Question: A B C D E F Suppose a 10-year, 51,000 bond with an 8% coupon rate and semiannual coupons is trading for $1,034.74 Complete the

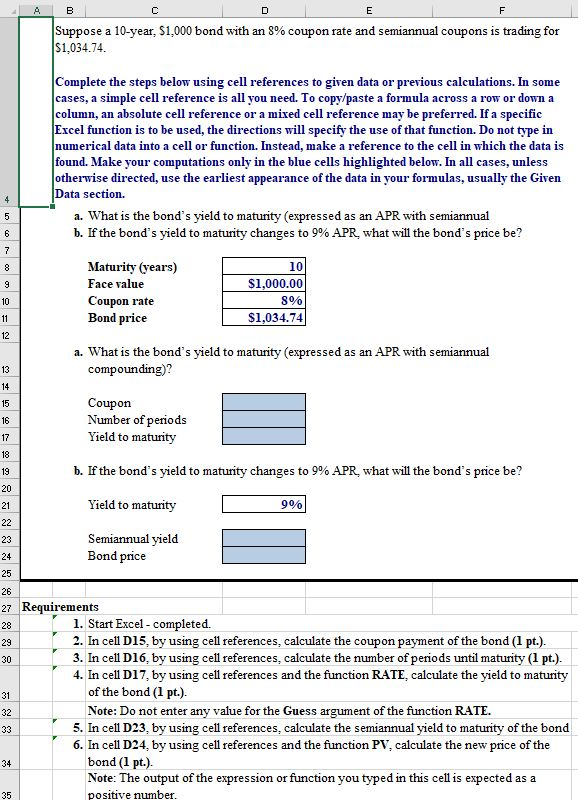

A B C D E F Suppose a 10-year, 51,000 bond with an 8% coupon rate and semiannual coupons is trading for $1,034.74 Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. a. What is the bond's yield to maturity (expressed as an APR with semiannual b. If the bond's yield to maturity changes to 9% APR what will the bond's price be? 4 5 6 7 8 9 Maturity (years) Face value Coupon rate Bond price 101 $1,000.00 8% $1,034.74 10 11 12 a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? 13 14 15 16 Coupon Number of periods Yield to maturity 17 18 19 20 b. If the bond's yield to maturity changes to 9% APR what will the bond's price be? Yield to maturity 9% 21 22 23 24 Semiannual yield Bond price 25 29 30 26 27 Requirements 28 1. Start Excel - completed. 2. In cell D15, by using cell references, calculate the coupon payment of the bond (1 pt.). 3. In cell D16, by using cell references, calculate the number of periods until maturity (1 pt.). 4. In cell D17, by using cell references and the function RATE, calculate the yield to maturity of the bond (1 pt.). Note: Do not enter any value for the Guess argument of the function RATE. 5. In cell D23, by using cell references, calculate the semiannual yield to maturity of the bond 6. In cell D24, by using cell references and the function PV, calculate the new price of the bond (1 pt.). Note: The output of the expression or function you typed in this cell is expected as a positive number. 31 32 33 34 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts