Question: A B C D E F I J K L M N 0 P Q R S T U V MSFT Microsoft F2020 Earnings -

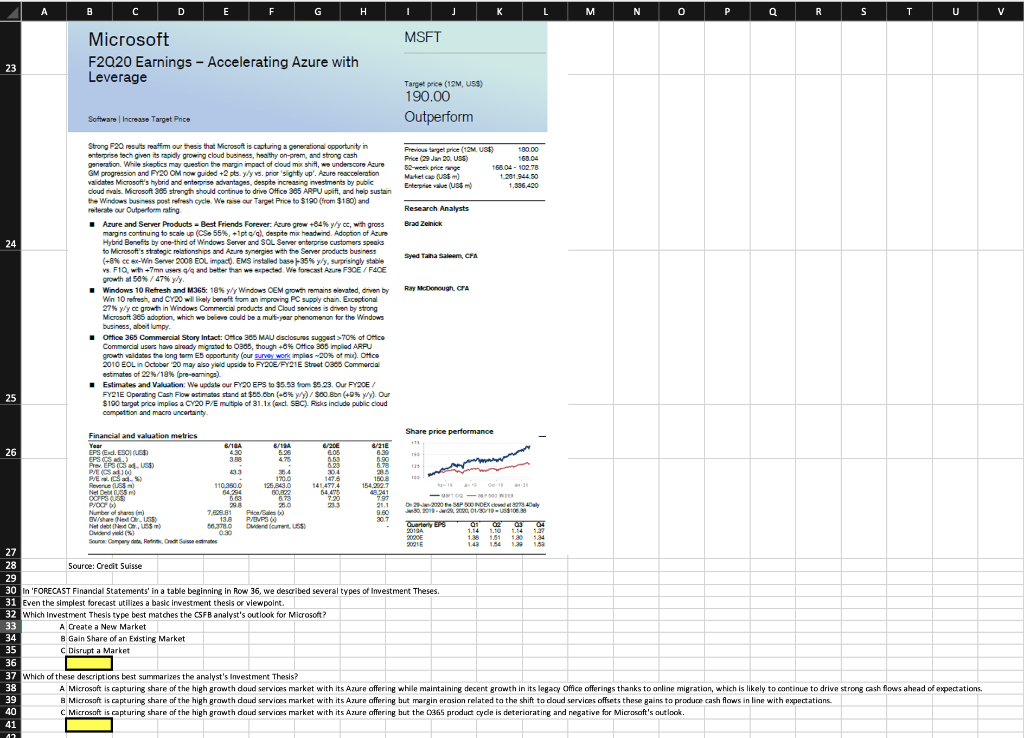

A B C D E F I J K L M N 0 P Q R S T U V MSFT Microsoft F2020 Earnings - Accelerating Azure with Leverage 23 Target price (12M, USS) 190.00 Outperform Software | Increase Target Price - Previous target price (12M US! 100 00 Price 9 Jan 2016) 16004 52-week price range 168.04 - 102.70 Martel cap (US) 1.281.944.50 Enterpe value (US) 1.336.490 Research Analysts Brad Zenick 24 Syed Tatha Sam, CFA Strong F20 results reaffirm or thesis that Microsoft is capturing a generational opportunity in interprise tech given its rapidly growing cloud business, healthy on-prem, and strong cash generation. While skeptics may question the margin impact of cloud a shift, wo underscore Azure GM progression and FY20 OM now guided +2 pt. yly vs. prior 'sighty up. Azure reacceleration validates Microsoft's hybrid and enterprise advantages, despite increasing investments by public cloud rivals. Microsoft 365 strength should continue to drive Office 365 ARPU upift, and help sustain the Windows business post refresh cycle. We raise our Target Price to $100 (from $180) and reiterate our Outperforating Azure and Server Products - Best Friends Forever: Asuro grow +84% y/yce, with gross margins continuing to scale up (CS. 55% +1pt/d)despite ma headwind. Adoption of Azure Hybrid Benefits by one-third of Windows Server and SOL Server enterprise customers speaks to Microsoft's strategic relationships and Azure synergies with the Server products business (+8% cc exe-Win Server 2008 EOL impact). EMS installed base-35% yly, surprisingly stable vs. F1Qwith+7mn users and better than we expected. We foscast Azure F30E / FACE growth at 50% / 47% y/y. Windows 10 Refresh and M365: 18% yly Windows CEM growth remains olevated, driven by Win 10 refresh, and CY20 will likely benefit from an improving PC supply chain. Exceptional 27% yly cc growth in Windows Commercial products and Cloud Services is driven by strong Microsoft 365 adoption, which we believe could be a mut-year phenomenon for the Windows business, albeit lumpy. Office 365 Commercial Story Intact: Office 308 MAU disclosures suggest > 70% of Office Commercial users have already migrated to 0305, though -0% Office 365 Implad ARPU growth validates the long term Es opportunity (our survey wors implies -20% of mq. Ofice 2010 EOL in October 20 may also yield upside to FY20E/PY21E Stroot 0365 Commercial estimates of 22/18% (pre-samnings) Estimates and Valuation: We update our FY20 EPS to $5.58 from $5 23. Our FY20E/ FY21E Operating Cash Flow estimates stand at $65.con (0%) / $0.Bon (40%). Ou $100 target price imples a CY20 P/E multiple of 31.1x (oncl. SBC). Risks include public cloud competition and macro uncertainty Ray McDonough. CRA 25 Financial and valuation metrics Share price performance Year 6/18 B/TA 6/2DE 6/21E 26 EPS Ed. ESONES 4.30 6.05 6.30 3.88 8.53 6.90 Prov.EPS ICS 4. US) 8.23 PECS 6) 13 29.4 235 P/E d. 170.0 147.5 1508 Revenue (USA 110.3600 126,843.0 141,497.4 154.209.7 OS (38 Net DORS 5474 BOUQ2 54.475 48.241 720 797 -100 - 2750 NTER P/OOT 60 23.3 21.1 2000 SAP BONDEX.cdr Number of 7.828.81 Pion/Sales 9.60 30, 2010 01//ID1106.30 B/she textos 13.8 PUMPS 307 Net date, 30.3.0 0 Chidard LES) ) Quarterly ES CE 2013 1.14 1.10 1.14 Ovidendid (%) 2020E 1.38 1.51 134 Source Company date, Porn, Oude Sites 2015 1 1.29 158 27 28 Source: Credit Suisse 29 30 in 'FORECAST Financial Statements' in a table beginning in Row 36, we described several types of Investment Theses. 31 Even the simplest forecast utilizes a basic investment thesis or viewpoint. 32 Which Investment Thesis type best matches the CSFB analyst's outlook for Microsoft? 33 A Create a New Market 34 B Gain Share of an Existing Market 35 C Disrupt a Market 36 D 37 Which of these descriptions best summarizes the analyst's Investment Thesis? 38 A Microsoft is capturing share of the high grawth doud services market with its Azure offering while maintaining decent growth in its legacy Office offerings thanks to online migration, which is likely to continue to drive strong cash flows ahead of expectations. 39 B Microsoft is capturing share of the high grawth doud services market with its Azure offering but margin erasion related to the shift to daud services offsets these gains to produce cash flows in line with expectations. 40 C Microsoft is capturing share of the high grawth doud services market with its Azure offering but the 365 product cycle is deteriorating and negative for Microsoft's outlook. 41 17 A B C D E F I J K L M N 0 P Q R S T U V MSFT Microsoft F2020 Earnings - Accelerating Azure with Leverage 23 Target price (12M, USS) 190.00 Outperform Software | Increase Target Price - Previous target price (12M US! 100 00 Price 9 Jan 2016) 16004 52-week price range 168.04 - 102.70 Martel cap (US) 1.281.944.50 Enterpe value (US) 1.336.490 Research Analysts Brad Zenick 24 Syed Tatha Sam, CFA Strong F20 results reaffirm or thesis that Microsoft is capturing a generational opportunity in interprise tech given its rapidly growing cloud business, healthy on-prem, and strong cash generation. While skeptics may question the margin impact of cloud a shift, wo underscore Azure GM progression and FY20 OM now guided +2 pt. yly vs. prior 'sighty up. Azure reacceleration validates Microsoft's hybrid and enterprise advantages, despite increasing investments by public cloud rivals. Microsoft 365 strength should continue to drive Office 365 ARPU upift, and help sustain the Windows business post refresh cycle. We raise our Target Price to $100 (from $180) and reiterate our Outperforating Azure and Server Products - Best Friends Forever: Asuro grow +84% y/yce, with gross margins continuing to scale up (CS. 55% +1pt/d)despite ma headwind. Adoption of Azure Hybrid Benefits by one-third of Windows Server and SOL Server enterprise customers speaks to Microsoft's strategic relationships and Azure synergies with the Server products business (+8% cc exe-Win Server 2008 EOL impact). EMS installed base-35% yly, surprisingly stable vs. F1Qwith+7mn users and better than we expected. We foscast Azure F30E / FACE growth at 50% / 47% y/y. Windows 10 Refresh and M365: 18% yly Windows CEM growth remains olevated, driven by Win 10 refresh, and CY20 will likely benefit from an improving PC supply chain. Exceptional 27% yly cc growth in Windows Commercial products and Cloud Services is driven by strong Microsoft 365 adoption, which we believe could be a mut-year phenomenon for the Windows business, albeit lumpy. Office 365 Commercial Story Intact: Office 308 MAU disclosures suggest > 70% of Office Commercial users have already migrated to 0305, though -0% Office 365 Implad ARPU growth validates the long term Es opportunity (our survey wors implies -20% of mq. Ofice 2010 EOL in October 20 may also yield upside to FY20E/PY21E Stroot 0365 Commercial estimates of 22/18% (pre-samnings) Estimates and Valuation: We update our FY20 EPS to $5.58 from $5 23. Our FY20E/ FY21E Operating Cash Flow estimates stand at $65.con (0%) / $0.Bon (40%). Ou $100 target price imples a CY20 P/E multiple of 31.1x (oncl. SBC). Risks include public cloud competition and macro uncertainty Ray McDonough. CRA 25 Financial and valuation metrics Share price performance Year 6/18 B/TA 6/2DE 6/21E 26 EPS Ed. ESONES 4.30 6.05 6.30 3.88 8.53 6.90 Prov.EPS ICS 4. US) 8.23 PECS 6) 13 29.4 235 P/E d. 170.0 147.5 1508 Revenue (USA 110.3600 126,843.0 141,497.4 154.209.7 OS (38 Net DORS 5474 BOUQ2 54.475 48.241 720 797 -100 - 2750 NTER P/OOT 60 23.3 21.1 2000 SAP BONDEX.cdr Number of 7.828.81 Pion/Sales 9.60 30, 2010 01//ID1106.30 B/she textos 13.8 PUMPS 307 Net date, 30.3.0 0 Chidard LES) ) Quarterly ES CE 2013 1.14 1.10 1.14 Ovidendid (%) 2020E 1.38 1.51 134 Source Company date, Porn, Oude Sites 2015 1 1.29 158 27 28 Source: Credit Suisse 29 30 in 'FORECAST Financial Statements' in a table beginning in Row 36, we described several types of Investment Theses. 31 Even the simplest forecast utilizes a basic investment thesis or viewpoint. 32 Which Investment Thesis type best matches the CSFB analyst's outlook for Microsoft? 33 A Create a New Market 34 B Gain Share of an Existing Market 35 C Disrupt a Market 36 D 37 Which of these descriptions best summarizes the analyst's Investment Thesis? 38 A Microsoft is capturing share of the high grawth doud services market with its Azure offering while maintaining decent growth in its legacy Office offerings thanks to online migration, which is likely to continue to drive strong cash flows ahead of expectations. 39 B Microsoft is capturing share of the high grawth doud services market with its Azure offering but margin erasion related to the shift to daud services offsets these gains to produce cash flows in line with expectations. 40 C Microsoft is capturing share of the high grawth doud services market with its Azure offering but the 365 product cycle is deteriorating and negative for Microsoft's outlook. 41 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts