Question: (a) Assuming that the basic insurance and cash reserve needs are met, individuals can start a serious investment program with their savings. With the use

(a) Assuming that the basic insurance and cash reserve needs are met, individuals can start a serious investment program with their savings. With the use of a diagram, assess the different stages of personal net worth over a life cycle. (15 marks)

(b) Baby Inc., Bull Corp., and Dark Company will each pay a dividend of $2.35 next year. The growth rate in dividends for all three companies is 5%. The required return for each company's stock is 8%, 11% and 14% respectively. Calculate the stock price for each company, and comment on the relationship between the required return and the stock price. (10 marks) (25 Marks)

(b) Baby Inc., Bull Corp., and Dark Company will each pay a dividend of $2.35 next year. The growth rate in dividends for all three companies is 5%. The required return for each company's stock is 8%, 11% and 14% respectively. Calculate the stock price for each company, and comment on the relationship between the required return and the stock price. (10 marks) (25 Marks)

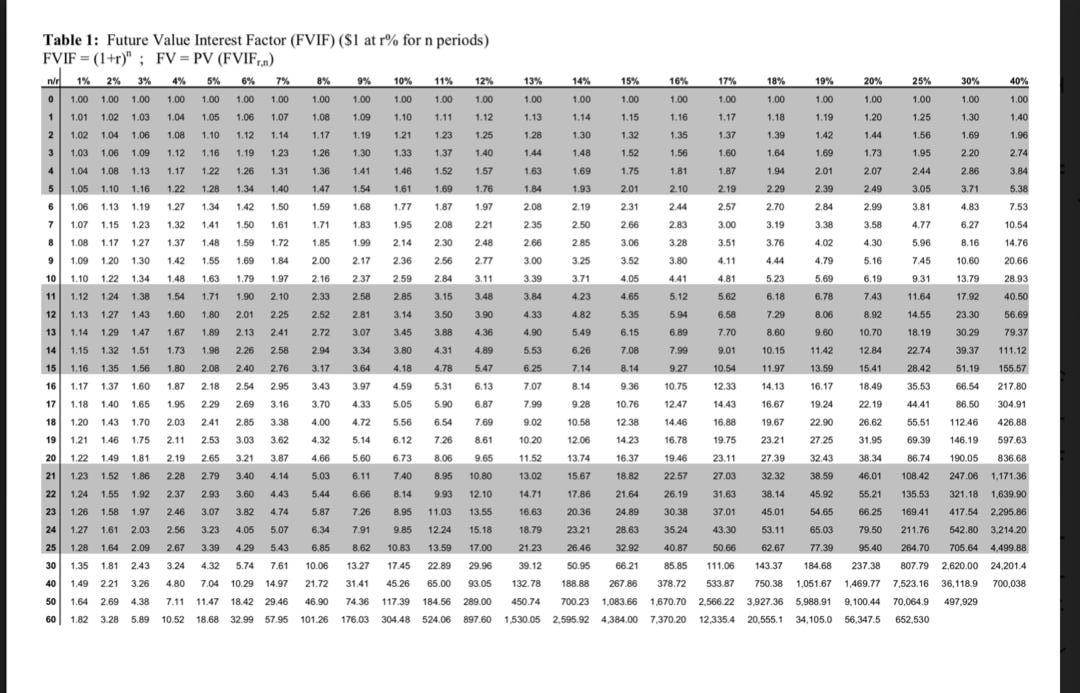

14% 15% 16% 17% 18% 19% 20% 25% 30% 40% 13% 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.30 1.13 1.14 1.15 1.16 1.17 1.18 1.19 1.20 1.25 1.40 1.28 1.30 1.32 1.35 1.37 1.39 1.42 1.44 1.56 1.69 1.96 1.33 1.44 1.48 1.52 1.56 1.60 1.64 1.69 1.73 2.20 2.74 1.95 2.44 1.63 1.69 1.75 1.81 1.87 1.94 201 2.07 2.86 3.84 1.93 2.01 2.10 2.19 2 29 2.39 2.49 3.05 3.71 5.38 1.84 2.08 2.19 2.31 2.44 2.57 2.70 2.83 3.00 3.19 235 266 2.50 2.85 2.66 3.06 3.28 3.51 3.76 3.00 3.25 3.52 3.80 4.11 4.44 3.71 4.81 5.62 5.23 6.18 4.23 3.39 3.84 4.33 4.90 4.82 Table 1: Future Value Interest Factor (FVIF) ($1 at r% for n periods) FVIF = (1+r)" ; FV = PV (FVIF..) nd 1% 2% 3% 1 2 4% 5% 6% 7% 8% 9% 10% 11% 12% 0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1 1 1.01 102 103 1.04 1.05 1.06 1.07 1.08 1.09 1.10 1.11 1.12 2 1,02 104 1.06 1.08 1.10 1.12 1.14 1.17 1.19 1.21 1.23 1.25 3 1.03 1.06 1.09 1.12 1.16 1.19 123 1.26 1.30 1.37 1.40 4 1.04 1.08 1.13 1.17 1.22 1.26 1.31 1.36 1.41 1.46 1.52 1.57 5 5 1.05 1.10 1.16 1.22 1.28 1.34 1.40 1.47 1.54 1.61 1.69 1.76 6 1.06 1.13 1.19 1.27 1.34 1.42 1.50 1.59 1.68 1.77 1.87 1.97 7 1.07 1.15 1.23 1.32 1.41 1.50 1.61 1.71 1.83 1.95 2.08 221 8 1.08 1.17 1.27 1.37 1.48 1.59 1.72 1.85 1.99 2.14 2.30 248 9 1.09 1.20 1.30 1.42 1.55 1.69 1.84 2.00 2.17 2.36 2.56 2.77 10 1.10 122 1.34 1 48 1.63 1.79 1.97 2.16 237 259 2.84 3.11 11 1.12 124 1.38 1.54 1.71 1.90 2.10 2.33 258 2.85 3.15 3.48 12 1.13 1.27 1.43 1.60 1.80 2.01 2 25 2.52 2.81 3.14 3.50 3.90 13 1.14 1.29 1.47 1.67 1.89 2.13 2.41 2.72 3.07 3.45 3.88 4.36 14 1.15 1.32 1.51 1.73 1.98 225 2.58 2.94 3.34 3.80 4.31 4.89 15 1.16 1.35 1.56 1.80 2.08 2.40 2.76 3.17 3.64 4.18 4.78 5.47 16 1.17 1.37 1.60 1.87 2.18 2.54 2.95 3.43 3.97 4.59 5.31 6.13 17 1.18 1.40 1.65 1.96 2.29 2.69 3.16 3.70 433 5.05 5.90 6.87 18 1.20 1.43 1.70 203 241 2.85 338 4.00 4.72 5.56 6.54 7.69 19 1.21 1.46 1.75 2.11 2.53 3.03 3.62 4.32 5.14 6.12 7.26 8.61 20 1.22 1.49 1.81 2.19 265 3.21 3.87 4.66 5.60 6.73 8.06 9.65 21 1.23 1.52 1.86 2.28 2.79 3.40 4.14 5.03 6.11 740 8.95 10.80 22 1.24 1.55 1.92 2.37 2.93 3.60 4.43 5.44 6.66 8.14 9.93 12.10 23 1.26 1.58 1.97 2.46 3.07 3.82 4.74 5.87 726 8.95 11.03 13.55 24 1.27 1.612.03 2.56 3.23 4.05 5.07 6.34 791 9.85 12.24 15.18 25 1.28 1.64 2.09 267 3.39 4.29 5.43 6.85 8.62 10.83 13.59 17.00 30 1.35 1.81 243 3.24 4.32 5.74 7.61 10.06 13.27 17.45 22.89 29.96 40 1.49 221 3.26 4.80 7.04 10.29 14.97 21.72 31.41 45.26 65.00 93.05 50 1.64 2.69 4.38 7.11 11.47 18.42 29.46 46.90 74.36 117.39 184.56 289.00 60 1.82 328 5.89 10.52 18.68 32.99 57.95 101.26 176.03 304,48 524.06 89760 4.05 4.65 5.35 6.15 7.08 441 5.12 5.94 6.89 6,58 7.29 5.49 7.70 8.60 5.53 6.26 7.99 9.01 10.15 6.25 7.14 8.14 9.27 10.54 12.33 11.97 14.13 7.07 8.14 9.36 10.76 10.75 12.47 7.99 9.28 14.43 16.67 2.84 2.99 3.81 4.83 753 3.38 3.58 4.77 6.27 10.54 4.02 4.30 5.96 8.16 14.76 4.79 5.16 7.45 10.60 20.66 5.69 6.19 9.31 13.79 28.93 6.78 7.43 11.64 17.92 40.50 8.06 8.92 14.55 23.30 56.69 9.60 10.70 18.19 30.29 79,37 11.42 12.84 22.74 39.37 111.12 13.59 15.41 28.42 51.19 155.57 16.17 18.49 35.53 66.54 217.80 19.24 22.19 44.41 86.50 304.91 22.90 26.62 55.51 112.46 426.88 27.25 31.95 69.39 146.19 597.63 32.43 38.34 86.74 190.05 836.68 38.59 46.01 108.42 247.06 1,171,36 45.92 55.21 135.53 321.18 1,639.90 54.65 66.25 169.41 417.54 2.295.86 65.03 79,50 211.76 542.80 3.214.20 77.39 95.40 264.70 705.64 4.499.88 184.68 237.38 807.79 2.620.00 24.2014 1.051.67 1,469.77 7,523.16 36.118.9 700,038 5,988.91 9.100.44 70,064.9 497,929 34,105.0 56.347.5 652,530 9.02 10.58 12 38 14.46 16.88 19.67 10.20 12.06 14.23 16.78 19.75 23.21 11.52 13.74 16.37 19.46 23.11 27.39 13.02 15 67 18.82 22 57 27.03 32 32 14.71 17.86 21.64 26.19 31.63 38.14 16.63 20 36 24.89 30.38 37.01 45.01 18.79 23 21 28.63 35.24 43.30 53.11 21.23 26.46 32 92 40.87 50.66 62.67 39.12 50.95 66.21 85.85 111.06 143.37 132.78 188 88 267.86 378.72 533 87 750.38 450.74 700.23 1,083.66 1.670.70 2,566 223,927.36 1,530.05 2.595.92 4.384.00 7,370.20 12,335.4 20,555.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts