Question: A B C [ 0 . It is July 1 , 2 0 2 0 . You work as an analyst for Clsa Frigorifics in

A

B

C

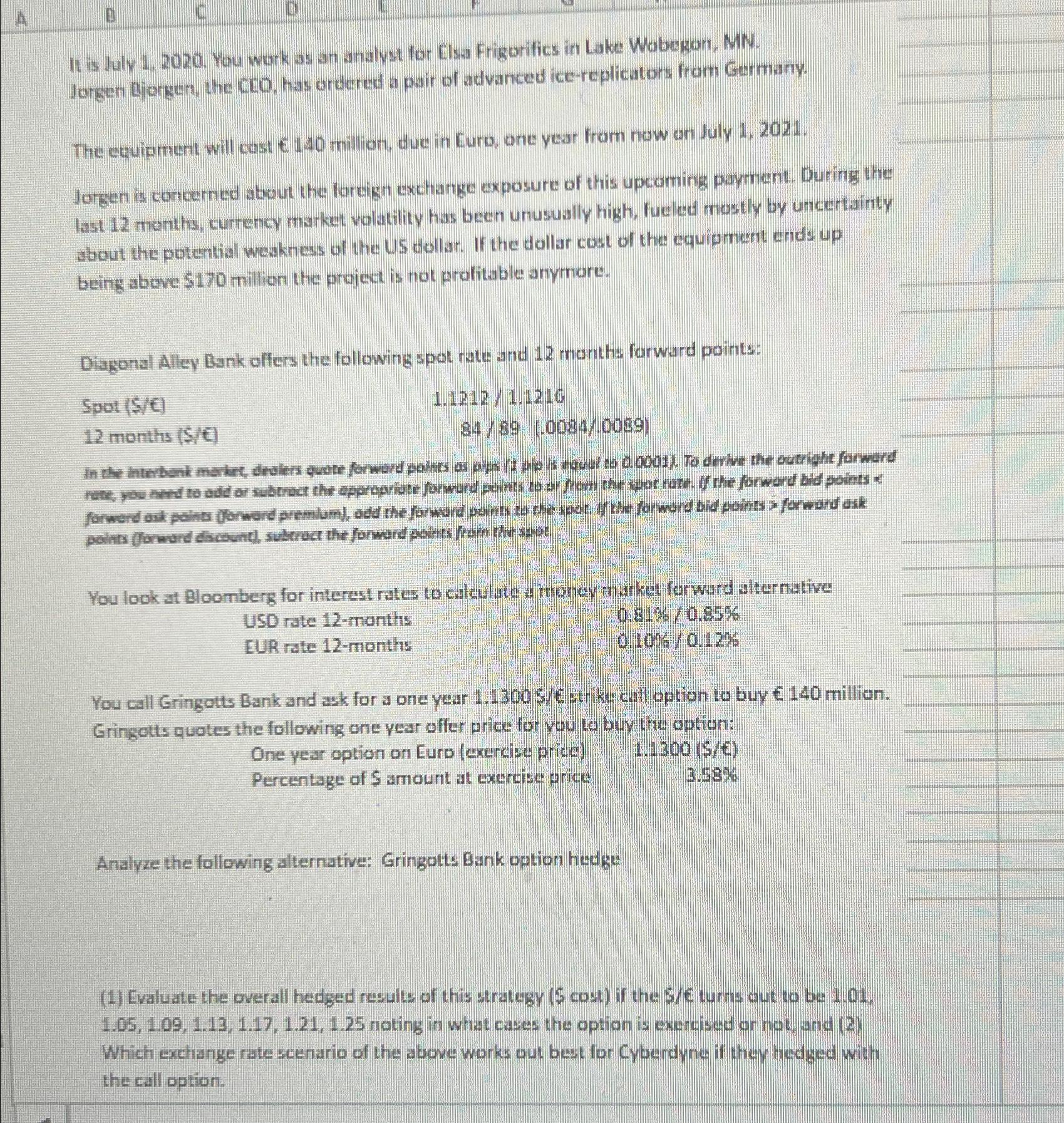

It is July You work as an analyst for Clsa Frigorifics in Lake Wobegon, MN Jorgen Giongen, the CCO, has ordered a pair of advanced icereplicators from Genmany.

The equipment will cast million, due in Curo, one year from now on July

Jorgen is conoerned about the forcign exchange exposure of this upcoming puynent. During the last months, currency market volatility has been unusually high, fueled mostly by uncertainty about the potential weakness of the U dollar. If the dollar cost of the equipment ends up being above $ million the project is not prolitsble amyrnore.

Diagonal Alley Bank offers the following spot nate and months forward points:

Spot S

months $C

USD rate months

EUR rate months

You call Gringotts Bank and ask for a one year s Cptn ike ct option to buy million. Gringots quotes the following one vear offer price for you le buy the option:

One year option on Euro exercise price

Percentage of $ amount at excroise price

Analyze the following alternative: Gringotts Bank option hedge:

Evaluate the overall hedged rusults of this strategy $ cost if the turns cout to be noting in what cases the option is exencised or not, and Which exchange rote scenario of the above works out best for Cyberdyne if they hedged with the call option.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock