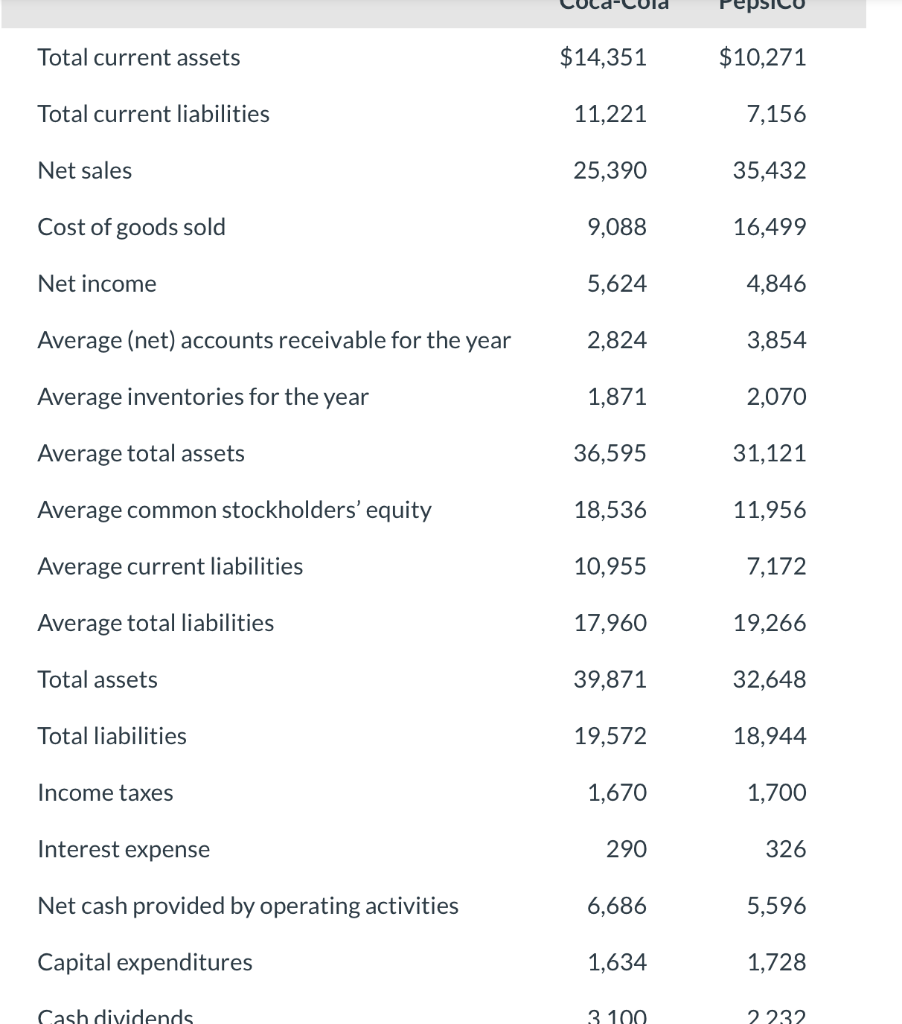

Question: A, B, and C, please! The table at the top is what the problems are referring to. Total current assets $14,351$10,271 Total current liabilities 11,2217,156

A, B, and C, please! The table at the top is what the problems are referring to.

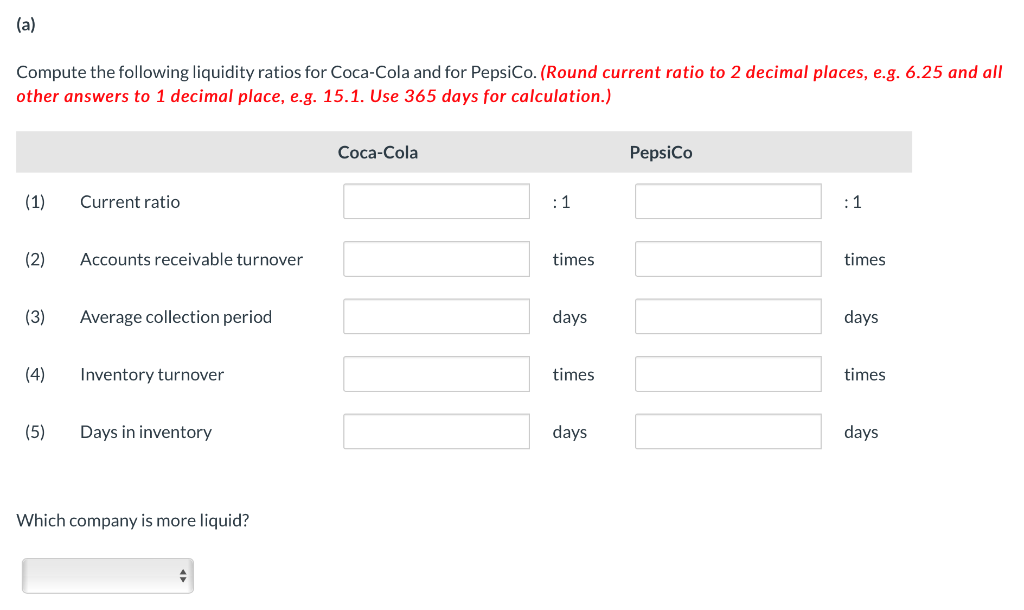

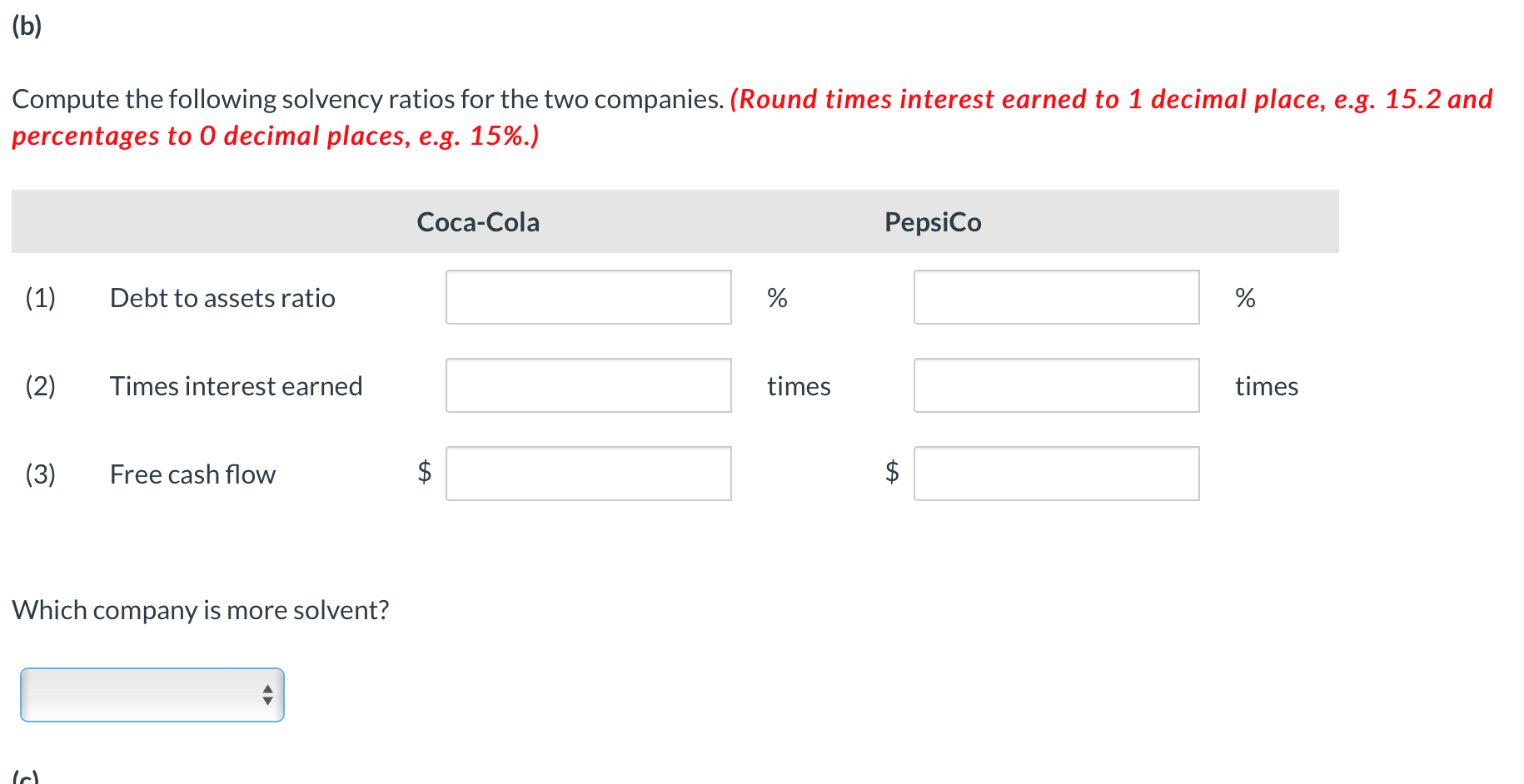

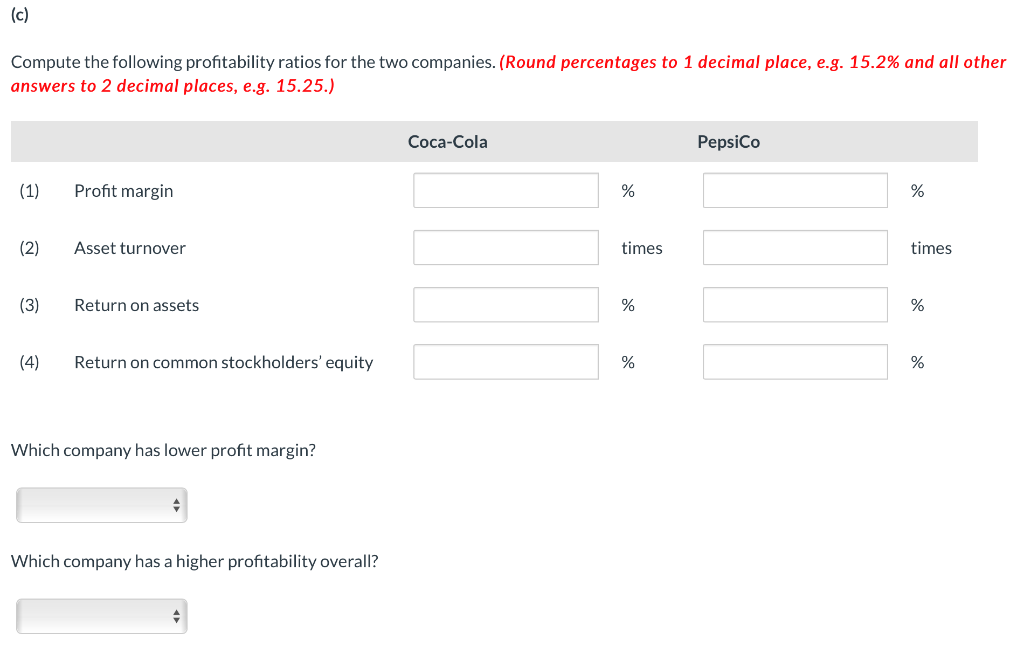

Total current assets $14,351$10,271 Total current liabilities 11,2217,156 Net sales 25,39035,432 Cost of goods sold 9,08816,499 Net income Average (net) accounts receivable for the year 2,8243,854 Average inventories for the year Average total assets 1,87136,5952,07031,121 Average common stockholders' equity 18,536 Average current liabilities Average total liabilities Total assets 10,95517,96039,8717,17219,26632,648 Total liabilities 19,57218,944 Income taxes Interest expense Net cash provided by operating activities Capital expenditures 1,6702906,6861,63431001,7003265,5961,7282232 Compute the following liquidity ratios for Coca-Cola and for PepsiCo. (Round current ratio to 2 decimal places, e.g. 6.25 and al other answers to 1 decimal place, e.g. 15.1. Use 365 days for calculation.) Compute the following solvency ratios for the two companies. (Round times interest earned to 1 decimal place, e.g. 15.2 and percentages to 0 decimal places, e.g. 15\%.) Which company is more solvent? Compute the following profitability ratios for the two companies. (Round percentages to 1 decimal place, e.g. 15.2% and all other answers to 2 decimal places, e.g. 15.25.) Which company has lower profit margin? Which company has a higher profitability overall

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts