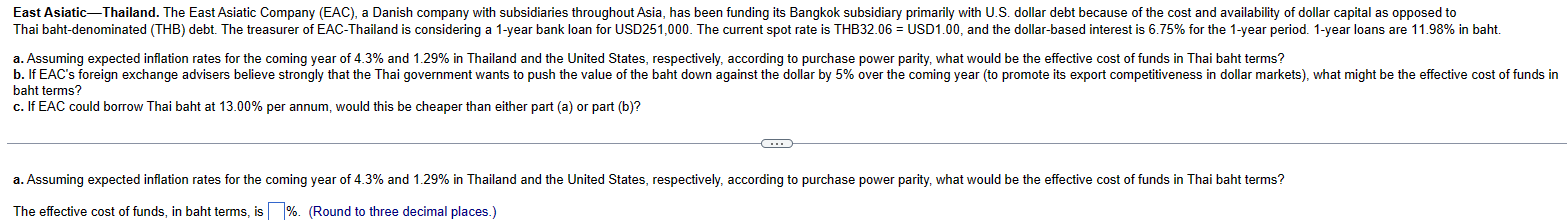

Question: a . Assuming expected inflation rates for the coming year of 4 . 3 % and 1 . 2 9 % in Thailand and the

a Assuming expected inflation rates for the coming year of and in Thailand and the United States, respectively, according to purchase power parity, what would be the effective cost of funds in Thai baht terms? baht terms?

c If EAC could borrow Thai baht at per annum, would this be cheaper than either part a or part b

a Assuming expected inflation rates for the coming year of and in Thailand and the United States, respectively, according to purchase power parity, what would be the effective cost of funds in Thai baht terms?

The effective cost of funds, in baht terms, is Round to three decimal places.

Please answer all parts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock