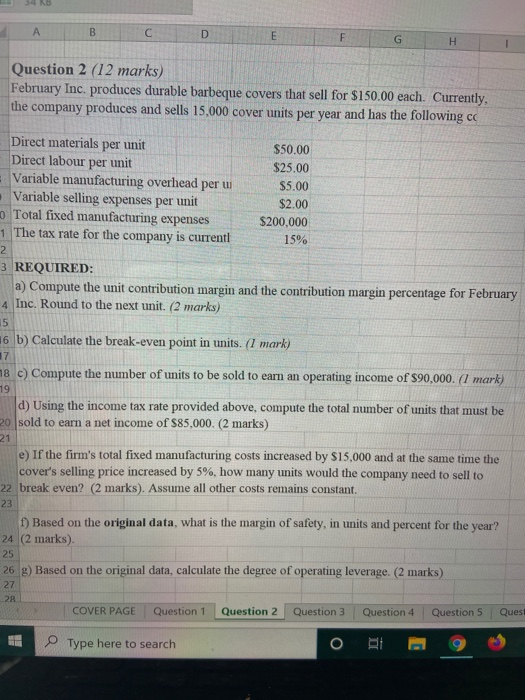

Question: A B C D E GHI Question 2 (12 marks) February Inc. produces durable barbeque covers that sell for $150.00 each. Currently. the company

" A B C D E GHI Question 2 (12 marks) February Inc. produces durable barbeque covers that sell for $150.00 each. Currently. the company produces and sells 15,000 cover units per year and has the following cc Direct materials per unit Direct labour per unit Variable manufacturing overhead per u Variable selling expenses per unit Total fixed manufacturing expenses 1 The tax rate for the company is currentl $50.00 $25.00 $5.00 $2.00 $200,000 15% 3 REQUIRED: a) Compute the unit contribution margin and the contribution margin percentage for February 4 Inc. Round to the next unit. (2 marks) 16 b) Calculate the break-even point in units. (1 mark) 18 ) Compute the number of units to be sold to earn an operating income of $90,000. (1 mark) d) Using the income tax rate provided above, compute the total number of units that must be 20 sold to earn a net income of $85,000. (2 marks) e) If the firm's total fixed manufacturing costs increased by $15,000 and at the same time the cover's selling price increased by 5%, how many units would the company need to sell to 22 break even? (2 marks). Assume all other costs remains constant. 23 1) Based on the original data, what is the margin of safety, in units and percent for the year? 24 (2 marks) 26 g) Based on the original data, calculate the degree of operating leverage. (2 marks) 27 28 COVER PAGE Question 1 Question 2 Question 3 Question 4 Question 5 Ques H O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts