Question: a) b) c) d) e) f) g) h) a. Suppose that between the ages of 22 and 40, you contribute $1000 per year to a

a)

b)

c)

d)

e)

f)

g)

h)

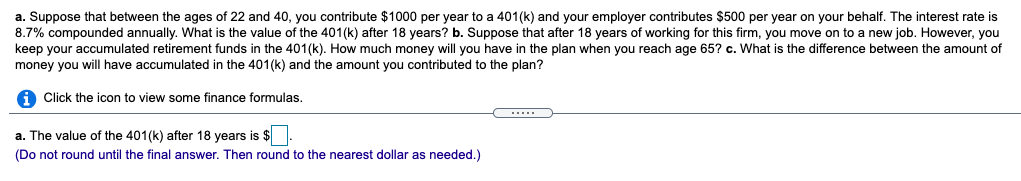

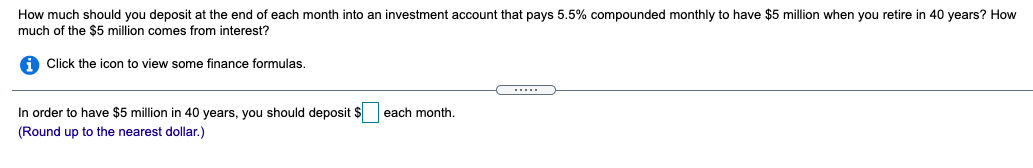

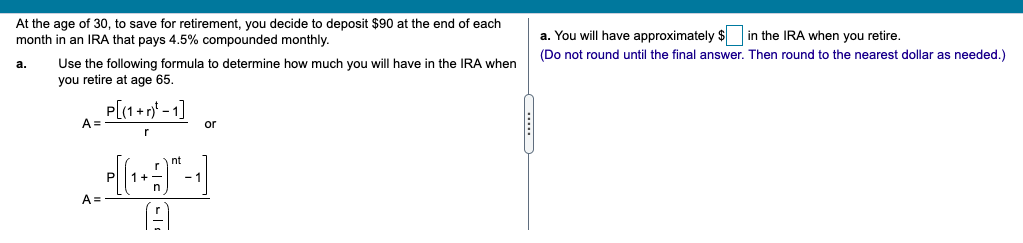

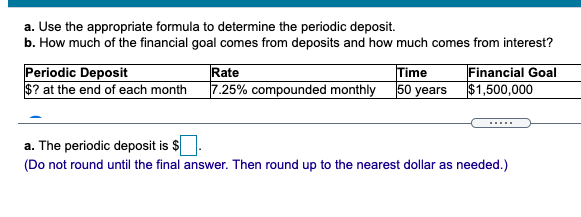

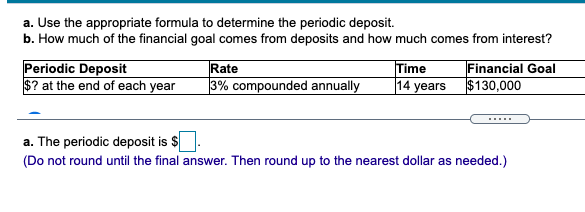

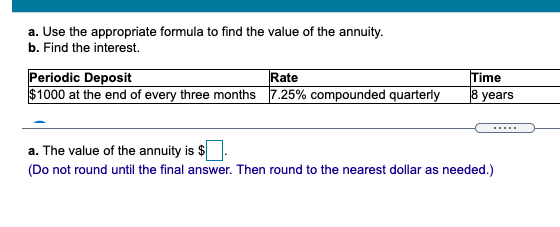

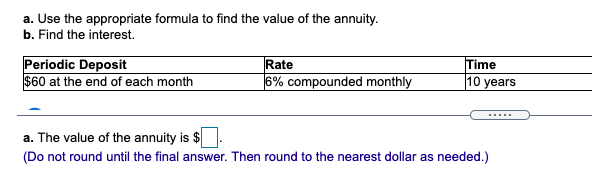

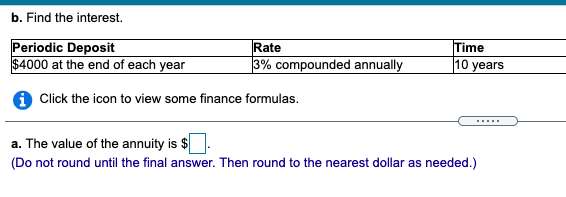

a. Suppose that between the ages of 22 and 40, you contribute $1000 per year to a 401(k) and your employer contributes $500 per year on your behalf. The interest rate is 8.7% compounded annually. What is the value of the 401(k) after 18 years? b. Suppose that after 18 years of working for this firm, you move on to a new job. However, you keep your accumulated retirement funds in the 401(k). How much money will you have in the plan when you reach age 65? c. What is the difference between the amount of money you will have accumulated in the 401(k) and the amount you contributed to the plan? Click the icon to view some finance formulas. C. a. The value of the 401(k) after 18 years is $ 3. (Do not round until the final answer. Then round to the nearest dollar as needed.) How much should you deposit at the end of each month into an investment account that pays 5.5% compounded monthly to have $5 million when you retire in 40 years? How much of the $5 million comes from interest? Click the icon to view some finance formulas. In order to have $5 million in 40 years, you should deposit $ each month. (Round up to the nearest dollar.) a. You will have approximately $ in the IRA when you retire. (Do not round until the final answer. Then round to the nearest dollar as needed.) At the age of 30, to save for retirement, you decide to deposit $90 at the end of each month in an IRA that pays 4.5% compounded monthly. a. Use the following formula to determine how much you will have in the IRA when you retire at age 65. P[(1 + r)* - 1] A= or -1 A= A a. Use the appropriate formula to determine the periodic deposit. b. How much of the financial goal comes from deposits and how much comes from interest? Periodic Deposit Rate Time Financial Goal $? at the end of each month 17.25% compounded monthly 50 years $1,500,000 a. The periodic deposit is $ (Do not round until the final answer. Then round up to the nearest dollar as needed.) a. Use the appropriate formula to determine the periodic deposit. b. How much of the financial goal comes from deposits and how much comes from interest? Periodic Deposit Rate Time Financial Goal $? at the end of each year 3% compounded annually $130,000 14 years a. The periodic deposit is $. (Do not round until the final answer. Then round up to the nearest dollar as needed.) a. Use the appropriate formula to find the value of the annuity. b. Find the interest. Periodic Deposit Rate $1000 at the end of every three months 7.25% compounded quarterly Time 8 years a. The value of the annuity is $ (Do not round until the final answer. Then round to the nearest dollar as needed.) a. Use the appropriate formula to find the value of the annuity. b. Find the interest. Time Periodic Deposit $60 at the end of each month Rate 6% compounded monthly 10 years a. The value of the annuity is $ (Do not round until the final answer. Then round to the nearest dollar as needed.) b. Find the interest. Time Periodic Deposit $4000 at the end of each year Rate 3% compounded annually 10 years Click the icon to view some finance formulas. a. The value of the annuity is $ (Do not round until the final answer. Then round to the nearest dollar as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts