Question: A: B: C: D: E: Calculate the finance charge (in $), the finance charge per $100 (in $), and the annual percentage rate for the

A:

B:

B:

C:

D:

D:

E:

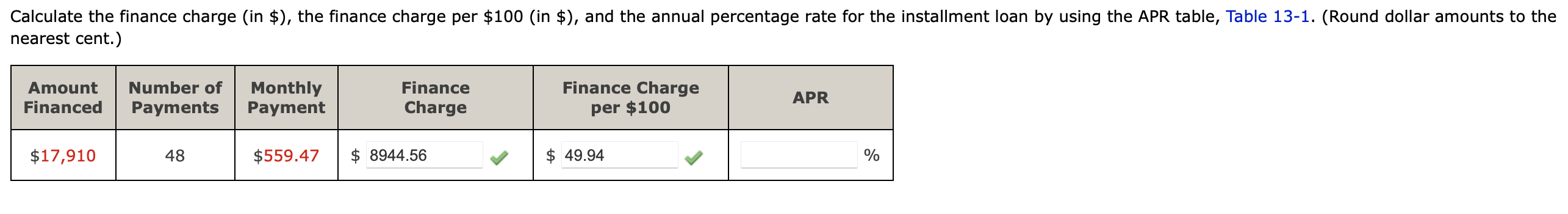

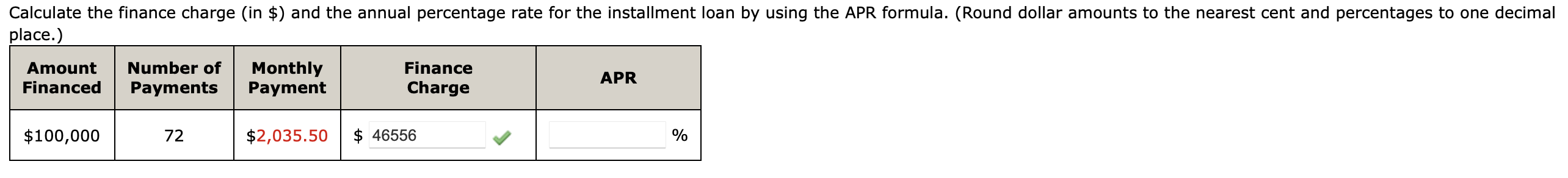

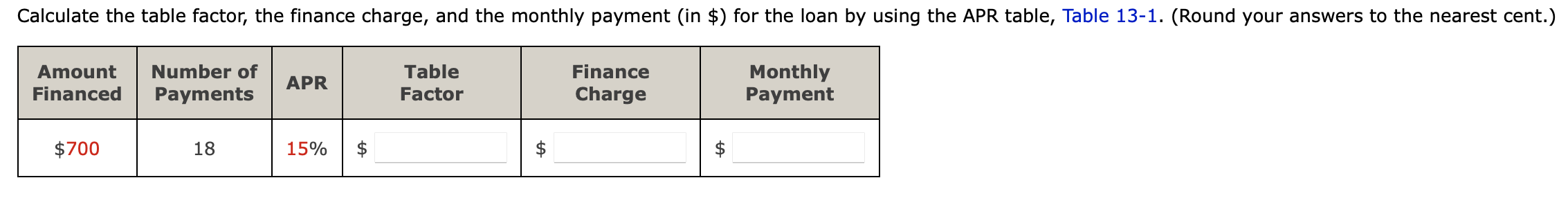

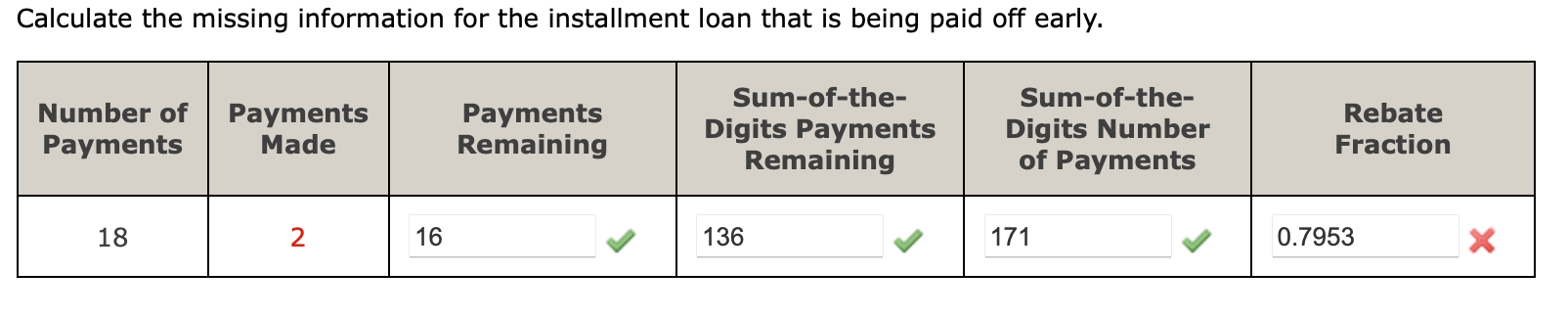

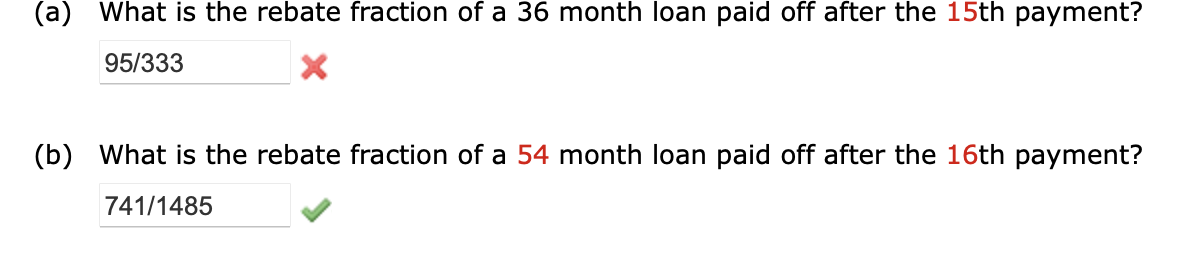

Calculate the finance charge (in $), the finance charge per $100 (in $), and the annual percentage rate for the installment loan by using the APR table, Table 13-1. (Round dollar amounts to the nearest cent.) Finance Charge Amount Financed Number of Payments Monthly Payment Finance Charge APR per $100 $17,910 48 $559.47 $ 8944.56 $ 49.94 % Calculate the finance charge (in $) and the annual percentage rate for the installment loan by using the APR formula. (Round dollar amounts to the nearest cent and percentages to one decimal place.) Amount Number of Monthly Finance APR Financed Payments Payment Charge $100,000 72 $2,035.50 $ 46556 % Calculate the table factor, the finance charge, and the monthly payment in $) for the loan by using the APR table, Table 13-1. (Round your answers to the nearest cent.) Amount Financed Number of Payments APR Table Factor Finance Charge Monthly Payment $700 18 15% $ $ $ Calculate the missing information for the installment loan that is being paid off early. Number of Payments Payments Made Payments Remaining Sum-of-the- Digits Payments Remaining Sum-of-the- Digits Number of Payments Rebate Fraction 18 2 16 136 171 0.7953 X (a) What is the rebate fraction of a 36 month loan paid off after the 15th payment? 95/333 x (b) What is the rebate fraction of a 54 month loan paid off after the 16th payment? 741/1485 Calculate the finance charge (in $), the finance charge per $100 (in $), and the annual percentage rate for the installment loan by using the APR table, Table 13-1. (Round dollar amounts to the nearest cent.) Finance Charge Amount Financed Number of Payments Monthly Payment Finance Charge APR per $100 $17,910 48 $559.47 $ 8944.56 $ 49.94 % Calculate the finance charge (in $) and the annual percentage rate for the installment loan by using the APR formula. (Round dollar amounts to the nearest cent and percentages to one decimal place.) Amount Number of Monthly Finance APR Financed Payments Payment Charge $100,000 72 $2,035.50 $ 46556 % Calculate the table factor, the finance charge, and the monthly payment in $) for the loan by using the APR table, Table 13-1. (Round your answers to the nearest cent.) Amount Financed Number of Payments APR Table Factor Finance Charge Monthly Payment $700 18 15% $ $ $ Calculate the missing information for the installment loan that is being paid off early. Number of Payments Payments Made Payments Remaining Sum-of-the- Digits Payments Remaining Sum-of-the- Digits Number of Payments Rebate Fraction 18 2 16 136 171 0.7953 X (a) What is the rebate fraction of a 36 month loan paid off after the 15th payment? 95/333 x (b) What is the rebate fraction of a 54 month loan paid off after the 16th payment? 741/1485

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts