Question: a) Assuming constant volatility and only focusing on the second moment of the return distribution are heroic assumptions when estimating VaR . Discuss the previous

Note that the 99% confidence is 2.33 and the 95% confidence is 1.65.

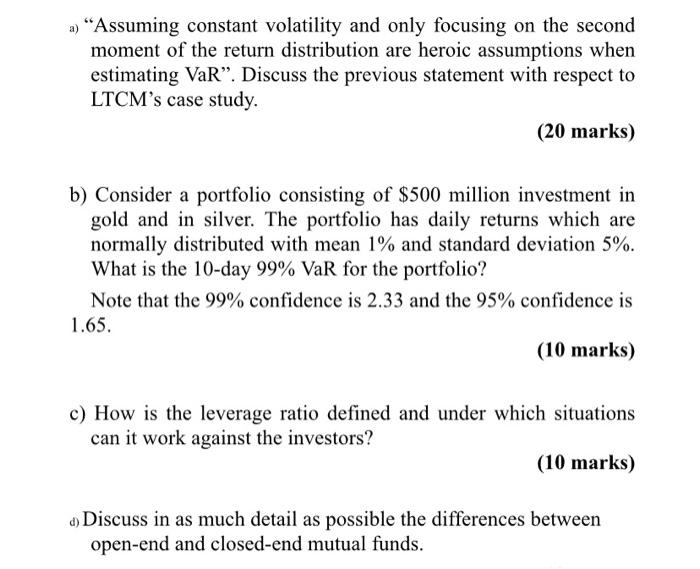

a) "Assuming constant volatility and only focusing on the second moment of the return distribution are heroic assumptions when estimating VaR. Discuss the previous statement with respect to LTCM's case study. (20 marks) b) Consider a portfolio consisting of $500 million investment in gold and in silver. The portfolio has daily returns which are normally distributed with mean 1% and standard deviation 5%. What is the 10-day 99% VaR for the portfolio? Note that the 99% confidence is 2.33 and the 95% confidence is 1.65. (10 marks) c) How is the leverage ratio defined and under which situations can it work against the investors? (10 marks) .) Discuss in as much detail as possible the differences between open-end and closed-end mutual funds. a) "Assuming constant volatility and only focusing on the second moment of the return distribution are heroic assumptions when estimating VaR. Discuss the previous statement with respect to LTCM's case study. (20 marks) b) Consider a portfolio consisting of $500 million investment in gold and in silver. The portfolio has daily returns which are normally distributed with mean 1% and standard deviation 5%. What is the 10-day 99% VaR for the portfolio? Note that the 99% confidence is 2.33 and the 95% confidence is 1.65. (10 marks) c) How is the leverage ratio defined and under which situations can it work against the investors? (10 marks) .) Discuss in as much detail as possible the differences between open-end and closed-end mutual funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts