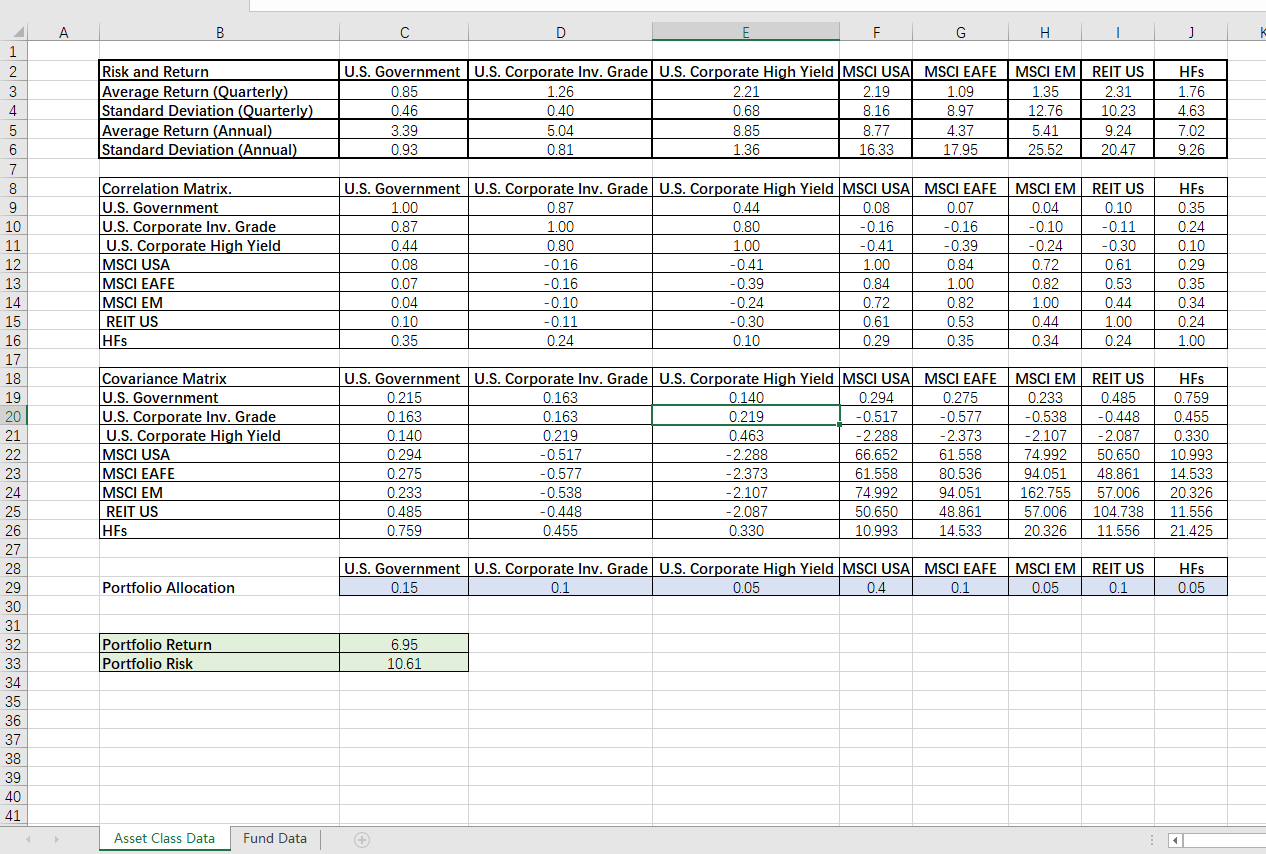

Question: A B C D E F G H Risk and Return U.S. Government|U.S. Corporate Inv. Grade |U.S. Corporate High Yield |MSCI USA MSCI EAFE |

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock