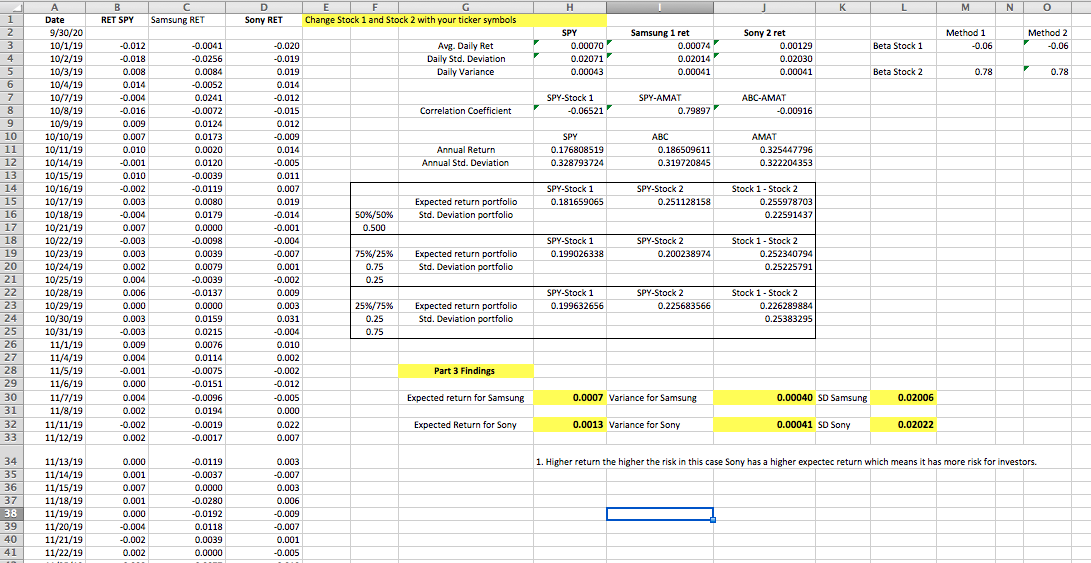

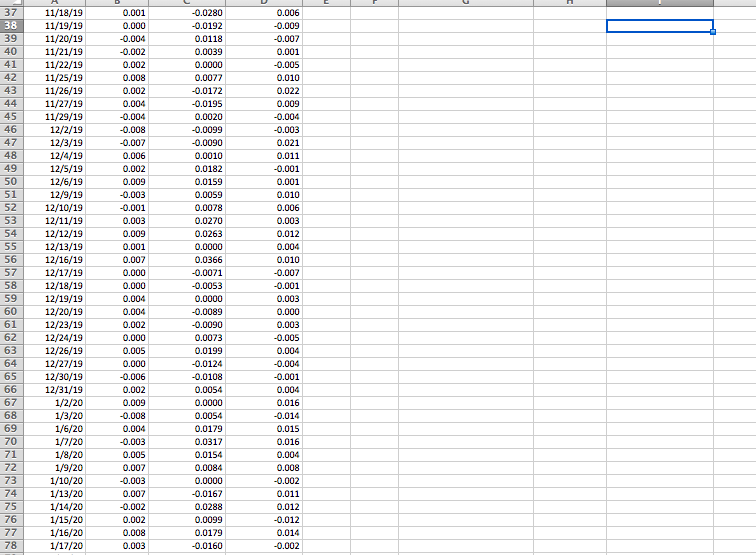

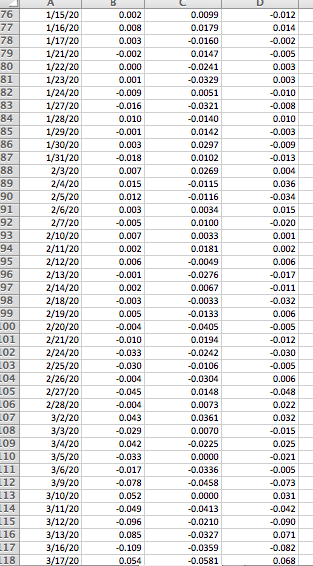

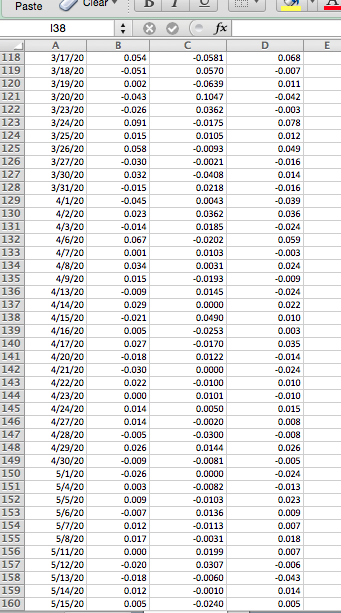

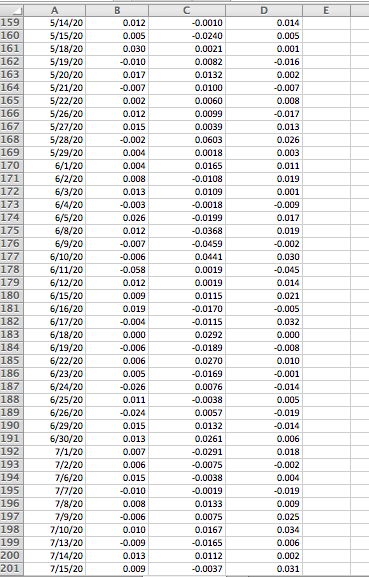

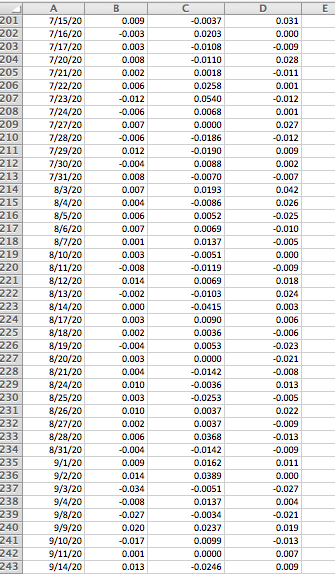

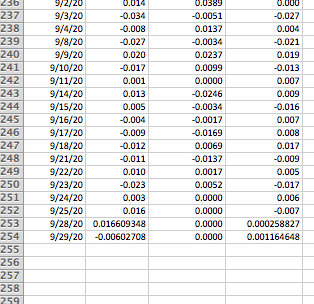

Question: A B C D E F G H K M N Date RET SPY Samsung RET Sony RET Change Stock 1 and Stock 2 with

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock