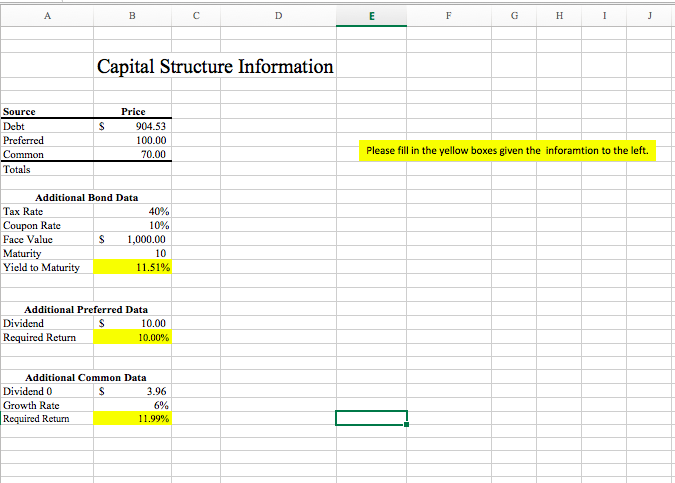

Question: A B C D E F G H I Capital Structure Information Source Price Debt S 904.53 Preferred 100.00 Please fill in the yellow boxes

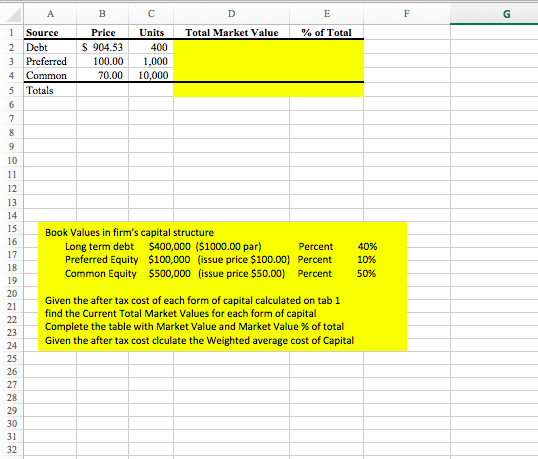

A B C D E F G H I Capital Structure Information Source Price Debt S 904.53 Preferred 100.00 Please fill in the yellow boxes given the inforamtion to the left. Common 70.00 Totals Additional Bond Data Tax Rate 40% Coupon Rate Face Value 10% 1,000,00 Maturity Yield to Maturity 10 11.51% Additional Preferred Data Dividend S 10.00 Required Return 10.00% Additional Common Data Dividend 0 S 3.96 Growth Rate 6% Required Return 11.99% G A C E F 1 Source Price Units Total Market Value % of Total S 904.53 Debt 400 2 Preferred 100.00 1,000 10,000 3 Common 70,00 4 Totals 5 6 7 10 11 12 13 14 15 Book Values in firm's capital structure 16 Long term debt $400,000 ($1000.00 par) Preferred Equity $100,000 (issue price $100.00) Percent Common Equity $500,000 (issue price $50.00) Percent 40% 17 10 % 18 Percent 50% 19 20 Given the after tax cost of each form of capital calculated on tab 1 21 find the Current Total Market Values for each form of capital Complete the table with Market Value and Market Value % of total Given the after tax cost clculate the Weighted average cost of Capital 22 23 24 25. 26 27 28 29 30 31 32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts