Question: A B C D E F G H Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate

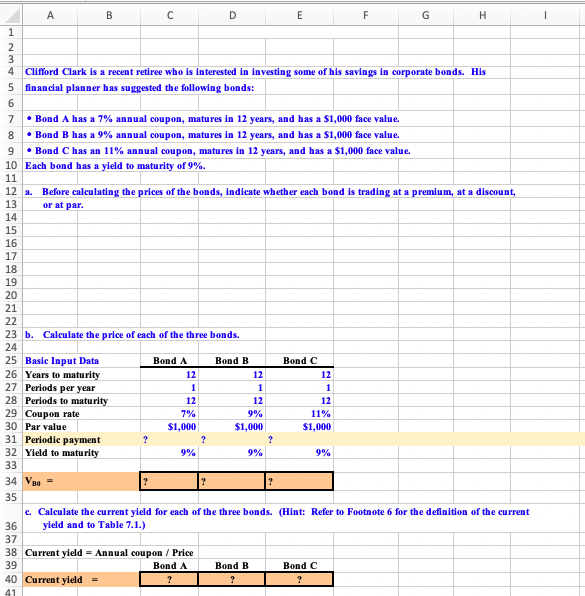

A B C D E F G H Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: * Bond A has a 7% annual coupon, matures in 12 years, and has a $1,000 face value. * Bond B has a 9% annual coupon, matures in 12 years, and has a $1,000 face value. * Bond C has an 11% annual coupon, matures in 12 years, and has a $1,010 face value. 10 Each bond has a yield to maturity of 9%. 11 12 a. Before calculating the prices of the bonds, Indicate whether each bond is trading at a premium, at a discount, 13 or at par. 14 15 16 17 18 19 20 21 22 23 b. Calculate the price of each of the three bonds. 24 25 Basic Input Data Bond A Bond B Bond C 26 Years to maturity 12 12 12 27 Perlods per year 1 1 1 28 Perlods to maturity 12 12 12 29 Coupon rate 7% 9% 11% 30 Par value $1, 0 0 0 $1,0 0 0 $1, 0 0 0 31 Periodic payment ? ? ? 32 Yield to maturity 9% 9% 33 34 VRI = 35 c. Calculate the current yield for each of the three bonds. (Hint: Refer to Footnote 6 for the definition of the current 36 yield and to Table 7.1.) 37 38 Current yield = Annual coupon / Price 39 Bond A Bond B Bond C 40 Current yield =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts