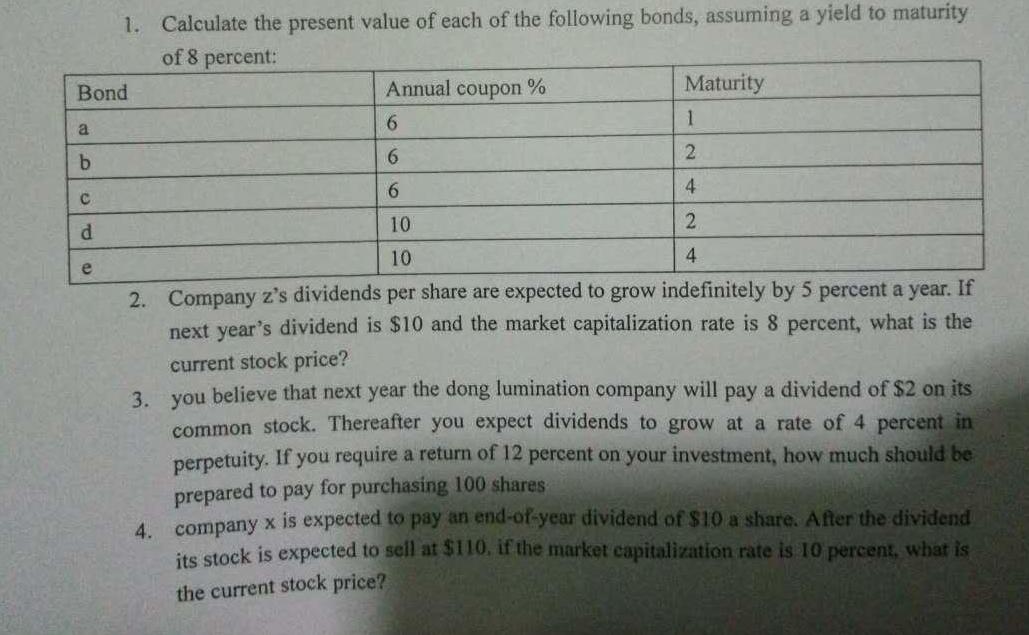

Question: a b Bond C d 1. Calculate the present value of each of the following bonds, assuming a yield to maturity of 8 percent:

a b Bond C d 1. Calculate the present value of each of the following bonds, assuming a yield to maturity of 8 percent: e Maturity Annual coupon % 6 6 6 10 10 2. Company z's dividends per share are expected to grow indefinitely by 5 percent a year. If next year's dividend is $10 and the market capitalization rate is 8 percent, what is the current stock price? 1 2 4 2 4 3. you believe that next year the dong lumination company will pay a dividend of $2 on its common stock. Thereafter you expect dividends to grow at a rate of 4 percent in perpetuity. If you require a return of 12 percent on your investment, how much should be prepared to pay for purchasing 100 shares 4. company x is expected to pay an end-of-year dividend of $10 a share. After the dividend its stock is expected to sell at $110. if the market capitalization rate is 10 percent, what is the current stock price?

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

1Bond Present Value a 1000 par value pays interest semiannually ... View full answer

Get step-by-step solutions from verified subject matter experts