Question: A, B, and D are equal general partners in the ABD Partnership, which manufac- tures internal guidance systems for NASA rockets, and has the following

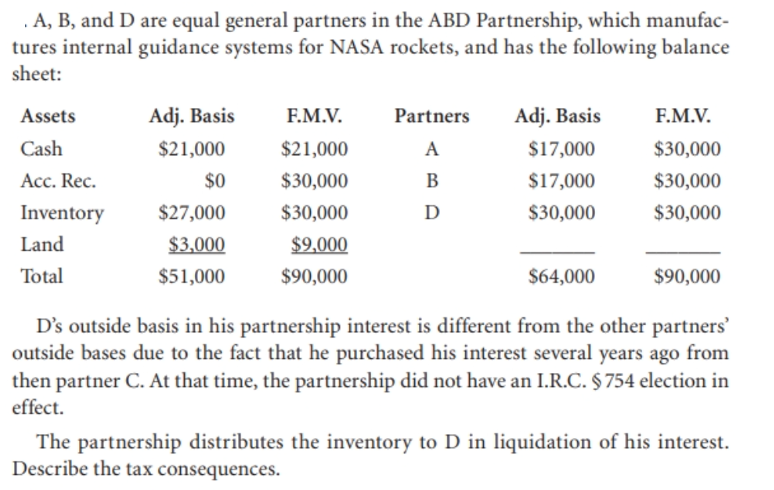

A, B, and D are equal general partners in the ABD Partnership, which manufac- tures internal guidance systems for NASA rockets, and has the following balance sheet: F.M.V. Partners A B Assets Cash Acc. Rec. Inventory Land Total Adj. Basis $21,000 $0 $27,000 $3,000 $51,000 $21,000 $30,000 $30,000 $9,000 $90,000 Adj. Basis $17,000 $17,000 $30,000 F.M.V. $30,000 $30,000 $30,000 D $64,000 $90,000 D's outside basis in his partnership interest is different from the other partners' outside bases due to the fact that he purchased his interest several years ago from then partner C. At that time, the partnership did not have an I.R.C. $ 754 election in effect. The partnership distributes the inventory to D in liquidation of his interest. Describe the tax consequences. A, B, and D are equal general partners in the ABD Partnership, which manufac- tures internal guidance systems for NASA rockets, and has the following balance sheet: F.M.V. Partners A B Assets Cash Acc. Rec. Inventory Land Total Adj. Basis $21,000 $0 $27,000 $3,000 $51,000 $21,000 $30,000 $30,000 $9,000 $90,000 Adj. Basis $17,000 $17,000 $30,000 F.M.V. $30,000 $30,000 $30,000 D $64,000 $90,000 D's outside basis in his partnership interest is different from the other partners' outside bases due to the fact that he purchased his interest several years ago from then partner C. At that time, the partnership did not have an I.R.C. $ 754 election in effect. The partnership distributes the inventory to D in liquidation of his interest. Describe the tax consequences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts