Question: a, b, c, Although the Chen Company's milling machine is old, it is still in relatively good working order and would last for another 10

a, b,

b,

c,

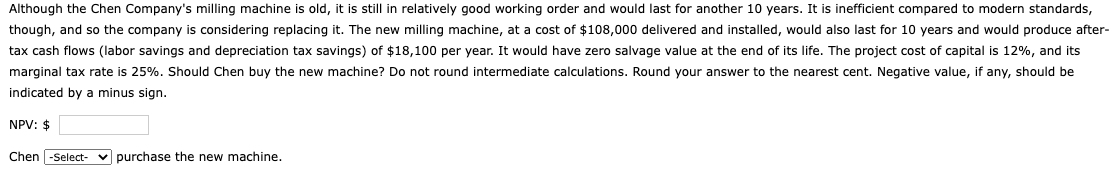

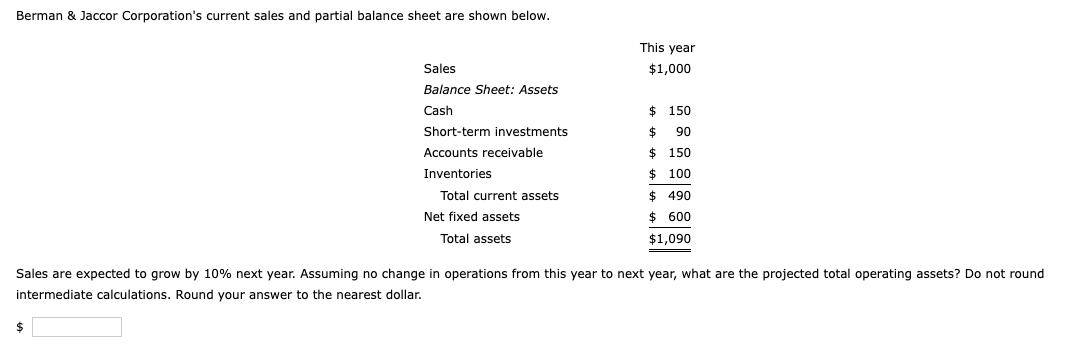

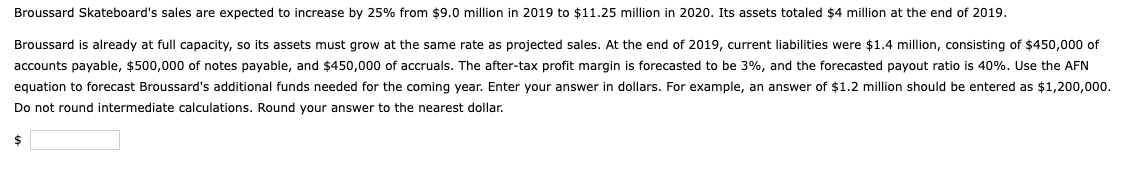

Although the Chen Company's milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $108,000 delivered and installed, would also last for 10 years and would produce after- tax cash flows (labor savings and depreciation tax savings) of $18,100 per year. It would have zero salvage value at the end of its life. The project cost of capital is 12%, and its marginal tax rate is 25%. Should Chen buy the new machine? Do not round intermediate calculations. Round your answer to the nearest cent. Negative value, if any, should be indicated by a minus sign. NPV: $ Chen -Select- purchase the new machine. Berman & Jaccor Corporation's current sales and partial balance sheet are shown below. This year $1,000 Sales Balance Sheet: Assets Cash $ 150 $ 90 Short-term investments Accounts receivable Inventories Total current assets Net fixed assets Total assets $ 150 $ 100 $ 490 $ 600 $1,090 Sales are expected to grow by 10% next year. Assuming no change in operations from this year to next year, what are the projected total operating assets? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Broussard Skateboard's sales are expected to increase by 25% from $9.0 million in 2019 to $11.25 million in 2020. Its assets totaled $4 million at the end of 2019. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2019, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. The after-tax profit margin is forecasted to be 3%, and the forecasted payout ratio is 40%. Use the AFN equation to forecast Broussard's additional funds needed for the coming year. Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts