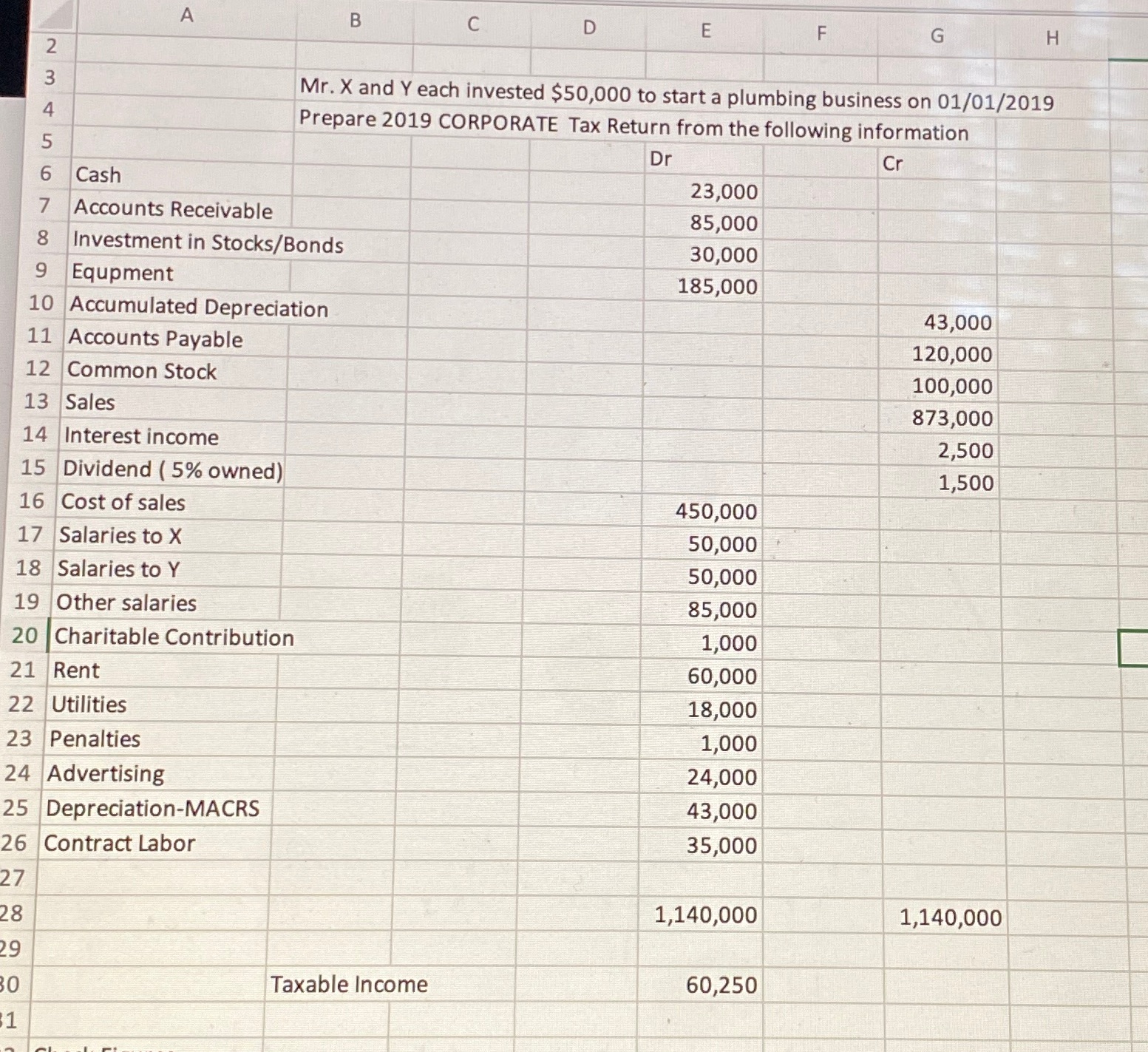

Question: A B C D E F OUT A W N G H Mr. X and Y each invested $50,000 to start a plumbing business on

A B C D E F OUT A W N G H Mr. X and Y each invested $50,000 to start a plumbing business on 01/01/2019 Prepare 2019 CORPORATE Tax Return from the following information Dr Cr Cash 7 23,000 Accounts Receivable 8 85,000 Investment in Stocks/Bonds 9 Equpment 30,000 185,000 10 Accumulated Depreciation 43,000 11 Accounts Payable 120,000 12 Common Stock 100,000 13 Sales 873,000 14 Interest income 2,500 15 Dividend ( 5% owned) 1,500 16 Cost of sales 450,000 17 Salaries to X 50,000 18 Salaries to Y 50,000 19 Other salaries 85,000 20 Charitable Contribution 1,000 21 Rent 60,000 22 Utilities 18,000 23 Penalties 1,000 24 Advertising 24,000 25 Depreciation-MACRS 43,000 26 Contract Labor 35,000 28 1,140,000 1,140,000 Taxable Income 60,250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts