Question: A: B: C: D: E: Calculate the total cost, total depreciation, and annual depreciation (in $) for the following assets by using the straight-line method.

A:

B:

B:

C:

C:

D:

E:

E:

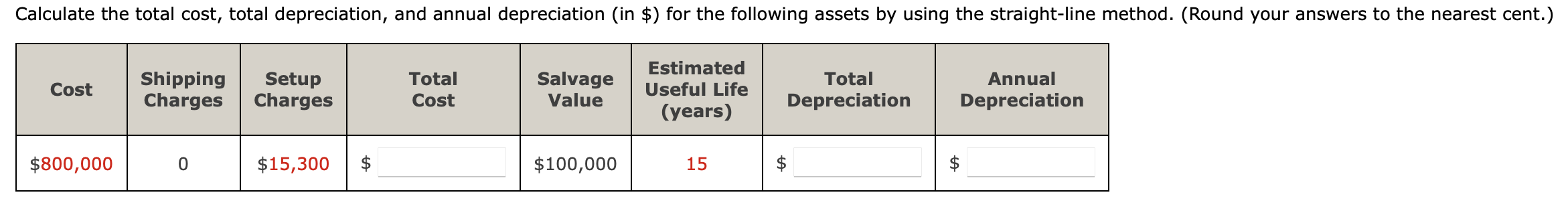

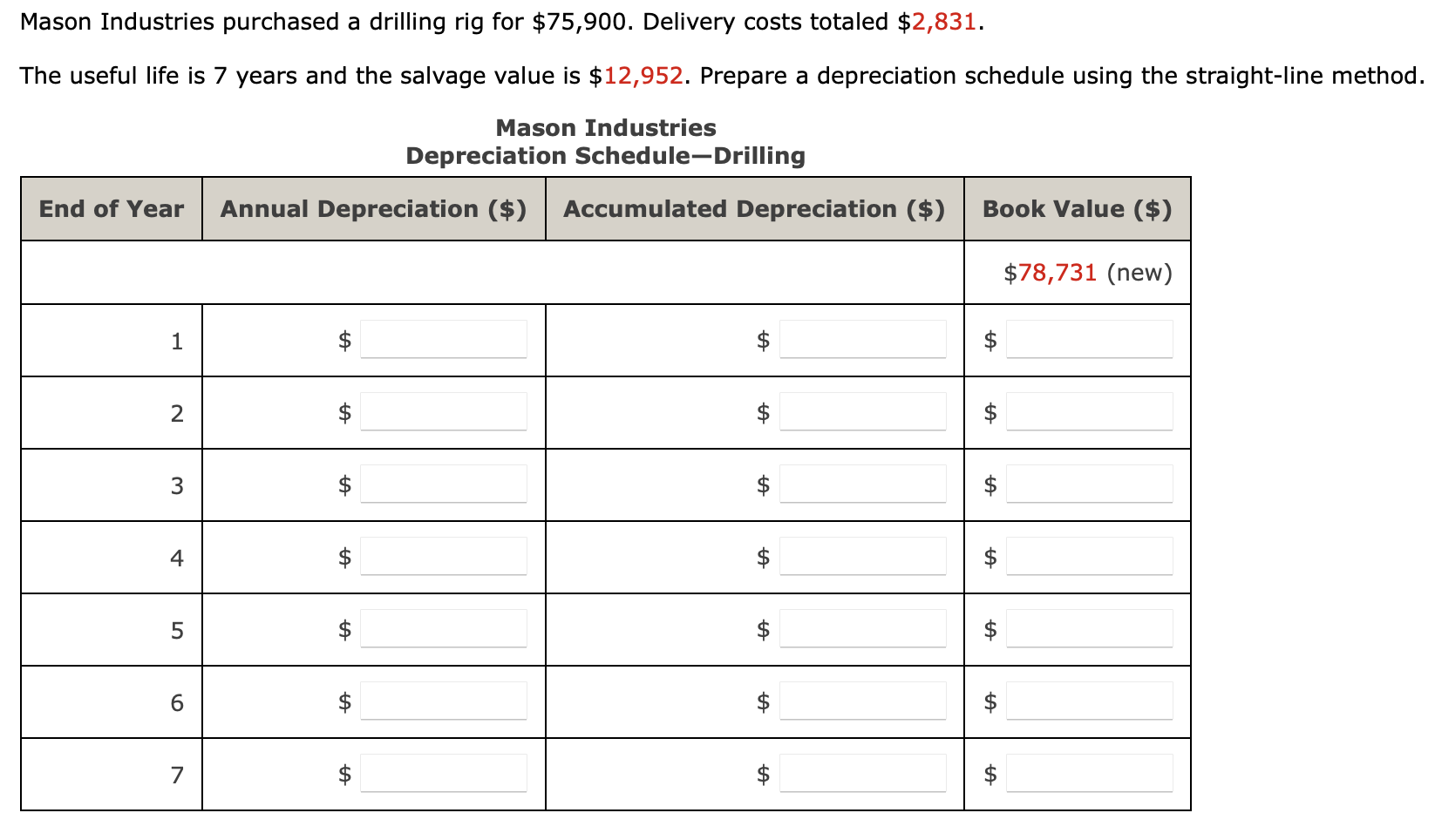

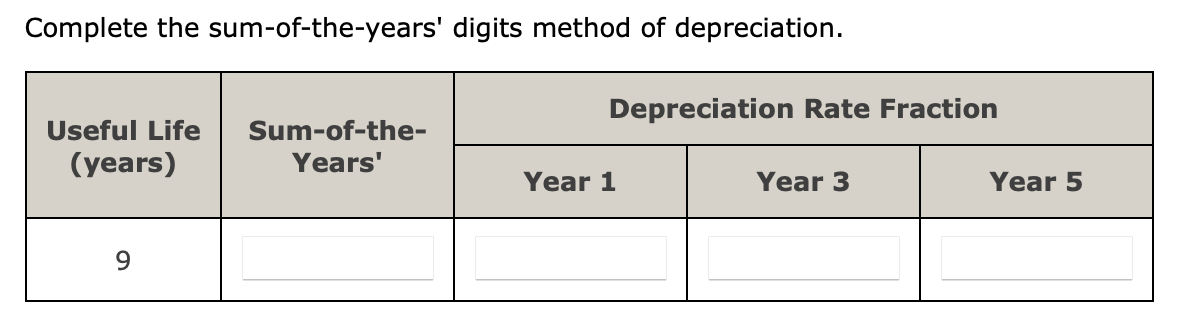

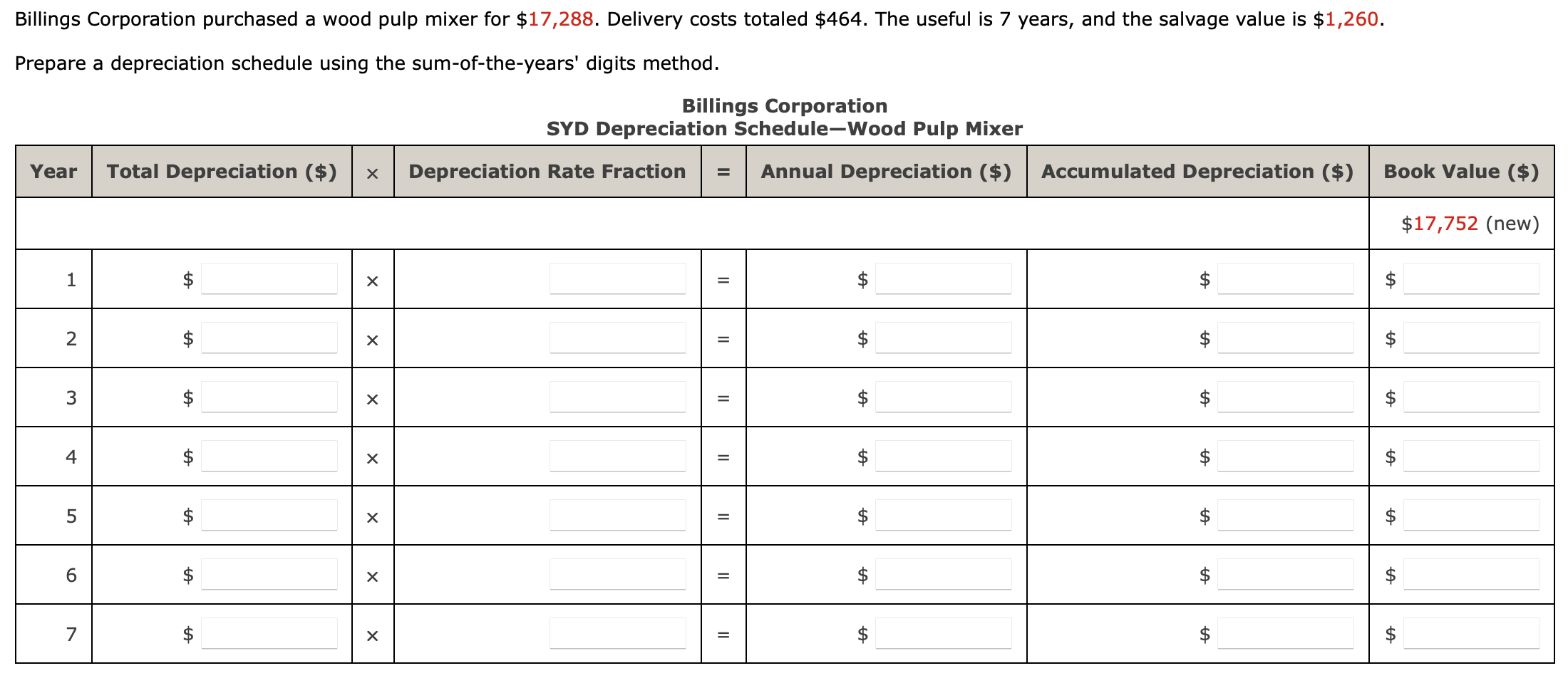

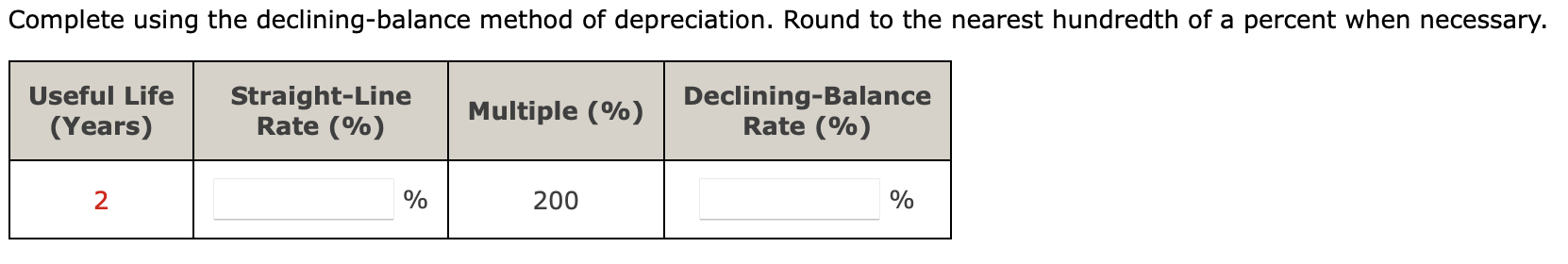

Calculate the total cost, total depreciation, and annual depreciation (in $) for the following assets by using the straight-line method. (Round your answers to the nearest cent.) Cost Shipping Charges Setup Charges Total Cost Salvage Value Estimated Useful Life (years) Total Depreciation Annual Depreciation $800,000 0 $15,300 $ $100,000 15 $ Mason Industries purchased a drilling rig for $75,900. Delivery costs totaled $2,831. The useful life is 7 years and the salvage value is $12,952. Prepare a depreciation schedule using the straight-line method. Mason Industries Depreciation Schedule-Drilling End of Year Annual Depreciation ($) Accumulated Depreciation ($) Book Value ($) $78,731 (new) 1 $ $ $ 2. $ $ $ 3 $ $ $ 4 $ $ ta $ 5 $ $ 6 $ $ $ 7 $ $ $ Complete the sum-of-the-years' digits method of depreciation. Depreciation Rate Fraction Useful Life (years) Sum-of-the- Years' Year 1 Year 3 Year 5 9 Billings Corporation purchased a wood pulp mixer for $17,288. Delivery costs totaled $464. The useful is 7 years, and the salvage value is $1,260. Prepare a depreciation schedule using the sum-of-the-years' digits method. Billings Corporation SYD Depreciation Schedule-Wood Pulp Mixer Year Total Depreciation ($) Depreciation Rate Fraction Annual Depreciation ($) Accumulated Depreciation ($) Book Value ($) $17,752 (new) 1 = $ $ $ 2 $ x = 11 $ $ $ ta 3 $ X = II $ $ $ ta 4 = - $ $ 5 $ = $ $ $ 6 $ = $ 7 $ = $ $ $ Complete using the declining-balance method of depreciation. Round to the nearest hundredth of a percent when necessary. Useful Life (Years) Straight-Line Rate (%) Multiple (%) Declining-Balance Rate (%) 2 % 200 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts