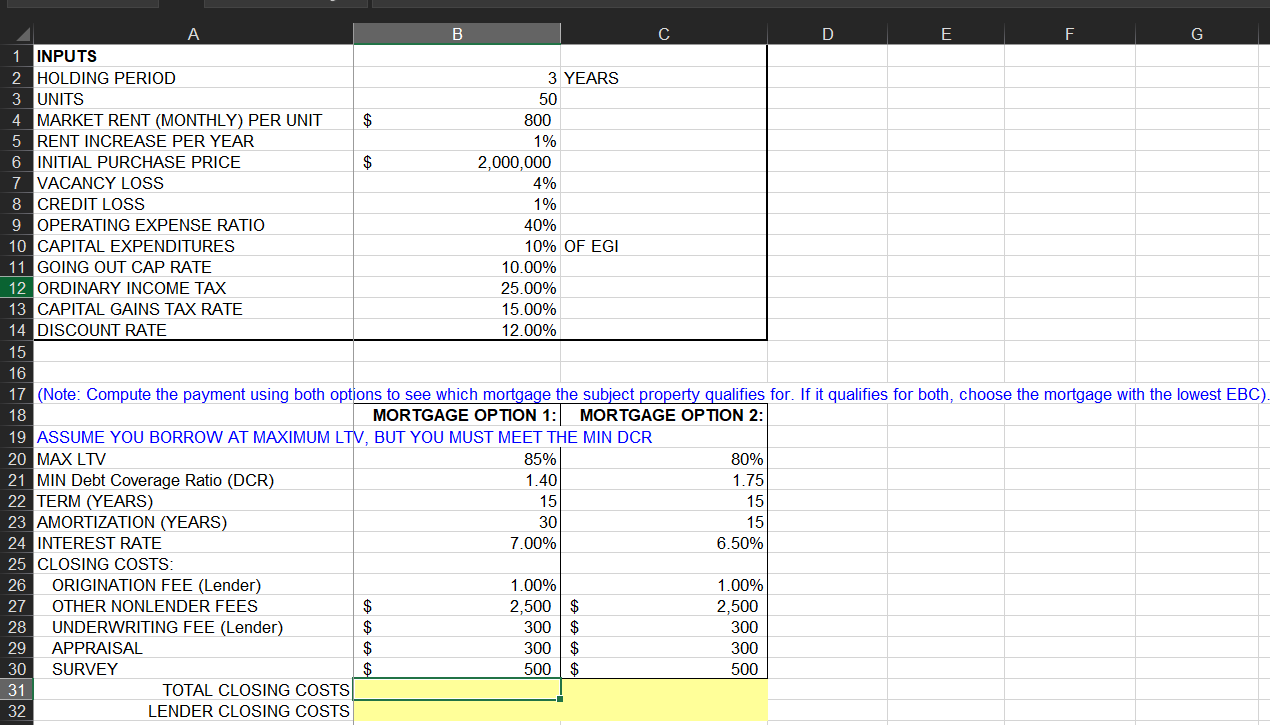

Question: A B C D E F. G 1. INPUTS 2 HOLDING PERIOD 3 YEARS 3 UNITS 50 4 MARKET RENT (MONTHLY) PER UNIT $ 800

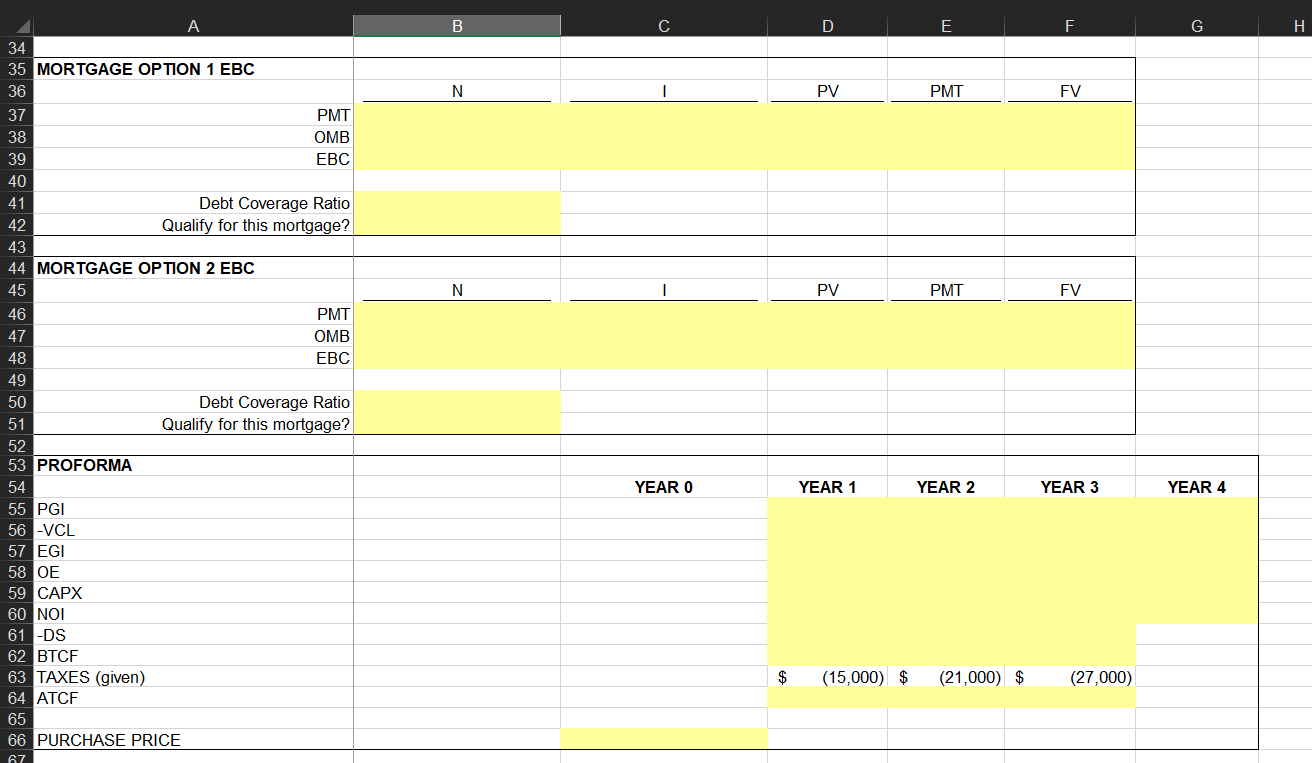

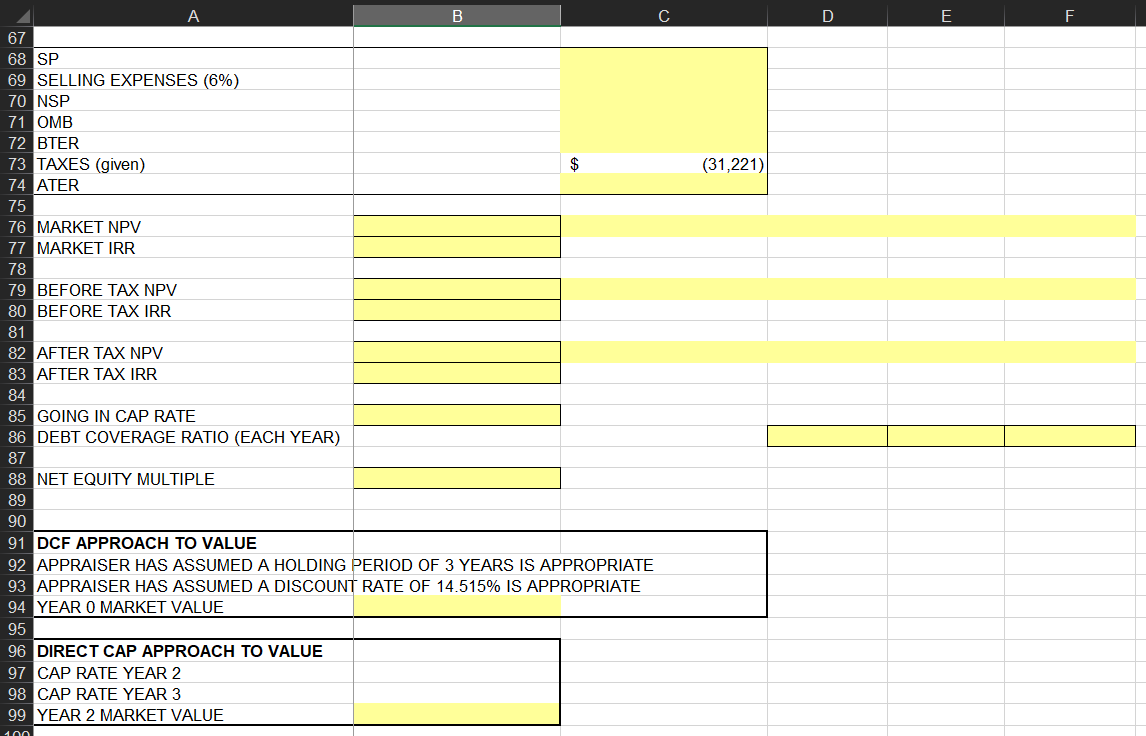

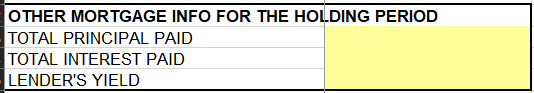

A B C D E F. G 1. INPUTS 2 HOLDING PERIOD 3 YEARS 3 UNITS 50 4 MARKET RENT (MONTHLY) PER UNIT $ 800 5 RENT INCREASE PER YEAR 1% 6 INITIAL PURCHASE PRICE $ 2,000,000 7 VACANCY LOSS 4% 8 CREDIT LOSS 1% 9 OPERATING EXPENSE RATIO 40% 10 CAPITAL EXPENDITURES 10% OF EGI 11 GOING OUT CAP RATE 10.00% 12 ORDINARY INCOME TAX 25.00% 13 CAPITAL GAINS TAX RATE 15.00% 14 DISCOUNT RATE 12.00% 15 16 17 (Note: Compute the payment using both options to see which mortgage the subject property qualifies for. If it qualifies for both, choose the mortgage with the lowest EBC). 18 MORTGAGE OPTION 1: MORTGAGE OPTION 2: 19 ASSUME YOU BORROW AT MAXIMUM LTV, BUT YOU MUST MEET THE MIN DCR 20 MAX LTV 85% 80% 21 MIN Debt Coverage Ratio (DCR) 1.40 1.751 22 TERM (YEARS) 15 15 23 AMORTIZATION (YEARS) 30 15 24 INTEREST RATE 7.00% 6.50% 25 CLOSING COSTS: 26 ORIGINATION FEE (Lender) 1.00% 1.00% 27 OTHER NONLENDER FEES $ 2,500 $ 2,500 28 UNDERWRITING FEE (Lender) $ 300 $ 300 29 APPRAISAL $ 300 $ 300 30 SURVEY 500 $ 500 31 TOTAL CLOSING COSTS 32 LENDER CLOSING COSTS B D E F G H N PV PMT FV OMB N 1 PV PMT FV A 34 35 MORTGAGE OPTION 1 EBC 36 37 PMT 38 39 EBC 40 41 Debt Coverage Ratio 42 Qualify for this mortgage? 43 44 MORTGAGE OPTION 2 EBC 45 46 PMT 47 OMB 48 EBC 49 50 Debt Coverage Ratio 51 Qualify for this mortgage? 52 53 PROFORMA 54 55 PGI 56 -VCL 57 EGI 58 OE 59 CAPX 60 NOI 61 -DS 62 BTCF 63 TAXES (given) 64 ATCF 65 66 PURCHASE PRICE 67 YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 $ (15,000) $ (21,000) $ (27,000) D E F. (31,221) B C 67 68 SP 69 SELLING EXPENSES (6%) 70 NSP 71 OMB 72 BTER 73 TAXES (given) $ 74 ATER 75 76 MARKET NPV 77 MARKET IRR 78 79 BEFORE TAX NPV 80 BEFORE TAX IRR 81 82 AFTER TAX NPV 83 AFTER TAX IRR 84 85 GOING IN CAP RATE 86 DEBT COVERAGE RATIO (EACH YEAR) 87 88 NET EQUITY MULTIPLE 89 90 91 DCF APPROACH TO VALUE 92 APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE 93 APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14.515% IS APPROPRIATE 94 YEAR O MARKET VALUE 95 96 DIRECT CAP APPROACH TO VALUE 97 CAP RATE YEAR 2 98 CAP RATE YEAR 3 99 YEAR 2 MARKET VALUE 100 OTHER MORTGAGE INFO FOR THE HOLDING PERIOD TOTAL PRINCIPAL PAID TOTAL INTEREST PAID LENDER'S YIELD A B C D E F. G 1. INPUTS 2 HOLDING PERIOD 3 YEARS 3 UNITS 50 4 MARKET RENT (MONTHLY) PER UNIT $ 800 5 RENT INCREASE PER YEAR 1% 6 INITIAL PURCHASE PRICE $ 2,000,000 7 VACANCY LOSS 4% 8 CREDIT LOSS 1% 9 OPERATING EXPENSE RATIO 40% 10 CAPITAL EXPENDITURES 10% OF EGI 11 GOING OUT CAP RATE 10.00% 12 ORDINARY INCOME TAX 25.00% 13 CAPITAL GAINS TAX RATE 15.00% 14 DISCOUNT RATE 12.00% 15 16 17 (Note: Compute the payment using both options to see which mortgage the subject property qualifies for. If it qualifies for both, choose the mortgage with the lowest EBC). 18 MORTGAGE OPTION 1: MORTGAGE OPTION 2: 19 ASSUME YOU BORROW AT MAXIMUM LTV, BUT YOU MUST MEET THE MIN DCR 20 MAX LTV 85% 80% 21 MIN Debt Coverage Ratio (DCR) 1.40 1.751 22 TERM (YEARS) 15 15 23 AMORTIZATION (YEARS) 30 15 24 INTEREST RATE 7.00% 6.50% 25 CLOSING COSTS: 26 ORIGINATION FEE (Lender) 1.00% 1.00% 27 OTHER NONLENDER FEES $ 2,500 $ 2,500 28 UNDERWRITING FEE (Lender) $ 300 $ 300 29 APPRAISAL $ 300 $ 300 30 SURVEY 500 $ 500 31 TOTAL CLOSING COSTS 32 LENDER CLOSING COSTS B D E F G H N PV PMT FV OMB N 1 PV PMT FV A 34 35 MORTGAGE OPTION 1 EBC 36 37 PMT 38 39 EBC 40 41 Debt Coverage Ratio 42 Qualify for this mortgage? 43 44 MORTGAGE OPTION 2 EBC 45 46 PMT 47 OMB 48 EBC 49 50 Debt Coverage Ratio 51 Qualify for this mortgage? 52 53 PROFORMA 54 55 PGI 56 -VCL 57 EGI 58 OE 59 CAPX 60 NOI 61 -DS 62 BTCF 63 TAXES (given) 64 ATCF 65 66 PURCHASE PRICE 67 YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 $ (15,000) $ (21,000) $ (27,000) D E F. (31,221) B C 67 68 SP 69 SELLING EXPENSES (6%) 70 NSP 71 OMB 72 BTER 73 TAXES (given) $ 74 ATER 75 76 MARKET NPV 77 MARKET IRR 78 79 BEFORE TAX NPV 80 BEFORE TAX IRR 81 82 AFTER TAX NPV 83 AFTER TAX IRR 84 85 GOING IN CAP RATE 86 DEBT COVERAGE RATIO (EACH YEAR) 87 88 NET EQUITY MULTIPLE 89 90 91 DCF APPROACH TO VALUE 92 APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE 93 APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14.515% IS APPROPRIATE 94 YEAR O MARKET VALUE 95 96 DIRECT CAP APPROACH TO VALUE 97 CAP RATE YEAR 2 98 CAP RATE YEAR 3 99 YEAR 2 MARKET VALUE 100 OTHER MORTGAGE INFO FOR THE HOLDING PERIOD TOTAL PRINCIPAL PAID TOTAL INTEREST PAID LENDER'S YIELD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts