Question: A B C D E F G H | J K L M N O P Q R S T a) Why do you agree

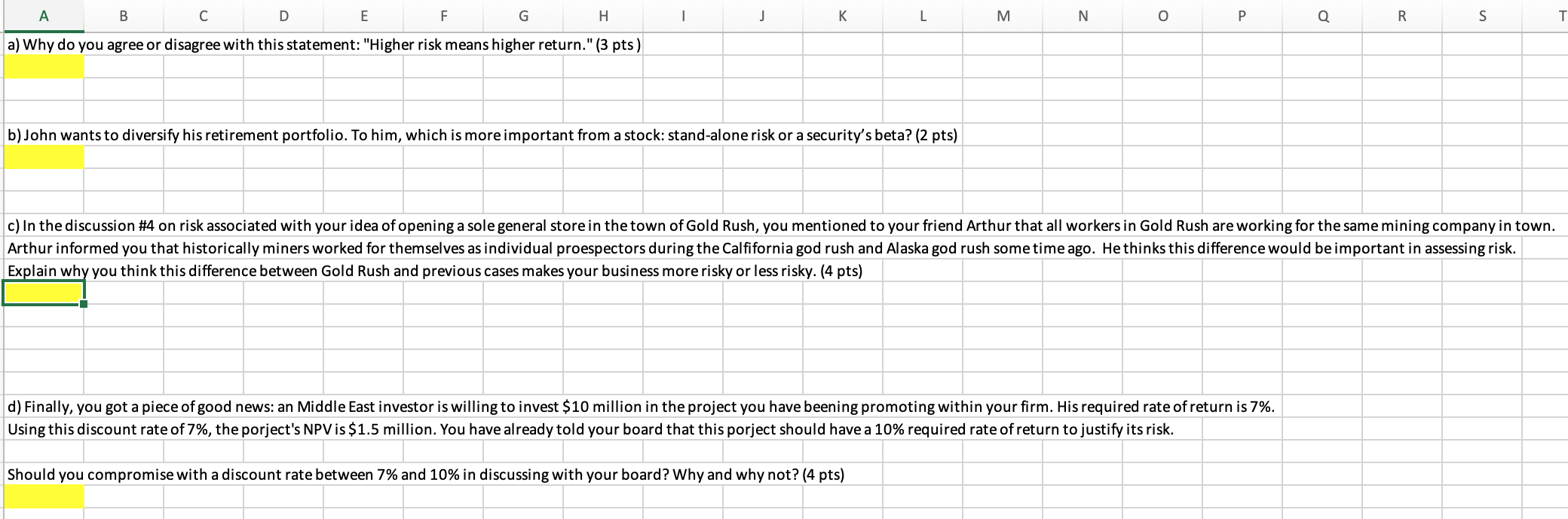

A B C D E F G H | J K L M N O P Q R S T a) Why do you agree or disagree with this statement: "Higher risk means higher return." (3 pts) b) John wants to diversify his retirement portfolio. To him, which is more important from a stock: stand-alone risk or a security's beta? (2 pts) c) In the discussion #4 on risk associated with your idea of opening a sole general store in the town of Gold Rush, you mentioned to your friend Arthur that all workers in Gold Rush are working for the same mining company in town. Arthur informed you that historically miners worked for themselves as individual proespectors during the Calfifornia god rush and Alaska god rush some time ago. He thinks this difference would be important in assessing risk. Explain why you think this difference between Gold Rush and previous cases makes your business more risky or less risky. (4 pts) d) Finally, you got a piece of good news: an Middle East investor is willing to invest $10 million in the project you have beening promoting within your firm. His required rate of return is 7%. Using this discount rate of 7%, the porject's NPV is $1.5 million. You have already told your board that this porject should have a 10% required rate of return to justify its risk. Should you compromise with a discount rate between 7% and 10% in discussing with your board? Why and why not? (4 pts) A B C D E F G H | J K L M N O P Q R S T a) Why do you agree or disagree with this statement: "Higher risk means higher return." (3 pts) b) John wants to diversify his retirement portfolio. To him, which is more important from a stock: stand-alone risk or a security's beta? (2 pts) c) In the discussion #4 on risk associated with your idea of opening a sole general store in the town of Gold Rush, you mentioned to your friend Arthur that all workers in Gold Rush are working for the same mining company in town. Arthur informed you that historically miners worked for themselves as individual proespectors during the Calfifornia god rush and Alaska god rush some time ago. He thinks this difference would be important in assessing risk. Explain why you think this difference between Gold Rush and previous cases makes your business more risky or less risky. (4 pts) d) Finally, you got a piece of good news: an Middle East investor is willing to invest $10 million in the project you have beening promoting within your firm. His required rate of return is 7%. Using this discount rate of 7%, the porject's NPV is $1.5 million. You have already told your board that this porject should have a 10% required rate of return to justify its risk. Should you compromise with a discount rate between 7% and 10% in discussing with your board? Why and why not? (4 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts