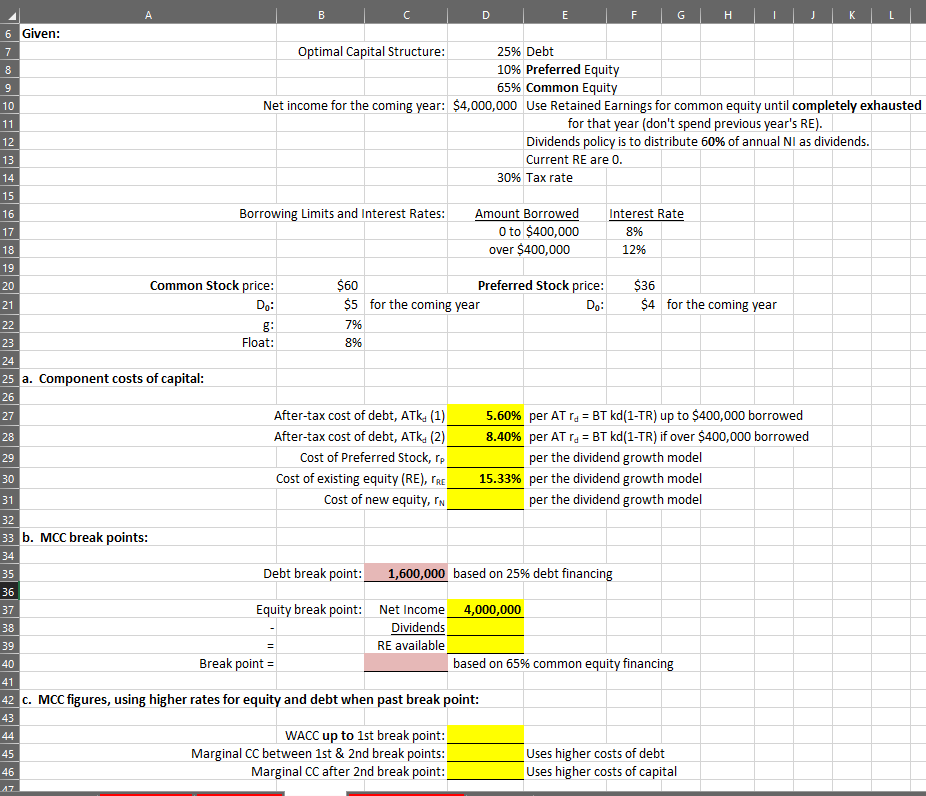

Question: A B C D E F G 6 Given: 7 8 9 10 Optimal Capital Structure: 25% Debt 10% Preferred Equity 65% Common Equity Net

A B C D E F G 6 Given: 7 8 9 10 Optimal Capital Structure: 25% Debt 10% Preferred Equity 65% Common Equity Net income for the coming year: $4,000,000 Use Retained Earnings for common equity until completely exhausted for that year (don't spend previous year's RE). Dividends policy is to distribute 50% of annual Nl as dividends. Current RE are 0. 30% Tax rate 11 12 13 14 15 16 Borrowing Limits and Interest Rates: Amount Borrowed O to $400,000 over $400,000 Interest Rate 8% 17 18 12% 19 28 29 20 Common Stock price: $60 Preferred Stock price: $36 21 Do: $5 for the coming year Do: $4 for the coming year 22 g: 79 23 Float: 8% 24 25 a. Component costs of capital: 26 27 After-tax cost of debt, ATK (1) 5.60% per AT ra = BT kd(1-TR) up to $400,000 borrowed After-tax cost of debt, ATK (2) 8.40% per AT rs = BT kd(1-TR) if over $400,000 borrowed Cost of Preferred Stock, re per the dividend growth model Cost of existing equity (RE), PRE 15.33% per the dividend growth model 31 Cost of new equity, IN per the dividend growth model 32 33 b. MCC break points: 34 35 Debt break point: 1,600,000 based on 25% debt financing 36 37 Equity break point: Net Income_4,000,000 38 Dividends 39 RE available 40 Break point = based on 65% common equity financing 30 = 41 42 C. MCC figures, using higher rates for equity and debt when past break point: 43 44 45 46 WACC up to 1st break point: Marginal CC between 1st & 2nd break points: Marginal CC after 2nd break point: Uses higher costs of debt Uses higher costs of capital 47 A B C D E F G 6 Given: 7 8 9 10 Optimal Capital Structure: 25% Debt 10% Preferred Equity 65% Common Equity Net income for the coming year: $4,000,000 Use Retained Earnings for common equity until completely exhausted for that year (don't spend previous year's RE). Dividends policy is to distribute 50% of annual Nl as dividends. Current RE are 0. 30% Tax rate 11 12 13 14 15 16 Borrowing Limits and Interest Rates: Amount Borrowed O to $400,000 over $400,000 Interest Rate 8% 17 18 12% 19 28 29 20 Common Stock price: $60 Preferred Stock price: $36 21 Do: $5 for the coming year Do: $4 for the coming year 22 g: 79 23 Float: 8% 24 25 a. Component costs of capital: 26 27 After-tax cost of debt, ATK (1) 5.60% per AT ra = BT kd(1-TR) up to $400,000 borrowed After-tax cost of debt, ATK (2) 8.40% per AT rs = BT kd(1-TR) if over $400,000 borrowed Cost of Preferred Stock, re per the dividend growth model Cost of existing equity (RE), PRE 15.33% per the dividend growth model 31 Cost of new equity, IN per the dividend growth model 32 33 b. MCC break points: 34 35 Debt break point: 1,600,000 based on 25% debt financing 36 37 Equity break point: Net Income_4,000,000 38 Dividends 39 RE available 40 Break point = based on 65% common equity financing 30 = 41 42 C. MCC figures, using higher rates for equity and debt when past break point: 43 44 45 46 WACC up to 1st break point: Marginal CC between 1st & 2nd break points: Marginal CC after 2nd break point: Uses higher costs of debt Uses higher costs of capital 47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts