Question: A. B. C. D. E. On May 1, Nerd Corporation purchased 400 shares of the company's own common stock at $20 cash per share. On

A.

B.

B.

C.

D.

D.

E.

E.

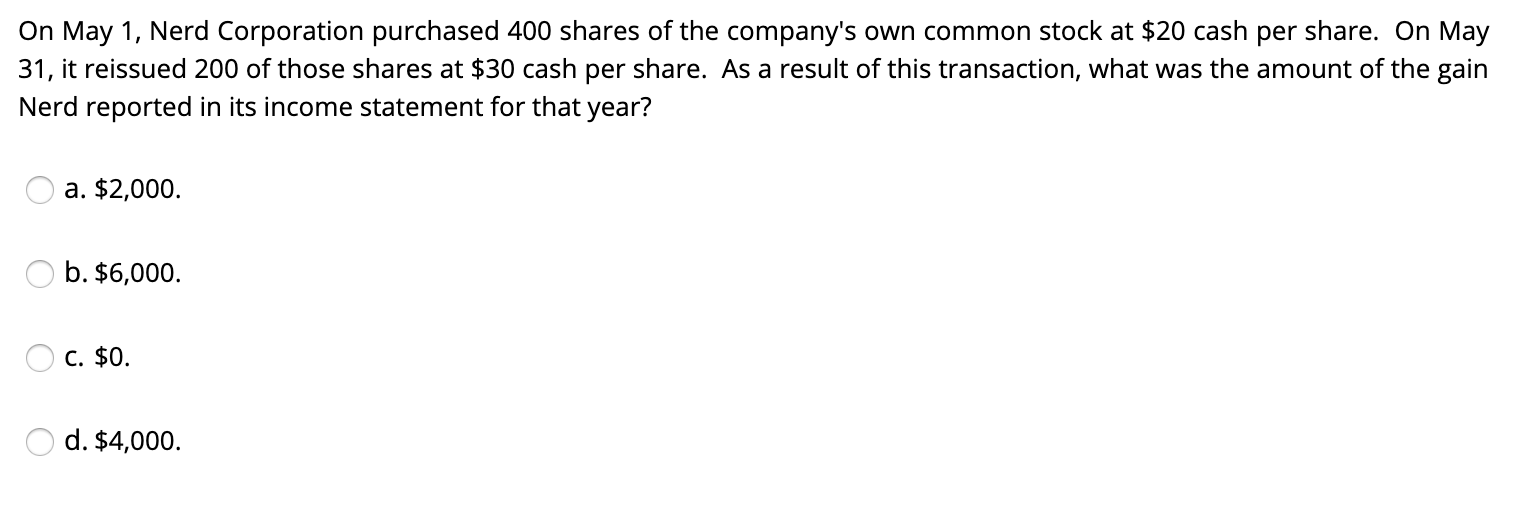

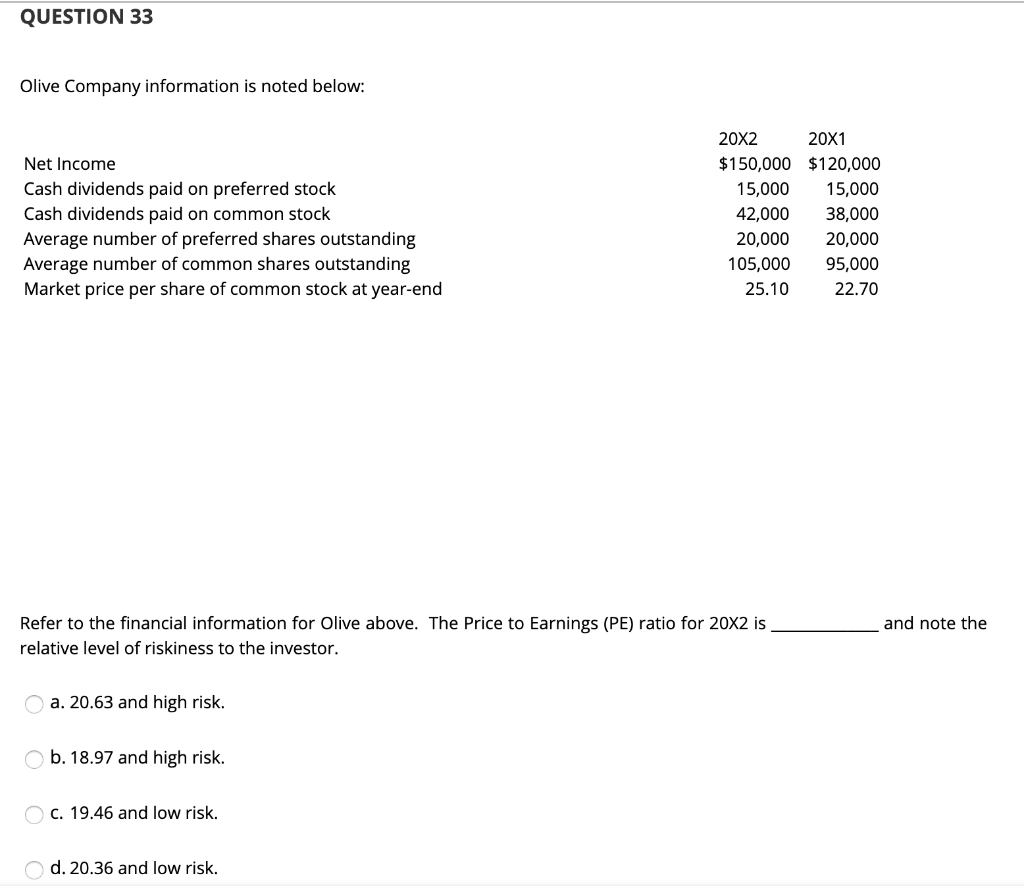

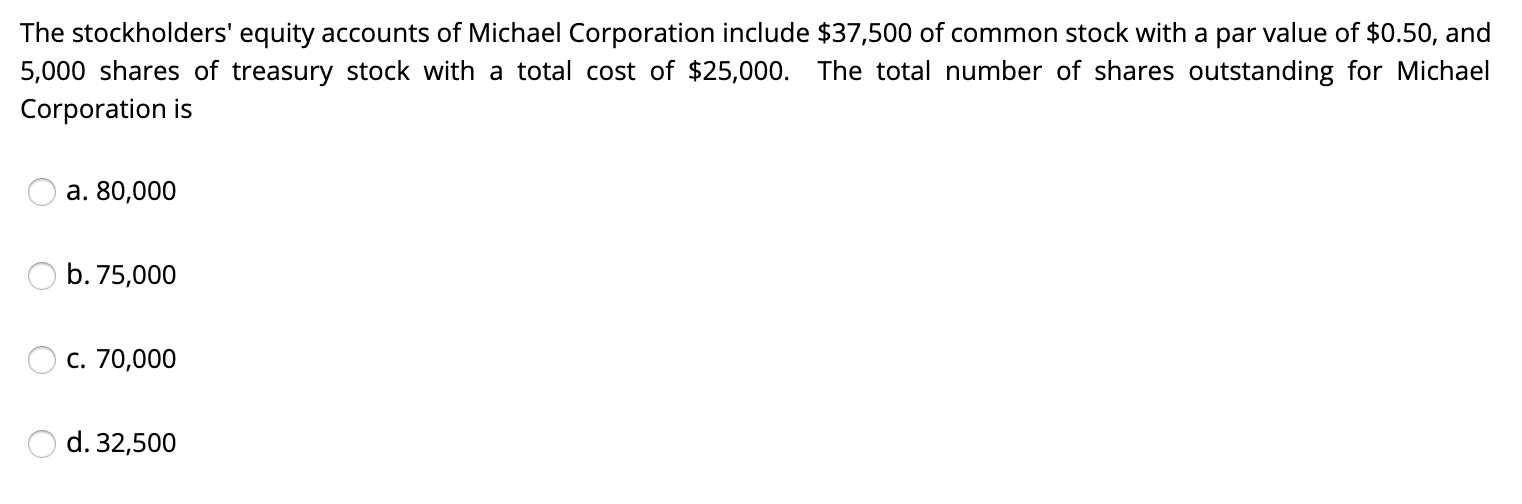

On May 1, Nerd Corporation purchased 400 shares of the company's own common stock at $20 cash per share. On May 31, it reissued 200 of those shares at $30 cash per share. As a result of this transaction, what was the amount of the gain Nerd reported in its income statement for that year? O a. $2,000. O b. $6,000. OC. $0. O d. $4,000. QUESTION 33 Olive Company information is noted below: Net Income Cash dividends paid on preferred stock Cash dividends paid on common stock Average number of preferred shares outstanding Average number of common shares outstanding Market price per share of common stock at year-end 20X2 20X1 $150,000 $120,000 15,000 15,000 42,000 38,000 20,000 20,000 105,000 95,000 25.10 22.70 and note the Refer to the financial information for Olive above. The Price to Earnings (PE) ratio for 20X2 is relative level of riskiness to the investor. a. 20.63 and high risk. b. 18.97 and high risk. C. 19.46 and low risk. d. 20.36 and low risk. In a statement of cash flows, proceeds from issuing stocks and bonds should be classified as cash flows from O a. Lending activities O b. investing activities O c. Financing activities O d. Operating activities The stockholders' equity accounts of Michael Corporation include $37,500 of common stock with a par value of $0.50, and 5,000 shares of treasury stock with a total cost of $25,000. The total number of shares outstanding for Michael Corporation is O a. 80,000 O b. 75,000 O c. 70,000 O d. 32,500 The financial statement which summarizes operating, iinvesting and financing activities of an entity for a period of time is the a. Statement of cash flows. O b. Income statement. O C. Retained earnings statement. O d. Statement of financial position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts