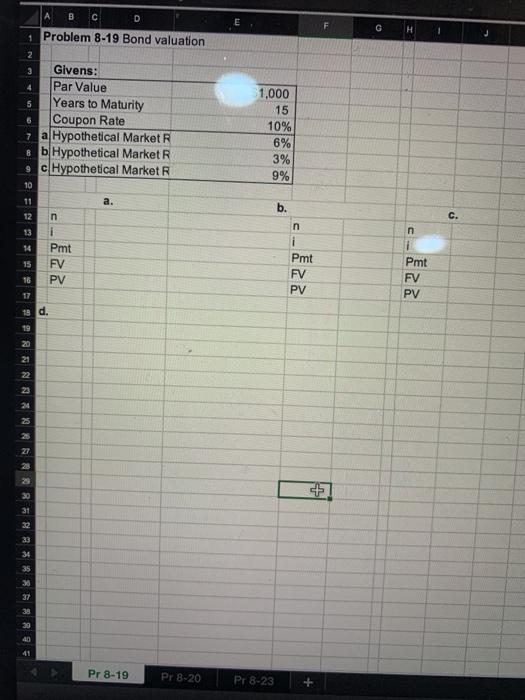

Question: A B C D 1 Problem 8-19 Bond valuation 2 4 3 Givens: Par Value 5 Years to Maturity 6 Coupon Rate 7 a Hypothetical

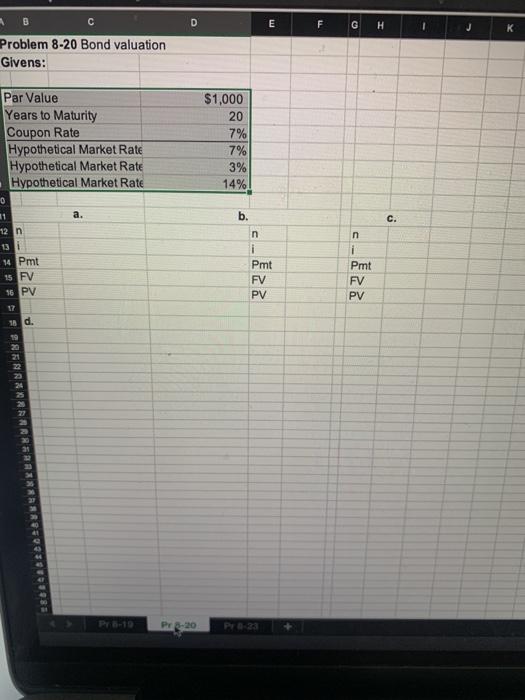

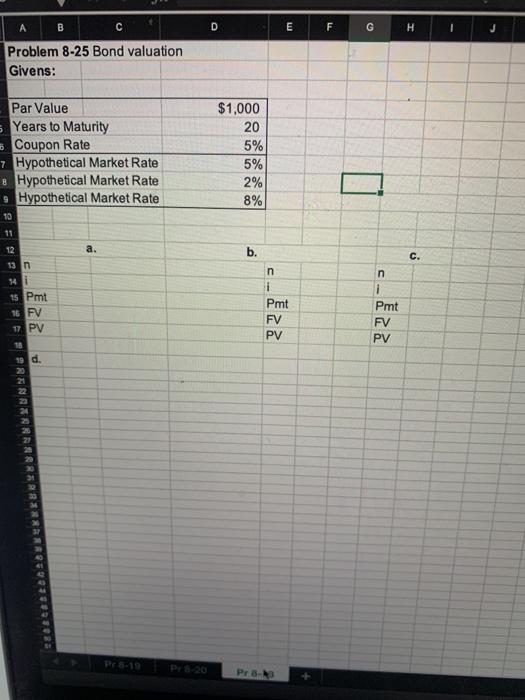

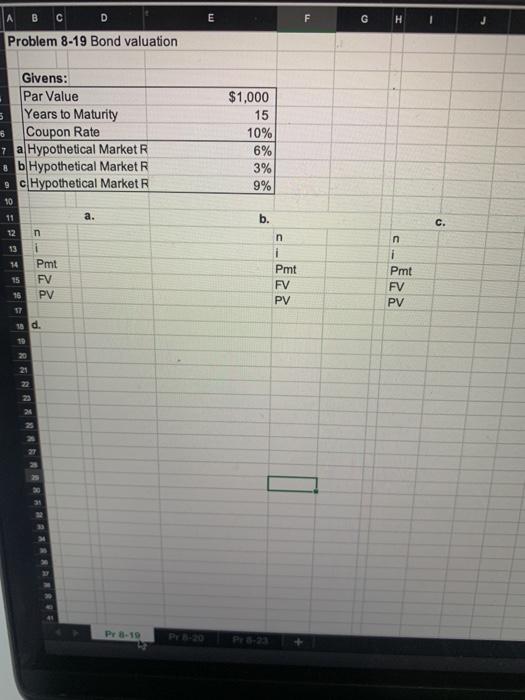

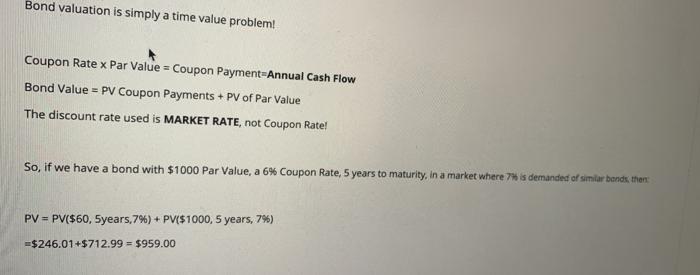

A B C D 1 Problem 8-19 Bond valuation 2 4 3 Givens: Par Value 5 Years to Maturity 6 Coupon Rate 7 a Hypothetical Market R 8 b Hypothetical Market R 9 c Hypothetical Market R 10 a. 12 i Pmt FV PV 1,000 15 10% 6% 3% 9% b. C. C 14 n i Pmt FV PV Pmt FV PV 17 18 d. 24 &&&&&%89%WNNNNNNB== 33 Pr 8-19 Pr 8-20 Pr 8-23 D E F G H 1 Problem 8-20 Bond valuation Givens: $1,000 20 7% 7% 3% 14% Par Value Years to Maturity Coupon Rate Hypothetical Market Rate Hypothetical Market Rate Hypothetical Market Rate 0 11 a. 12 13 14 Pmt 15 FV 16 PV b. c. n n i Pmt FV PV i Pmt FV PV 17 Bmwwm8832nm mmmm 24 21 Pr 8-20 Pr23 A B D E F G H J Problem 8-25 Bond valuation Givens: Par Value 5 Years to Maturity Coupon Rate 7 Hypothetical Market Rate Hypothetical Market Rate 9 Hypothetical Market Rate $1,000 20 5% 5% 2% 8% 10 11 b. 12 13 n c. n 15 Pmt 15 FV 17 PV n i Pmt FV PV Pmt FV PV 19 d. 22 23 31 Pro- A B C D E F G . Problem 8-19 Bond valuation Givens: Par Value 5 Years to Maturity Coupon Rate 7 a Hypothetical Market R 8 b Hypothetical Market R . c Hypothetical Market R 6 $1,000 15 10% 6% 3% 9% 10 11 b. C. 12 13 14 Pmt 15 FV 16 PV ST 18 d. n 1 Pmt FV PV n 1 Pmt FV PV 20 21 20 24 2 27 ) 31 Pe 8-10 Bond valuation is simply a time value problem! Coupon Rate x Par Value = Coupon Payment Annual Cash Flow Bond Value = PV Coupon Payments + PV of Par Value The discount rate used is MARKET RATE, not Coupon Ratel So, if we have a bond with $1000 Par Value, a 6% Coupon Rate, 5 years to maturity, in a market where 7* is demanded of similar bonds then PV = PV($60,5years,7%) + PV($1000, 5 years, 7%) =$246.01+$712.99 = $959.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts