Question: A B C D E F G H 2/6/19 UNDERSTANDING HEALTHCARE FINANCIAL MANAGEMENT Chapter 6 -- Debt Financing PROBLEM 1 Assume Venture Healthcare sold bonds

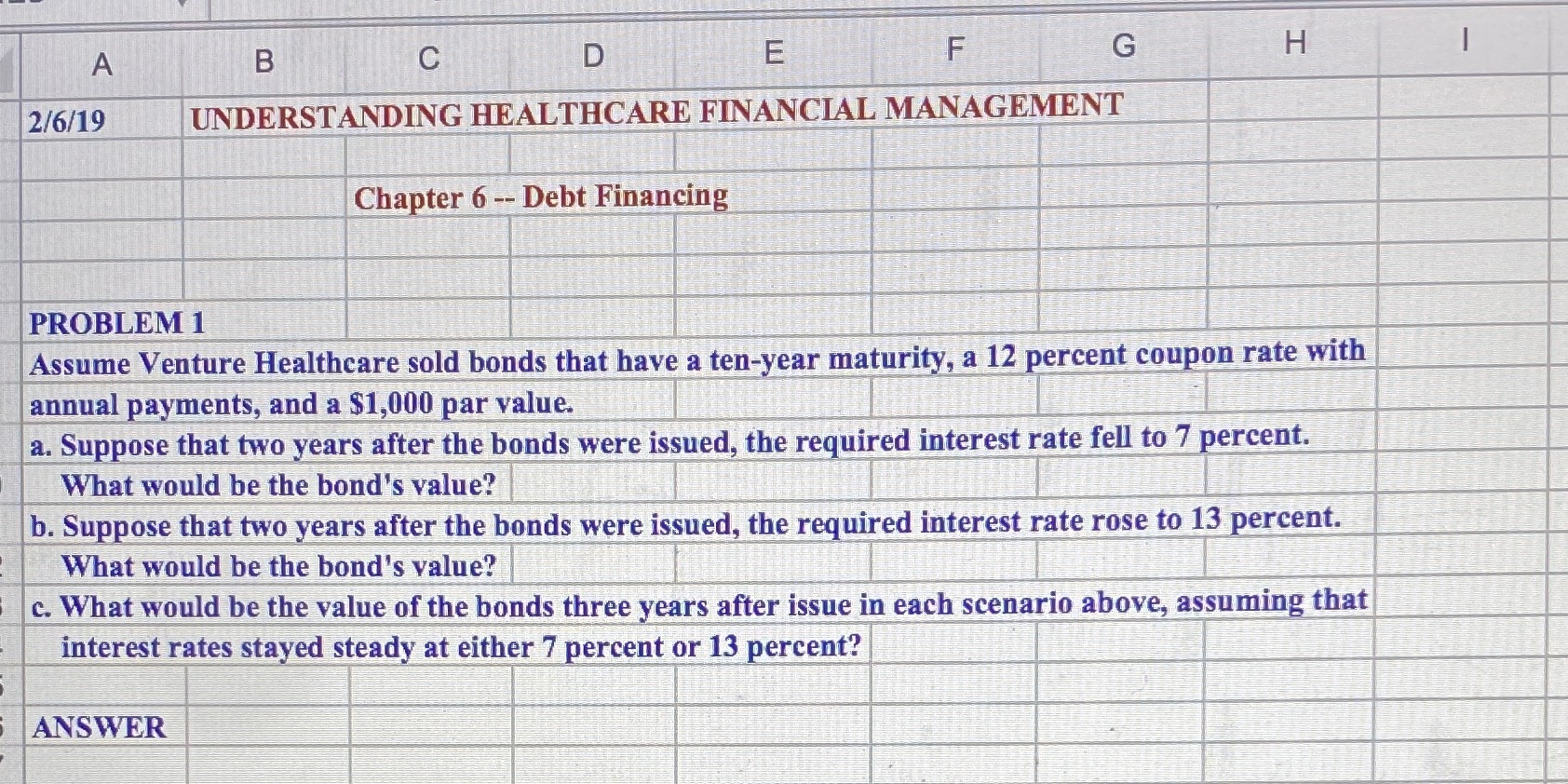

A B C D E F G H 2/6/19 UNDERSTANDING HEALTHCARE FINANCIAL MANAGEMENT Chapter 6 -- Debt Financing PROBLEM 1 Assume Venture Healthcare sold bonds that have a ten-year maturity, a 12 percent coupon rate with annual payments, and a $1,000 par value. a. Suppose that two years after the bonds were issued, the required interest rate fell to 7 percent. What would be the bond's value? b. Suppose that two years after the bonds were issued, the required interest rate rose to 13 percent. What would be the bond's value? c. What would be the value of the bonds three years after issue in each scenario above, assuming that interest rates stayed steady at either 7 percent or 13 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts