securities market versus for nondollar bonds and stocks

III. If you consider only the stock and bond market, the US

proportion of this combined market is in

Explain your correct answer.

b Consider the following information:

The possible rate of

return for a portfolio for

an investment is shown

below.

What is the expected rate of return for the investment?

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock