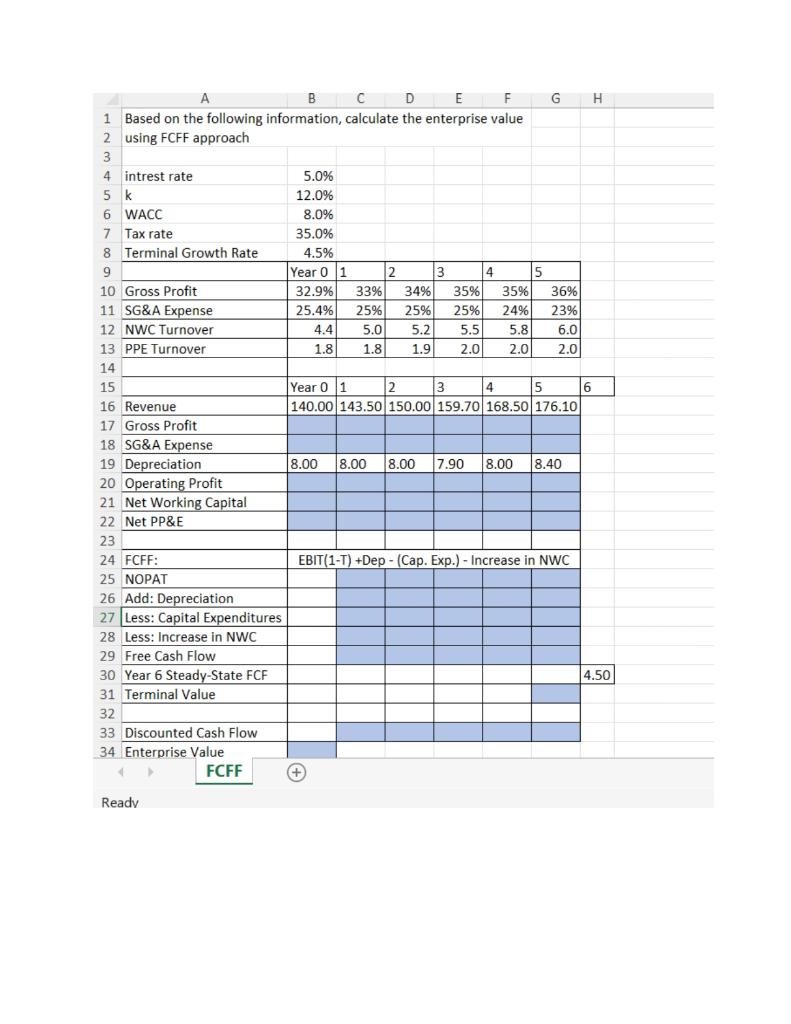

Question: A B C D E F G H 1 Based on the following information, calculate the enterprise value 2 using FCFF approach 3 4 intrest

A B C D E F G H 1 Based on the following information, calculate the enterprise value 2 using FCFF approach 3 4 intrest rate 5.0% 5 k 12.0% % 6 WACC 8.0% 7 Tax rate 35.0% 8 Terminal Growth Rate 4.5% 9 Year 0 11 12 3 3 4 5 10 Gross Profit 32.9% 33% 3496 % 35% 35% 36% 11 SG&A Expense 25.4% 25% 25% 25% 249 23% 12 NWC Turnover 4.4 5.0 5.2 5.5 5.8 6.0 13 PPE Turnover 1.8 1.81 1.91 2.0 2.0 2.0 14 15 Year 0 1 2 3 4 5 6 16 Revenue 140.00 143.50 150.00 159.70 168.50 176.10 17 Gross Profit 18 SG&A Expense 19 Depreciation 8.00 8.00 8.00 7.90 8.00 8.40 20 Operating Profit 21 Net Working Capital 22 Net PP&E 23 24 FCFF: EBIT(1-T) +Dep - (Cap. Exp.) - Increase in NWC 25 NOPAT 26 Add: Depreciation 27 Less: Capital Expenditures 28 Less: Increase in NWC 29 Free Cash Flow 30 Year 6 Steady-State FCF 4.50 31 Terminal Value 32 33 Discounted Cash Flow 34 Enterprise Value FCFF Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts