Question: A B c D E 4 5 7 8 11 12 1 On August 1, 2020, ABC contracted with XYZ to provide XYZ with the

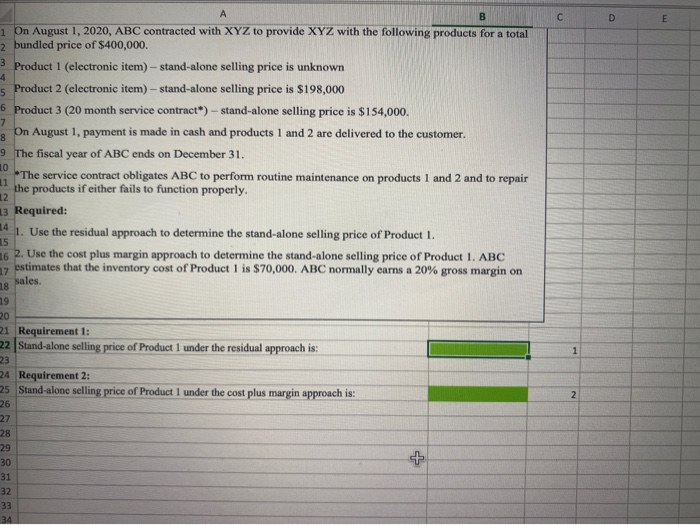

A B c D E 4 5 7 8 11 12 1 On August 1, 2020, ABC contracted with XYZ to provide XYZ with the following products for a total 2 bundled price of $400,000 3 Product 1 (electronic item) - stand-alone selling price is unknown Product 2 (electronic item) - stand-alone selling price is $198,000 6 Product 3 (20 month service contract*) - stand-alone selling price is $154,000. On August 1, payment is made in cash and products 1 and 2 are delivered to the customer. 9 The fiscal year of ABC ends on December 31. LO *The service contract obligates ABC to perform routine maintenance on products 1 and 2 and to repair the products if either fails to function properly. 13 Required: 1. Use the residual approach to determine the stand-alone selling price of Product 1. 15 16 2. Use the cost plus margin approach to determine the stand-alone selling price of Product 1. ABC estimates that the inventory cost of Product 1 is $70,000. ABC normally carns a 20% gross margin on sales. 18 19 20 21 Requirement 1: 22 Stand-alone selling price of Product 1 under the residual approach is: 23 24 Requirement 2: 25 Stand-alone selling price of Product I under the cost plus margin approach is 17 1 2 26 27 28 29 30 31 32 33 34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts