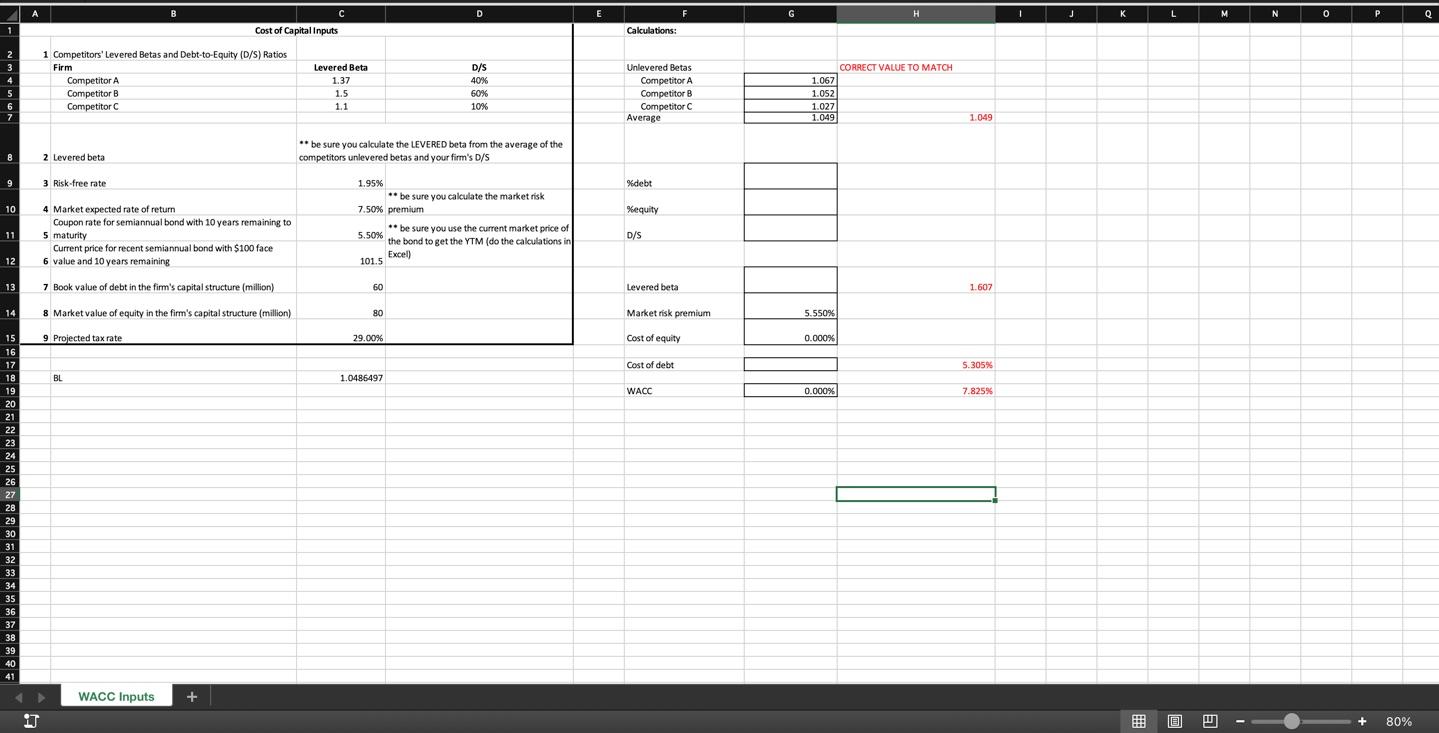

Question: A B C D E F G H I J K L M N 0 P Q 1 Cost of Capital Inputs Calculations: 2 3

A B C D E F G H I J K L M N 0 P Q 1 Cost of Capital Inputs Calculations: 2 3 1 Competitors' Levered Betas and Debt-to-Equity (D/S) Ratios Firm Competitor A Competitor B Competitor C Levered Beta 1.37 1.5 1.1 D/S 40% 60% 10% 5 6 7 Unlevered Betas Competitor A Competitor B Competitor C Average CORRECT VALUE TO MATCH 1.067 1.052 1.027 1.049 1.049 ** be sure you calculate the LEVERED beta from the average of the competitors unlevered betas and your firm's D/S / B 2 Levered beta 9 3 Risk-free rate %debt 10 %equity 1.95% ** be sure you calculate the market risk 7.50% premium ** be sure you use the current market price of 5.50% the bond to get the YTM (do the calculations in Excel) 101.5 4 Market expected rate of return Coupon rate for semiannual bond with 10 years remaining to 5 maturity Current price for recent semiannual bond with $100 face 6 value and 10 years remaining 11 D/S 12 13 7 Book value of debt in the firm's capital structure (million) 7 60 Levered beta 1.607 14 8 Market value of equity in the firm's capital structure (million) 80 Market risk premium 5.550% 9 Projected tax rate 29.00% Cost of equity 0.000% Cost of debt 5.305% BL 1.0486497 WACC 0.000% 7.825% 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 WACC Inputs + || 80% A B C D E F G H I J K L M N 0 P Q 1 Cost of Capital Inputs Calculations: 2 3 1 Competitors' Levered Betas and Debt-to-Equity (D/S) Ratios Firm Competitor A Competitor B Competitor C Levered Beta 1.37 1.5 1.1 D/S 40% 60% 10% 5 6 7 Unlevered Betas Competitor A Competitor B Competitor C Average CORRECT VALUE TO MATCH 1.067 1.052 1.027 1.049 1.049 ** be sure you calculate the LEVERED beta from the average of the competitors unlevered betas and your firm's D/S / B 2 Levered beta 9 3 Risk-free rate %debt 10 %equity 1.95% ** be sure you calculate the market risk 7.50% premium ** be sure you use the current market price of 5.50% the bond to get the YTM (do the calculations in Excel) 101.5 4 Market expected rate of return Coupon rate for semiannual bond with 10 years remaining to 5 maturity Current price for recent semiannual bond with $100 face 6 value and 10 years remaining 11 D/S 12 13 7 Book value of debt in the firm's capital structure (million) 7 60 Levered beta 1.607 14 8 Market value of equity in the firm's capital structure (million) 80 Market risk premium 5.550% 9 Projected tax rate 29.00% Cost of equity 0.000% Cost of debt 5.305% BL 1.0486497 WACC 0.000% 7.825% 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 WACC Inputs + || 80%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts