Question: A, B, and C formed a partnership with A contributing $30,000, B contributing $50,000, and C contributing $80,000. Their partnership agreement called for the earnings

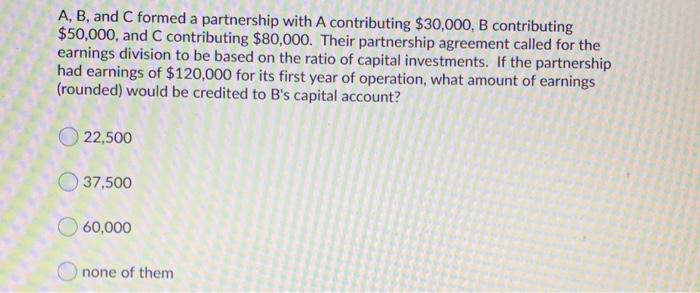

A, B, and C formed a partnership with A contributing $30,000, B contributing $50,000, and C contributing $80,000. Their partnership agreement called for the earnings division to be based on the ratio of capital investments. If the partnership had earnings of $120,000 for its first year of operation, what amount of earnings (rounded) would be credited to B's capital account? 22,500 37,500 60,000 none of them

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock