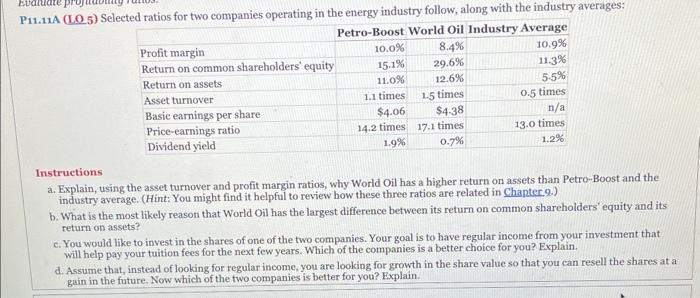

Question: a)? b)? c)? d)? a. Explain, using the asset turnover and profit margin ratios, why World Oil has a higher return on assets than Petro-Boost

a. Explain, using the asset turnover and profit margin ratios, why World Oil has a higher return on assets than Petro-Boost and the industry average. (Hint: You might find it helpful to review how these three ratios are related in Chapter.9.) b. What is the most likely reason that World Oil has the largest difference between its return on common shareholders' equity and its return on assets? c. You would like to invest in the shares of one of the two companies. Your goal is to have regular income from your investment that will help pay your tuition fees for the next few years. Which of the companies is a better choice for you? Explain. d. Assume that, instead of looking for regular income, you are looking for growth in the share value so that you can resell the shares at a gain in the future. Now which of the two companies is better for you? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts