Question: A, B, C, and D are equal partners in the ABCD partnership. The partnership's current balance sheets are as follows. Assets Book Value FMV Cash

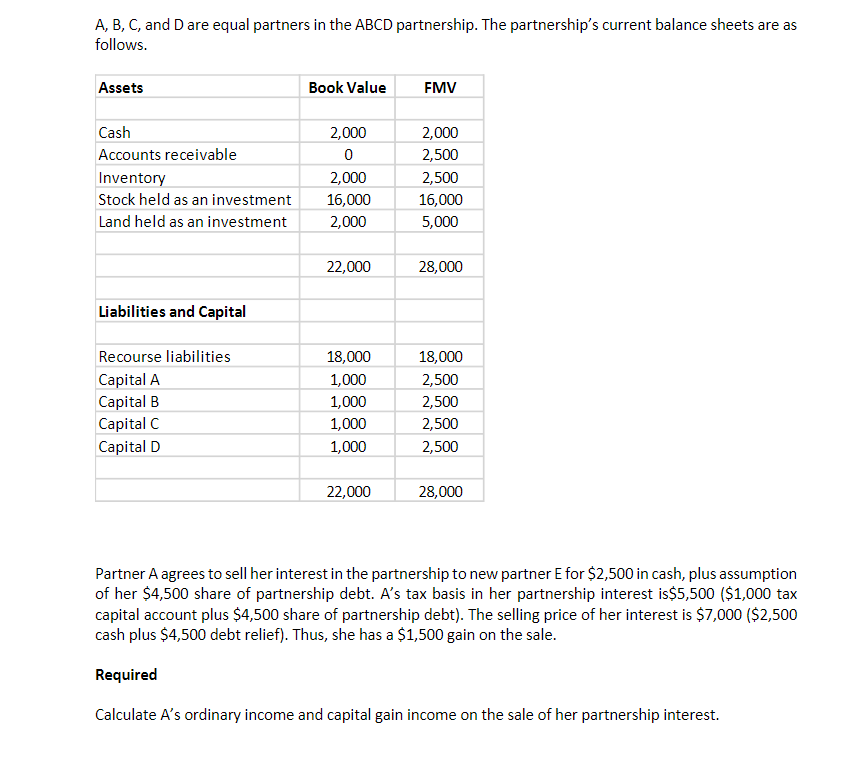

A, B, C, and D are equal partners in the ABCD partnership. The partnership's current balance sheets are as follows. Assets Book Value FMV Cash 2,000 2,000 Accounts receivable 0 2,500 Inventory 2,000 2,500 Stock held as an investment 16,000 16,000 Land held as an investment 2,000 5,000 22,000 28,000 Liabilities and Capital Recourse liabilities 18,000 18,000 Capital A 1,000 2,500 Capital B 1,000 2,500 Capital C 1,000 2,500 Capital D 1,000 2,500 22,000 28,000 Partner A agrees to sell her interest in the partnership to new partner E for $2,500 in cash, plus assumption of her $4,500 share of partnership debt. A's tax basis in her partnership interest is$5,500 ($1,000 tax capital account plus $4,500 share of partnership debt). The selling price of her interest is $7,000 ($2,500 cash plus $4,500 debt relief). Thus, she has a $1,500 gain on the sale. Required Calculate A's ordinary income and capital gain income on the sale of her partnership interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts