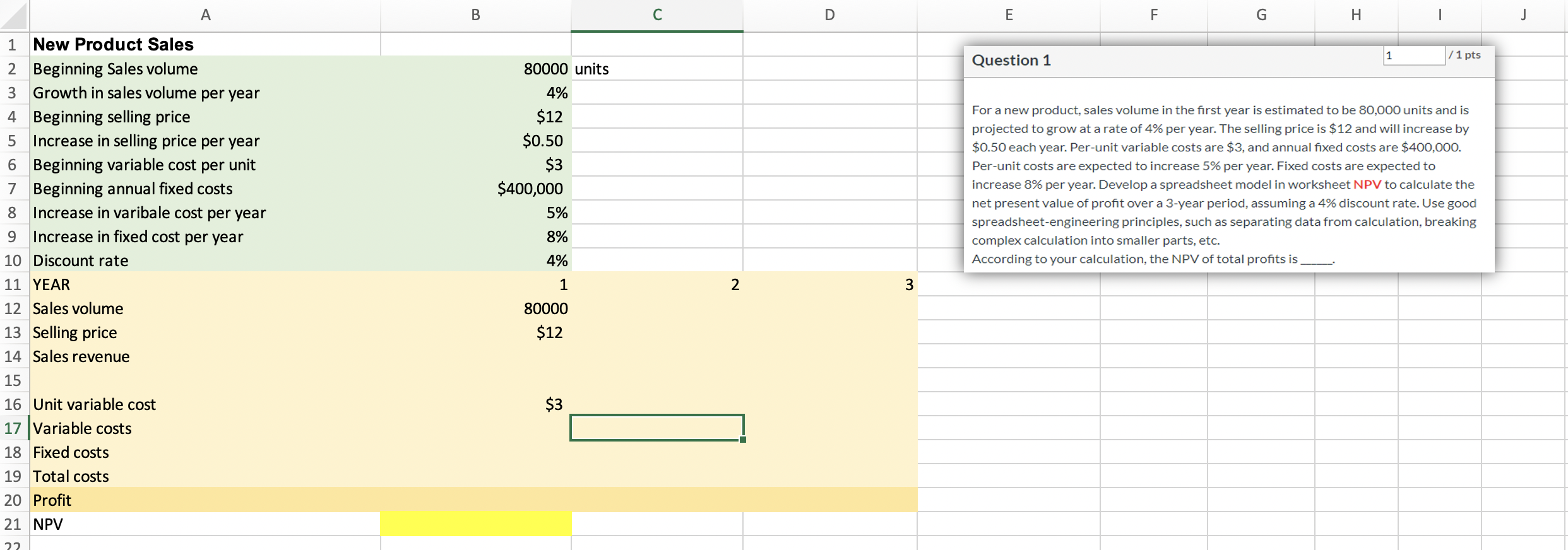

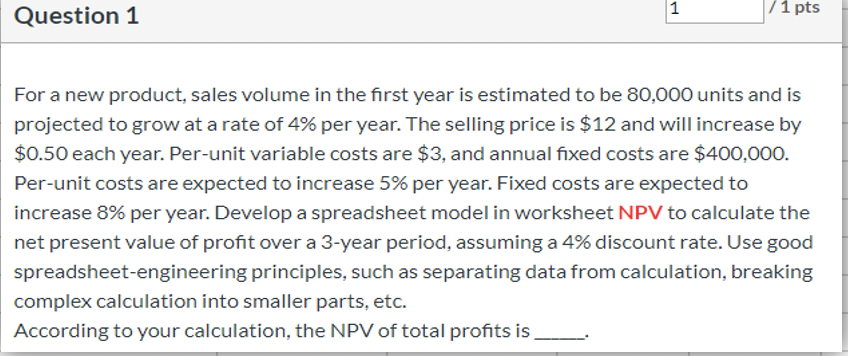

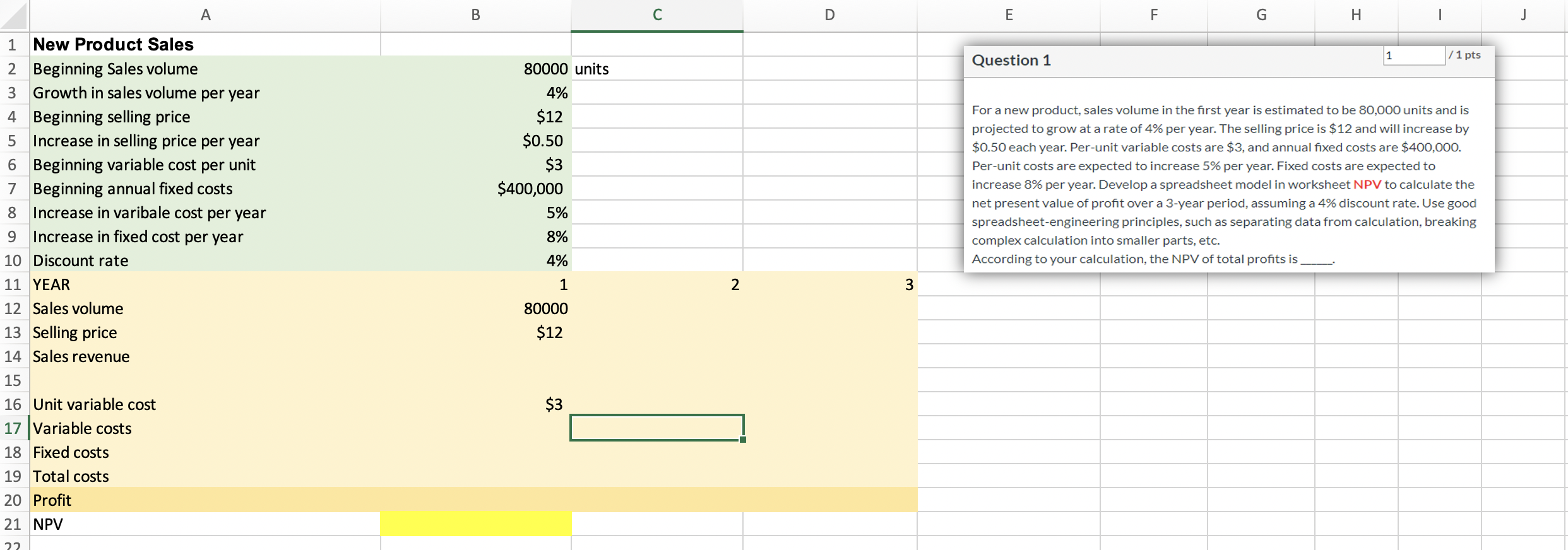

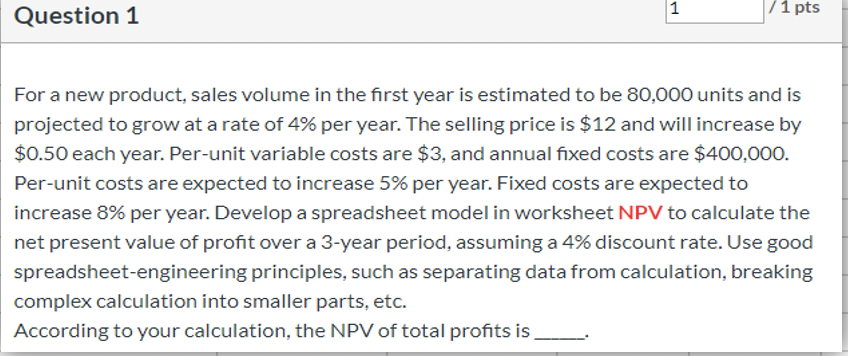

Question: A B C D E F G I 1 J / 1 pts Question 1 80000 units 4% $12 $0.50 $3 $400,000 5% 8% For

A B C D E F G I 1 J / 1 pts Question 1 80000 units 4% $12 $0.50 $3 $400,000 5% 8% For a new product, sales volume in the first year is estimated to be 80,000 units and is projected to grow at a rate of 4% per year. The selling price is $12 and will increase by $0.50 each year. Per-unit variable costs are $3, and annual fixed costs are $400,000. Per-unit costs are expected to increase 5% per year. Fixed costs are expected to increase 8% per year. Develop a spreadsheet model in worksheet NPV to calculate the net present value of profit over a 3-year period, assuming a 4% discount rate. Use good spreadsheet-engineering principles, such as separating data from calculation, breaking complex calculation into smaller parts, etc. According to your calculation, the NPV of total profits is 4% 1 New Product Sales 2 Beginning Sales volume 3 Growth in sales volume per year 4 Beginning selling price 5 Increase in selling price per year 6 Beginning variable cost per unit 7 Beginning annual fixed costs 8 Increase in varibale cost per year 9 Increase in fixed cost per year 10 Discount rate 11 YEAR 12 Sales volume 13 Selling price 14 Sales revenue 15 16 Unit variable cost 17 Variable costs 18 Fixed costs 19 Total costs 20 Profit 21 NPV 1 2 3 80000 $12 $3 22 Question 1 1 / 1 pts For a new product, sales volume in the first year is estimated to be 80,000 units and is projected to grow at a rate of 4% per year. The selling price is $12 and will increase by $0.50 each year. Per-unit variable costs are $3, and annual fixed costs are $400,000. Per-unit costs are expected to increase 5% per year. Fixed costs are expected to increase 8% per year. Develop a spreadsheet model in worksheet NPV to calculate the net present value of profit over a 3-year period, assuming a 4% discount rate. Use good spreadsheet-engineering principles, such as separating data from calculation, breaking complex calculation into smaller parts, etc. According to your calculation, the NPV of total profits is A B C D E F G I 1 J / 1 pts Question 1 80000 units 4% $12 $0.50 $3 $400,000 5% 8% For a new product, sales volume in the first year is estimated to be 80,000 units and is projected to grow at a rate of 4% per year. The selling price is $12 and will increase by $0.50 each year. Per-unit variable costs are $3, and annual fixed costs are $400,000. Per-unit costs are expected to increase 5% per year. Fixed costs are expected to increase 8% per year. Develop a spreadsheet model in worksheet NPV to calculate the net present value of profit over a 3-year period, assuming a 4% discount rate. Use good spreadsheet-engineering principles, such as separating data from calculation, breaking complex calculation into smaller parts, etc. According to your calculation, the NPV of total profits is 4% 1 New Product Sales 2 Beginning Sales volume 3 Growth in sales volume per year 4 Beginning selling price 5 Increase in selling price per year 6 Beginning variable cost per unit 7 Beginning annual fixed costs 8 Increase in varibale cost per year 9 Increase in fixed cost per year 10 Discount rate 11 YEAR 12 Sales volume 13 Selling price 14 Sales revenue 15 16 Unit variable cost 17 Variable costs 18 Fixed costs 19 Total costs 20 Profit 21 NPV 1 2 3 80000 $12 $3 22 Question 1 1 / 1 pts For a new product, sales volume in the first year is estimated to be 80,000 units and is projected to grow at a rate of 4% per year. The selling price is $12 and will increase by $0.50 each year. Per-unit variable costs are $3, and annual fixed costs are $400,000. Per-unit costs are expected to increase 5% per year. Fixed costs are expected to increase 8% per year. Develop a spreadsheet model in worksheet NPV to calculate the net present value of profit over a 3-year period, assuming a 4% discount rate. Use good spreadsheet-engineering principles, such as separating data from calculation, breaking complex calculation into smaller parts, etc. According to your calculation, the NPV of total profits is