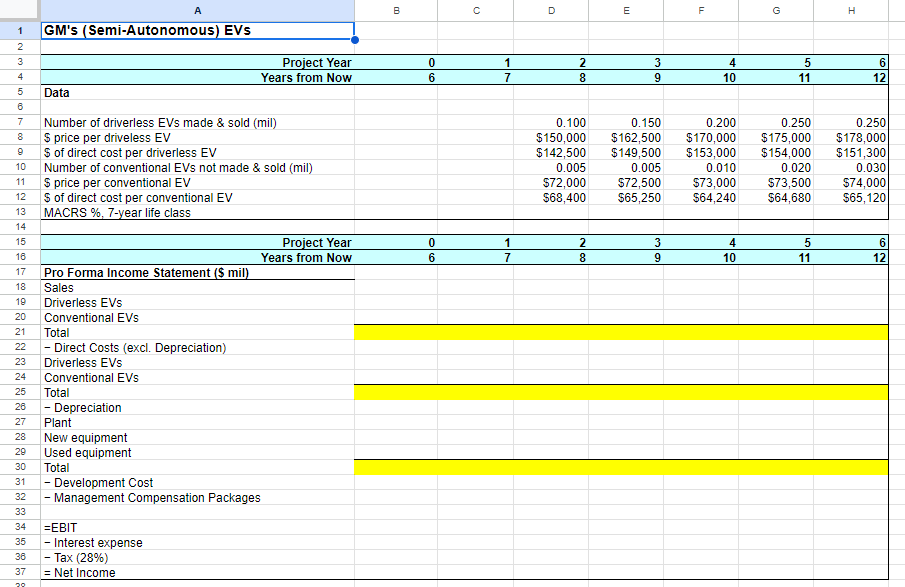

Question: A B C D E F G H 1 GM's ( Semi-Autonomous) EVs 2 3 Project Year 0 1 2 3 4 5 6 Years

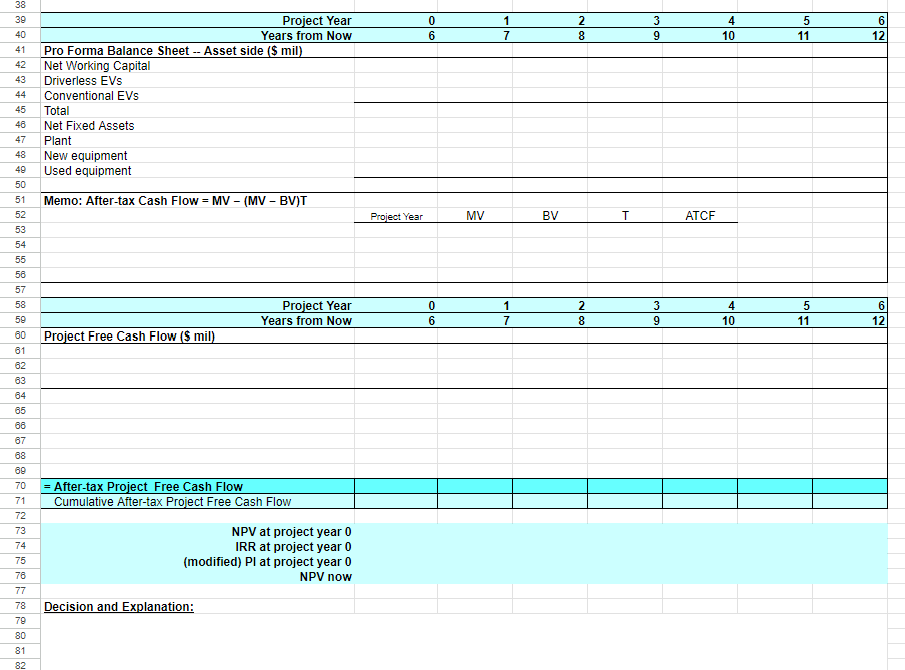

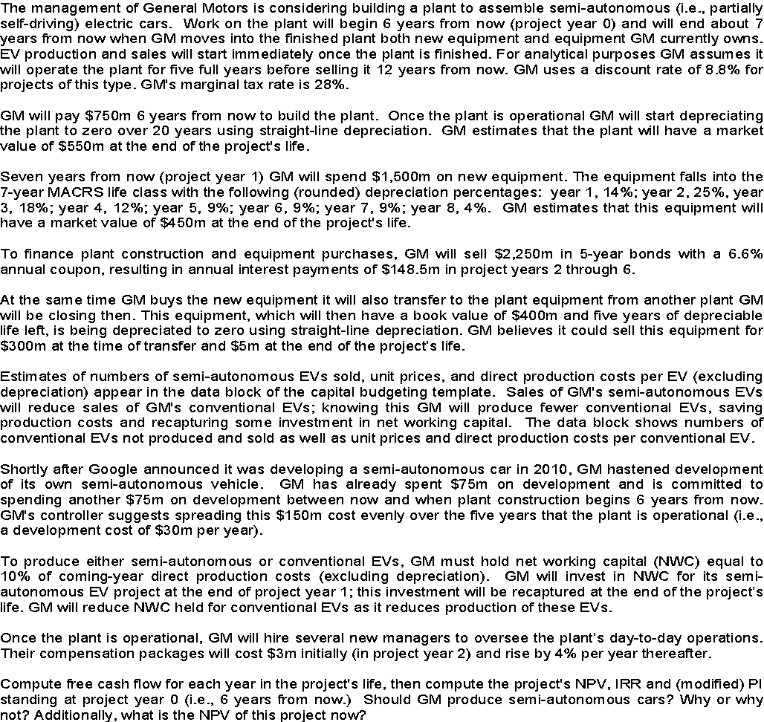

A B C D E F G H 1 GM's ( Semi-Autonomous) EVs 2 3 Project Year 0 1 2 3 4 5 6 Years from Now 6 10 11 12 Data 6 Number of driverless EVs made & sold (mil) 0.100 0.150 0.200 0.250 0.250 $ price per driveless EV $150,000 $162,500 $170,000 $175,000 $178,000 5 of direct cost per driverless EV $142,500 $149,500 $153,000 $154,000 $151,300 10 Number of conventional EVs not made & sold (mil) 0.005 0.005 0.010 0.020 0.030 11 $ price per conventional EV $72,000 $72,500 $73,000 $73,500 $74,000 12 $ of direct cost per conventional EV $68,400 565,250 $64,240 $64,680 $65,120 13 MACRS %, 7-year life class 14 15 Project Year 0 2 4 5 6 18 Years from Now 6 8 10 11 12 17 Pro Forma Income Statement ($ mil) 18 Sales 19 Driverless EVs 20 Conventional EVs 21 Total 22 - Direct Costs (excl. Depreciation) 23 Driverless EVs 24 Conventional EVs 25 Total 28 - Depreciation 27 Plant 28 New equipment 29 Used equipment 30 Total 31 - Development Cost 32 - Management Compensation Packages 33 34 =EBIT 35 - Interest expense 38 - Tax (28%) 37 = Net Income39 Project Year 0 40 Years from Now 7 9 10 11 12 41 Pro Forma Balance Sheet -- Asset side ($ mil) 42 Net Working Capital 43 Driverless EVs 44 Conventional EVs 45 Total 48 Net Fixed Assets 47 Plant 48 New equipment 49 Used equipment 50 51 Memo: After-tax Cash Flow = MV - (MV - BV)T 52 Project Year MV BV T ATCF 53 54 55 56 57 58 Project Year 0 59 Years from Now 7 10 11 12 60 Project Free Cash Flow ($ mil) 61 62 63 64 65 68 67 68 69 70 = After-tax Project Free Cash Flow 71 Cumulative After-tax Project Free Cash Flow 72 73 NPV at project year 0 74 IRR at project year 0 75 (modified) PI at project year 0 76 NPV now 77 78 Decision and Explanation: 79 80 81The management of General Motors is considering building a plant to assemble sami-autonomous {l.a., partially self-driving) electric cars. Woark on the plant will begin & years from now {project year Q) and will end about 7 years from now when GM moves into the finished plant both new equipment and equipment GM currently owns. EV production and sales will start imnmediataly once the plant is finished. For analytical purposes GM assumes it will operate the plant for five full years before selling it 12 years from now. GM uses a discount rate of 8.8% for projects of this type. GM's marginal tax rate is 28%._ GM will pay $750m 6 years from now to build the plant. Once the plant is operational GM will start depreciating the plant to zero over 20 years using straight-line depreciation. GM estimates that the plant will have a market value of $550m at the end of the project's life. Seven years from now {project year 1) GM will spend $1,500m on new equipment. The equipment falls into the T-year MACRS life class with the following {rounded) depreciation percentages: year 1, 14%; year 2, 25%, year 3, 18%; year 4, 12%; year 5, 9%:; year 6, 9%; year 7, 9% ; year 8, 4%. GM estimates that this equipment will have a market value of $450m at the end of the project's life. To finance plant construction and equipment purchases, GM will sell $2,250m in S-year bonds with a 6.6% annual coupon, resulting in annual interest payments of $148.5m in project years 2 through &. At the same time GM buys the new eguipment it will also transfer to the plant equipment from another plant G will be closing then. This equipment, which will then have a book value of 3400m and five years of depreciable life left, is being depreciated to zero using straight-line depreciation. GM believes it could sell this equipment for 300m at the time of transfer and $5m at the end of the project's life. Estimates of numbers of semi-autonomous EVs sold, unit prices, and direct production costs per EV {(excluding depraciation) appear in the data block of the capital budgeting template. Sales of GM's semi-autonomous EVs will reduce sales of GM's conventional EVs; knowing this GM will produce fewer conventional EVs, saving production costs and recapturing some investment in net working capital. The data block shows numbers of conventional EVs not produced and sold as well as unit prices and direct production costs per conventional EV. Shortly after Google announced it was developing a semi-autonomous car in 2010, GM hastened development of Its own seml-autonomous vehicle. GM has already spent $75m on development and is committed to spending another $75m on development between now and when plant construction begins & years from now. GM's controller suggests spreading this $150m cost evenly over the five years that the plant is operational {i.e., a development cost of $30m per year). To produce either semi-autonomous or conventional EVs, GM must hold net working capital (MWC) egqual to 10% of coming-year direct production costs {excluding depreciation). GM will invest in NWC for Its seml- autonomous EV project at the end of project year 1; this investment will be recaptured at the end of the project''s life. G will reduce MW held for conventional EVs as it reduces production of these EVs. Once the plant is operational, GM will hire several new managers to overses the plant's day-to-day operations. Their compensation packages will cost $3m initially {in project year 2) and rise by 4% per year thereafter. Compute free cash flow for each year in the project's life, then compute the project's NPV, IRR and {modified) PI standing at project year 0 {i.e., 6 years from now.) Should GM produce semi-autonomous cars? Why or why not? Additionally, what is the NPV of this project now