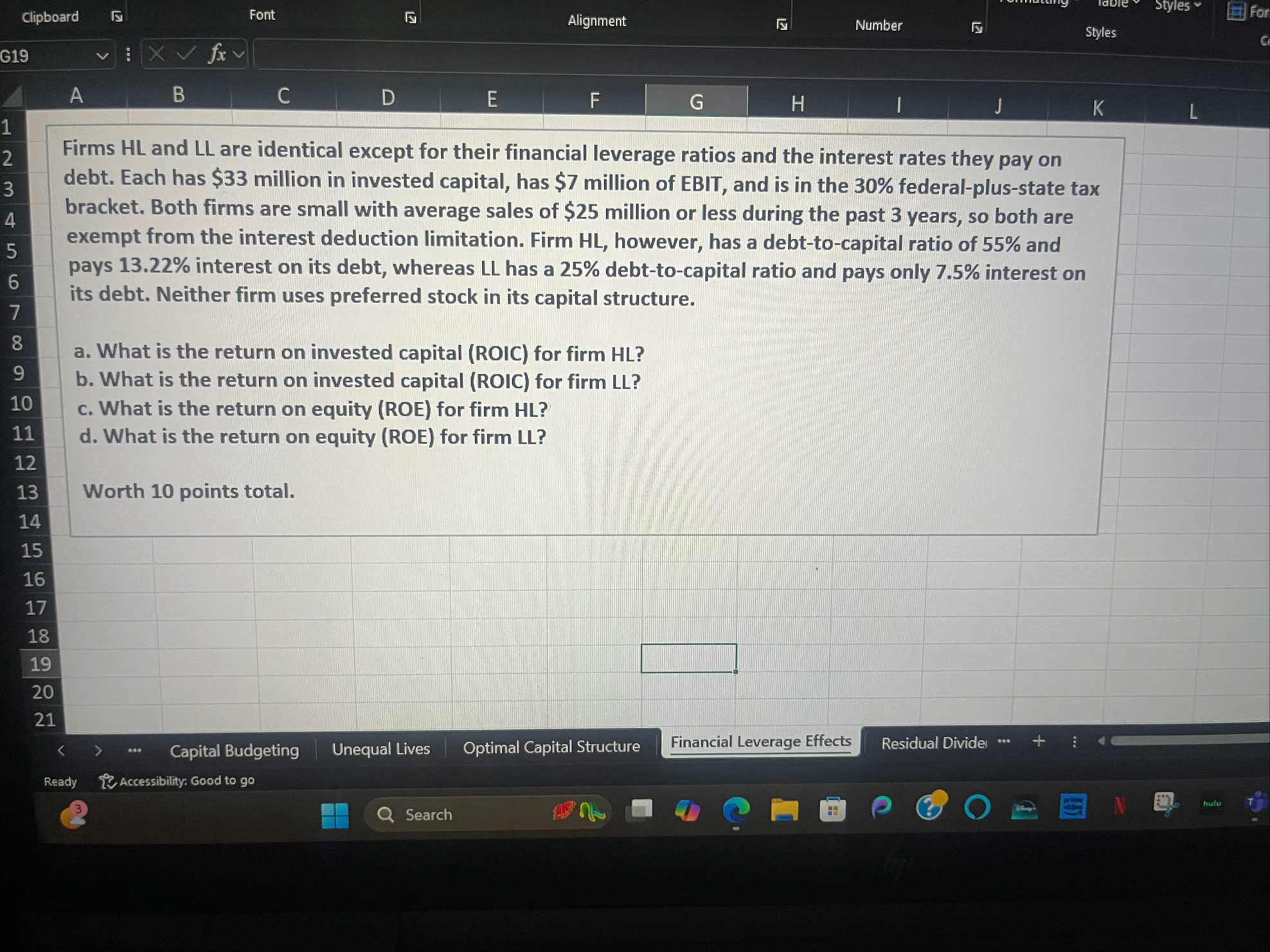

Question: A B C D E F G H I J K Firms HL and LL are identical except for their financial leverage ratios and the

A

B

C

D

E

F

G

H

I

J

K

Firms HL and LL are identical except for their financial leverage ratios and the interest rates they pay on debt. Each has $ million in invested capital, has $ million of EBIT, and is in the federalplusstate tax bracket. Both firms are small with average sales of $ million or less during the past years, so both are exempt from the interest deduction limitation Firm HL however, has a debttocapital ratio of and pays interest on its debt, whereas LL has a debttocapital ratio and pays only interest on its debt. Neither firm uses preferred stock in its capital structure.

a What is the return on invested capital ROIC for firm HL

b What is the return on invested capital ROIC for firm LL

c What is the return on equity ROE for firm HL

d What is the return on equity ROE for firm LL

Worth points total.

Ready

Accessibility: Good to go

Unequal Lives

Optimal Capital Structure

Financial Leverage Effects

Residual Divide!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock